[ad_1]

Shell plc can pay round $2 billion in further UK taxes for the ultimate interval of 2022, however the reduce to income received’t overcome sturdy income from pure fuel buying and selling, the London-based main mentioned Friday.

Actually, Shell mentioned in a buying and selling replace that it ought to document “considerably increased” earnings for 4Q2022 even with the next tax load.

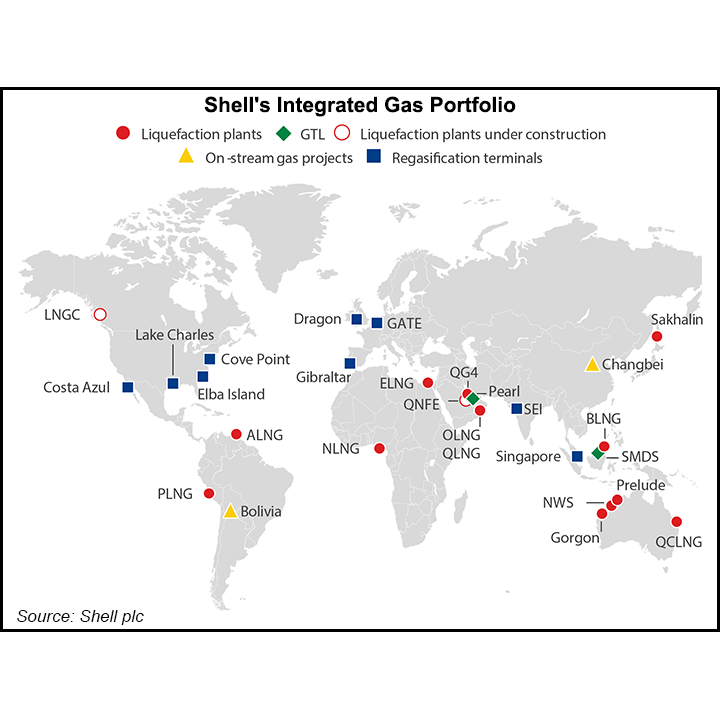

Within the Built-in Fuel unit, which incorporates LNG and gas-to-liquids companies, manufacturing for 4Q2022 was estimated at 900,000-940,000 boe/d. The diminished output was pinned on a “longer than anticipated outage” on the Prelude floating liquefied pure fuel venture in Australia following a union strike.

LNG liquefaction volumes within the ultimate three months of 2022 have been estimated at 6.6-7.0 million metric tons (mmt). The discount in volumes, mentioned Shell, principally mirrored the “longer than anticipated plant outage at Prelude and operational points” on the Queensland Curtis LNG terminal, additionally in Australia. Upstream manufacturing within the fourth quarter was estimated at 1.83-1.93 million boe/d.

For comparability, Built-in Fuel manufacturing in 3Q2022 was forecast at 890,000-940,000 boe/d. Liquefaction volumes have been round 6.9-7.5 mmt. Upstream output averaged 1.75-1.85 million boe/d in 3Q2022.

Shell, the world’s largest pure fuel dealer, had confronted a difficult third quarter due to unstable costs, but it surely nonetheless posted its second highest ever quarterly income.

For the ultimate interval of 2022, buying and selling and optimization outcomes are “anticipated to be considerably increased in comparison with 3Q2022,” Shell acknowledged.

Europe’s largest pure fuel and oil firm mentioned the impression of the UK’s Vitality Income Levy, which climbed 10% to 35% starting Jan. 1, would have restricted impacts due to the timing of the funds. The upper levy was imposed by the UK till the tip of March 2028.

Different governments even have imposed windfall taxes on producers to scale back client prices.

Russia reduce its pure fuel pipeline exports to Europe final yr within the wake of sanctions following its invasion of Ukraine. Many nations in Europe and past, together with Australia, have appeared to impose further taxes on fuel and oil producers, which raked in document income final yr, to cushion client prices.

The estimated $2 billion in levies imposed on Shell for 4Q2022 could be along with $360 million in windfall taxes that Shell disclosed late final yr. The corporate didn’t break down the levy quantities by area.

In the meantime, CEO Wael Sawan took the reins on Jan. 1 from Ben van Beurden. Sawan previously helmed Built-in Fuel, Renewables and Vitality Options. Van Beurden, who grew to become CEO in 2014, plans to stay a board adviser till later this yr.

Shell is scheduled to problem its full-year and fourth quarter outcomes on Feb. 2.

In associated information, ExxonMobil has filed a lawsuit in opposition to the European Union (EU) over the choice to impose the windfall tax levy. The corporate’s German and Dutch subsidiaries mentioned the lawsuit, filed with the EU’s Common Court docket in Luxembourg, is looking for to annul the levy on oil and fuel firms.

ExxonMobil throughout 3Q2022 recorded income leaping to $19.66 billion from $6.75 billion within the year-earlier quarter. The document earnings, although, have been about greater than sturdy commodity costs, CEO Darren Woods advised analysts throughout a convention name.

“Whereas it’s simple to attribute our success to increased commodity costs, the actual fact is, the diploma to which we have now grown worth can’t be defined solely by costs,” he mentioned.

[ad_2]

Source_link