[ad_1]

Bullish sentiment is creeping again into oil markets as China continues to open up after Covid, Russia hints at a manufacturing reduce subsequent yr, and a winter storm sweeps throughout North America.

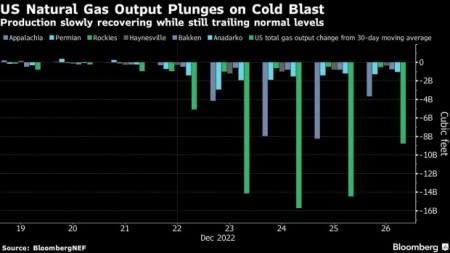

Chart of the Week

– Day by day pure gasoline output in america has been trending round 90 billion cubic toes this week, some 10% beneath regular as the intense chilly swept throughout two-thirds of the nation.

– The impression of the freeze was felt most markedly in North Dakota the place 300-350,000 b/d of Bakken manufacturing stays idled, roughly a 3rd of pre-storm readings.

– Day-ahead costs in Western Texas jumped to $9/mmBtu earlier than the weekend, though with the south anticipated to heat up considerably on Tuesday spot costs are nearly sure to say no from right here onwards.

– The ache remains to be felt in New England the place the chilly might be slower to subside, day-ahead costs on the Algonquin pricing hub are nonetheless above $20/mmBtu, after buying and selling late final week on the stage of Asian LNG.

Market Movers

– US LNG producer Enterprise World signed a 20-year take care of Japan’s Inpex (TYO:1605) to provide it with 1 million tons LNG per yr, to be sourced from the upcoming Calcasieu Cross 2 facility.

– UK power agency BP (NYSE:BP) signed a 20-year extension to its manufacturing sharing contract for 3 fields in West Papua, Indonesia, feeding the Tangguh LNG plant, remaining operator of the fields till 2055.

– ENI’s Norway-focused offshoot Vaar Energi (OSL:VAR) made a 57-132 MMboe gasoline discovery close to the Goliat discipline within the Arctic Barents Sea, the biggest discovery on the Norwegian Continental Shelf this yr.

Tuesday, December 27, 2022

China is regularly winding down its coronavirus-related restrictions, with the Asian nation’s Nationwide Well being Fee saying it will finish its quarantine necessities in January, offering one more enhance for oil demand throughout the nation. Russia’s declare that it may reduce manufacturing by 5-7% in 2023 and a winter storm devastating the U.S. each added to the bullish temper that pushed WTI previous the $80 per barrel mark once more.

WTI Open Curiosity the Lowest in 16 Years. In accordance with CFTC numbers, open curiosity held in WTI NYMEX futures and choices fell to its lowest since August 2006 over the week ended 20 December, coming in at a mere 1.82 million contracts, down 25% year-on-year.

USGC Refiners Adapt to Freeze. Most refiners within the US Gulf Coast have elevated flaring over the previous days as operations have been disrupted amid tools failures pushed by freezing temperatures, regardless of not seeing any energy outages that the jap coast has seen.

Winter Storms Set off Huge US Outages. Over 700,000 houses and companies skilled energy outages within the US this weekend as winter storms battered the jap half of the nation, with the best variety of them happening within the New England area.

Albertan Crude Can Circulate Once more. The US pipeline regulator PHMSA has permitted TC Vitality’s (NYSE:TRP) plan to restart the idled part of the Keystone pipeline from Steele Metropolis to Cushing, Oklahoma, with out specifying the precise date and including that works would nonetheless take “a number of days”.

Turkey Places Cyprus Again on the Agenda. Lower than every week handed since Cyprus hit one other offshore gasoline discovery led by ENI (BIT:ENI), the Turkish authorities accused the island nation of accelerating pressure within the Japanese Mediterranean, saying it will not enable exploration with out its consent.

US Faces Alaska Lawsuit for Neglecting Beluga Rights. Prepare dinner Inletkeeper, an environmentalist group, is making ready to sue the US authorities for not contemplating adequately the dangers to endangered species such because the beluga whale in its upcoming Lease Sale 258, providing acreage in Alaska’s Prepare dinner Inlet.

Nigeria Gives 7 New Offshore Oil Blocks. The primary main upstream licensing spherical to happen in cash-strapped Nigeria over the previous 15 years, will see the African nation’s upstream regulator NUPRC providing seven offshore blocks within the Benin basin in water depths of 1,150m to three,100m.

Japanese Insurers Search Reinsurance to Resume Russian Protection. Key Japanese insurance coverage corporations are in talks with new reinsurance corporations after their earlier suppliers walked away, as marine warfare insurance coverage is required to raise Japan’s fairness LNG manufacturing from Sakhalin.

Russia says it is Able to Restart Idled Pipeline. Russian deputy PM Alexander Novak stated Moscow is able to resume gasoline pipeline deliveries to Europe through the Yamal-Europe pipeline that was halted in December 2021, nevertheless for it to occur it will must first raise sanctions towards the operator of the pipe’s Polish part.

Turkey Finds Even Extra Fuel within the Black Sea. Turkish President Tayyip Erdogan introduced the invention of a brand new gasoline discipline within the Turkish a part of the Black Sea, with the Caycuma discipline including 58 bcm of reserves on prime of the large 650 bcm Sakarya discovery.

World Zinc Shares Hit Rock Backside. As zinc shares held in London Metallic Trade-registered warehouses fell to the bottom this century, a naked 36,500 tonnes, with Shanghai inventories equally depleted, the galvanizing steel is experiencing fairly the provision squeeze regardless of plentiful smelter closures.

Russian Financial institution Takes Glencore to Courtroom. Russia’s largest financial institution Sberbank (MCX:SBER) filed a lawsuit towards worldwide buying and selling agency Glencore (LON:GLEN) for not paying some $120 million over two oil consignments delivered in March 2022, with the latter citing restrictions brought on by sanctions.

Iron Ore Jumps on China Coverage Help Pledge. After the Individuals’s Financial institution of China referred to as for strengthening the nation’s actual property coverage to kickstart development once more, iron ore costs rose to $119 per metric ton on the Dalian change, brushing apart hovering coronavirus instances.

By Michael Kern for Oilprice.com

Extra High Reads From Oilprice.com:

Learn this text on OilPrice.com

[ad_2]

Source_link