[ad_1]

European pure fuel costs climbed greater Monday, breaking from the sharp losses of latest weeks because the market weighs elevated competitors with Asia for LNG and colder climate forecasted for later within the month.

The February Title Switch Facility (TTF) contract gained 7% Monday to complete above $23/MMBtu. It stays at pre-war ranges, however above the place it completed final week, when the contract plunged to a spread not seen since 2021. TTF has declined by roughly 50% during the last month amid a stretch of above-normal temperatures and file liquefied pure fuel imports.

“…Market contributors imagine that the European fuel steadiness isn’t comfy sufficient to afford a major enhance in fuel demand for energy era, significantly as the value decline may additionally set off a restart of some industrial demand,” stated analysts at Engie EnergyScan.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

Unseasonably heat climate is anticipated for a lot of the continent within the close to time period, however colder climate is forecast for northwest Europe within the 6-10 day interval.

Russian deliveries through Ukraine, the one path to Europe aside from Turkey nonetheless working, have additionally dropped during the last week. Flows have dipped to about 1 Bcf/d from 1.3 Bcf/d.

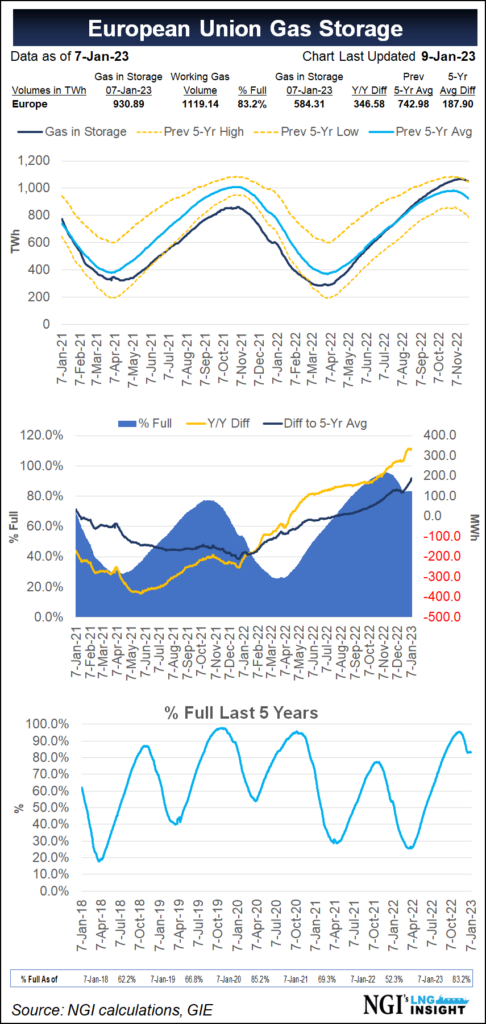

European storage inventories stay extremely robust, nevertheless, as capability has been preserved by hotter climate. Inventories have been regular for 3 weeks on the continent and had been at 83.1% Monday.

“A fuel deficit state of affairs this winter is turning into more and more unlikely,” Germany’s Federal Community Company stated Monday. “Nonetheless, a worsening of the state of affairs can nonetheless not be dominated out, the necessity to save fuel remains to be vital.”

Hotter climate has additionally settled over east China, Korea and Japan this week, however patterns are seen shifting colder over the 6-10 day interval. Japan-Korea Marker (JKM) futures are within the excessive $20s/MMBtu vary, whereas spot costs are within the decrease $20s vary.

“JKM is now buying and selling at a premium to TTF on the immediate, pushed by the mixture of increasing European regasification capability and the return of some worth delicate Asian demand,” stated UK consultancy Timera Power.

Tudor, Pickering, Holt & Co. famous that world LNG commerce hit 37.3 million tons (Mt) in December, up 3.6 Mt month/month. Whereas European imports hit a file 11.6 Mt final month, Asian imports additionally elevated 2.3 Mt month/month.

As winter competitors for cargoes slowly ramps up, Deutsche ReGas GmbH & Co. KGaA stated final week that Germany’s first personal floating regasification and storage unit (FSRU) would open Jan. 14 in Lubmin. The nation’s first state-chartered FSRU terminal operated by Uniper SE in Wilhelmshaven opened Dec. 17.

The Federal Community Company stated fuel consumption in Germany, Europe’s largest fuel consuming nation, has been restricted by hotter climate. Demand was 30% decrease than common through the week starting Dec. 26.

Morgan Stanley analysts stated Monday that European pure fuel storage is on monitor to exit the winter at 50% of capability, or twice the extent of final yr, which may in the end restrict the quantity of fuel wanted this summer season to refill inventories.

In one other optimistic signal for the European market on Monday, the Norwegian Petroleum Directorate forecast Norway’s oil and fuel manufacturing to achieve 4.12 boe/d in 2023, up from 3.99 boe/d in 2022. Norway has develop into Europe’s largest fuel provider since Russia invaded Ukraine and reduce off most of its fuel exports to the continent.

U.S. fuel costs tumbled final week as nicely amid heat climate. The February Henry Hub contract hit $3.52 in intraday buying and selling Friday, its lowest level in 18 months.

The contract rebounded on Monday “on overdue revenue taking by shorts,” stated EBW Analytics Group LLC analyst Eli Rubin.

He added that fundamentals stay bearish with dry fuel manufacturing close to file highs and climate forecasts persevering with to shed heating demand.

The Nationwide Oceanic and Atmospheric Administration expects warmer-than-normal temperatures throughout a lot of the Decrease 48 states via Jan. 18.

In the meantime, feed fuel deliveries to U.S. export terminals stay robust, with nominations above 12 Bcf/d as they’ve been since final week, in keeping with NGI’s U.S. LNG Export Tracker.

[ad_2]

Source_link