[ad_1]

Pure fuel manufacturing out of the U.S. Gulf Coast ought to rise over the following decade because it continues to look towards the export market, based on researchers at Louisiana State College’s (LSU) Heart for Power Research.

Within the middle’s newest Gulf Coast Power Outlook (GCEO) authors David E. Dismukes and Greg Upton mentioned that within the Gulf Coast “each oil and pure fuel manufacturing within the area are anticipated to expertise a decade of development even supposing oil and pure fuel costs are each in backwardation.”

Gulf Coast pure fuel manufacturing is seen rising to 53 Bcf/d in 2022, up 14% yr/yr. Gulf Coast pure fuel manufacturing might then exceed 68 Bcf/d by 2032.

This yr’s determine would imply greater than 50% of U.S. pure fuel could be produced within the Gulf Coast. The U.S. Power Info Administration sees U.S. pure fuel manufacturing averaging 100.4 Bcf/d subsequent yr, backed by rising manufacturing in Texas’s prolific Permian Basin and the Haynesville Shale in East Texas and Western Louisiana.

The Gulf Coast area refers back to the states of Texas, Louisiana, Mississippi and Alabama

Robust Demand

“This yr’s GCEO, very like final yr’s, anticipates that long-run vitality demand development will result in elevated U.S. vitality exports, particularly to the rising growing world,” the researchers mentioned. They added that given softening inflation, and powerful employment figures, “whereas a recession would possibly definitely be on the horizon, this isn’t the GCEO base case.”

Pure fuel and oil costs might nonetheless be pressured increased due to the Russia-Ukraine battle, the report mentioned. In the meantime, the exodus of Western technical knowhow from Russia will dent Russia’s oilfield providers sector. “Commerce flows have and can doubtless proceed to regulate by substituting Russian merchandise away from some markets towards others.”

General, Gulf Coast pure fuel costs “will doubtless stay elevated” attributable to LNG export pressures. “The related query right this moment is whether or not pure fuel costs have entered into a brand new epoch that displays a larger integration of U.S. pure fuel markets to world markets.”

When the two Bcf/d Freeport LNG facility was knocked offline by an explosion final June, U.S. pure fuel costs instantly dropped.

LNG Driver

The liquefied pure fuel market is poised to benefit from world market situations.

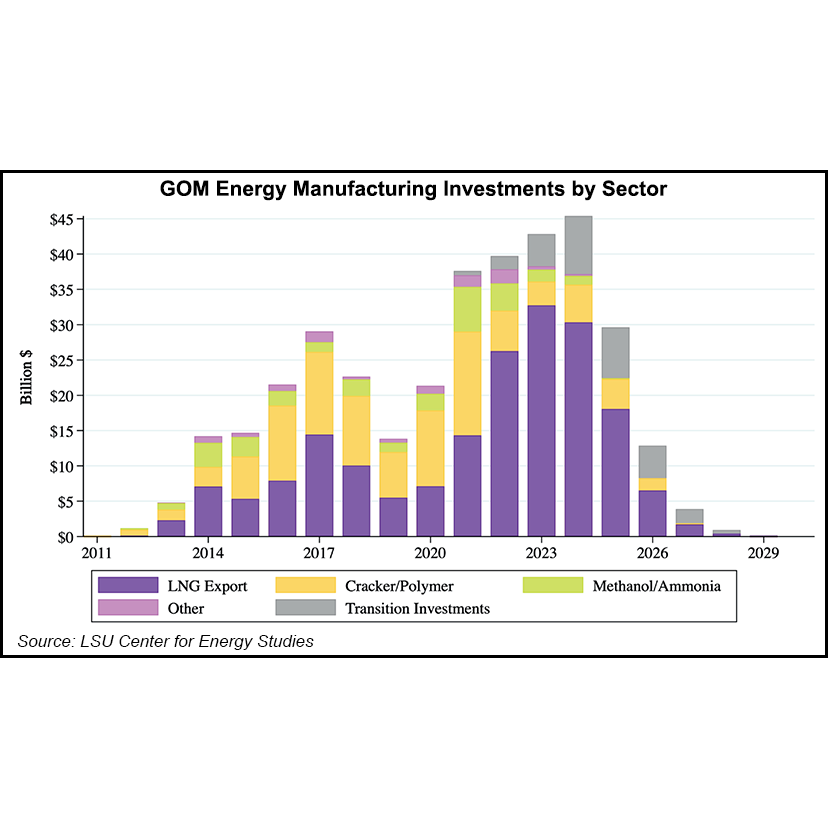

The 2023 GCEO sees as a lot as $175.4 billion in new vitality manufacturing funding exercise from 2022 by way of 2030 within the Gulf Coast. This represents a $15 billion, or 7.9% discount in complete regional capital funding relative to final yr’s GCEO over a comparable time frame.

“Whereas general funding {dollars} are down, what differs on this outlook relative to prior years is the surge in new vitality transition investments,” researchers mentioned.

Louisiana leads the Gulf Coast area in complete vitality manufacturing investments, with as a lot as $120.9 billion deliberate by 2030.

LNG investments dominate general funding at $116 billion, most of which is earmarked for Louisiana. Non-LNG investments ($27.6 billion) are largely related to chemical and refinery improve investments and are evenly balanced between Texas and Louisiana, the researchers mentioned.

The Gulf Coast has turn into the epicenter for U.S. LNG because the Decrease 48’s first main export terminal began operations in Louisiana in 2016.

However apart from the much-delayed restart of Freeport in South Texas, the most important addition to export demand isn’t anticipated for one more two years. The primary prepare of ExxonMobil and QatarEnergy’s Golden Go LNG southeast of Houston might begin up in 2024, with the second and third trains anticipated to comply with in 2025.

Enterprise International LNG Inc. is ramping up manufacturing on the Calcasieu Go terminal in Louisiana. Its Plaquemines LNG facility might have half of its 18 modular trains ramp up beginning in 2024. The opposite 9 trains might enter service someday in 2025.

“Given the Gulf Coast’s place as a internet exporter of vitality, we’re properly positioned to expertise financial development by way of this time of turbulence,” the researchers mentioned.

They added that provide chain constraints proceed to affect vitality companies and their potential to conduct work. “The present GCEO modeling assumes that provide chain constraints proceed to bind for the following yr or so earlier than starting to attenuate progressively,” they mentioned.

Decarbonization, in the meantime, “will problem current Gulf Coast vitality manufacturing, however it is going to additionally create a possibility for regional management within the improvement of the manufacturing capability for liquid fuels, chemical substances, plastics, fertilizers, and different merchandise traditionally derived from fossil fuels, with decrease, and even internet zero” greenhouse fuel emissions.

The researchers added that they thought-about that offshore leasing had been reinstated, and that the offshore trade is returning to a “enterprise as regular” situation.

[ad_2]

Source_link