Ocean transport demand is historically measured in “ton-miles”: volumes multiplied by distance. So, right here’s a paradox: Ton-miles for liquefied pure fuel transport have fallen in 2022, as a result of most cargoes from the U.S. are being pulled to war-stricken Europe as a substitute of going longer-haul to Asia. And but, LNG transport spot charges have skyrocketed to Guinness Ebook ranges of as much as $500,000 per day.

How is that this doable?

This paradox was addressed on the Marine Cash New York Ship Finance Discussion board on Thursday. The reply — which provides an necessary lesson on understanding demand in all transport segments, from tankers to bulkers to container ships — is that it’s not all about ton-miles.

Ton-days not ton-miles

There are two explanation why LNG transport spot charges have gone by way of the roof regardless of falling ton-miles: the impact of time or “ton-days” (quantity multiplied by voyage time) and the impact commodity pricing on ship availability.

Jefferson Clarke, head of LNG industrial analytics at Poten & Companions, stated on the Marine Cash occasion, “Once we forecast transport supply-demand balances, it’s not really nearly ton-miles. Whereas that’s an necessary component, we additionally deal with the impression of time.”

Brokerage BRS highlighted this problem in a dry bulk transport report earlier this 12 months. “For the uninitiated, freight demand is commonly perceived to be absolutely the quantity of cargo loaded and shipped. A transport skilled … is aware of {that a} cargo that traveled throughout half the globe goes to generate extra demand for freight capability [i.e., ton-miles].”

However “whereas ton-miles have been broadly used within the transport business, one hidden flaw is that it doesn’t keep in mind ready time,” wrote BRS. “Therefore, it will likely be instructive to [reexamine] freight demand utilizing ton-days.”

The runup in charges for bigger dry bulk ships in 2021 was closely pushed by Chinese language port delays that boosted ton-days. Surging container-ship freight charges from Asia to the West Coast in late 2021 had been partly pushed by unloading delays in Los Angeles/Lengthy Seashore. The increase in very massive crude service (VLCC) charges in spring 2020 was pushed by floating storage, vastly extending the time between loading and discharge.

That very same dynamic is now enjoying out in LNG transport.

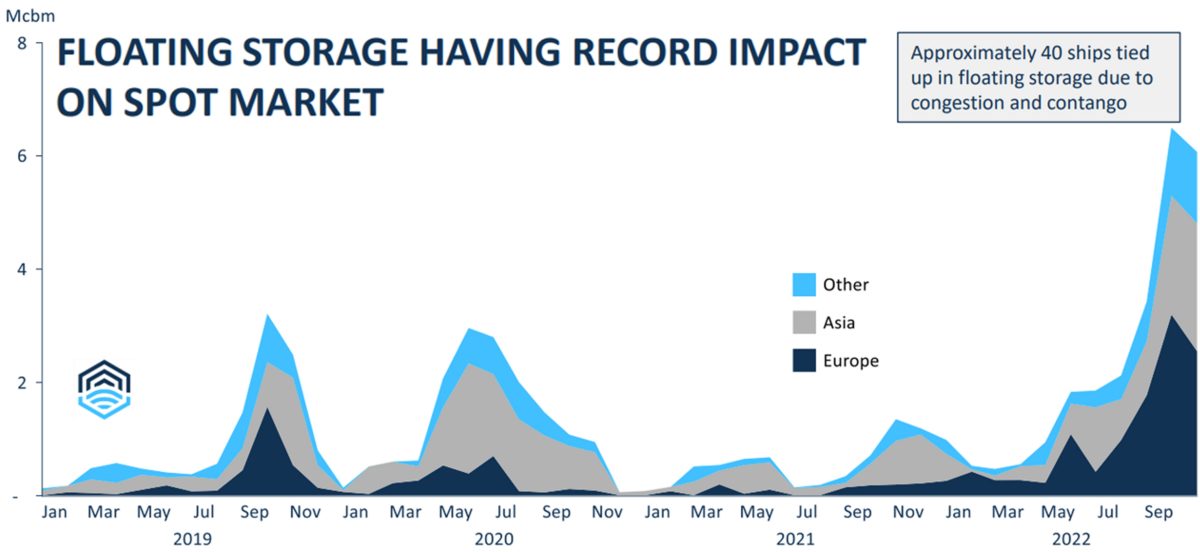

Flex LNG (NYSE: FLNG) CEO Oystein Kalleklev stated on a quarterly name final Tuesday, “There’s a big buildup of [LNG] ships tied up in floating storage, particularly in Europe but in addition in different nations. As of right now, we’re at an all-time excessive degree of round 40 ships being tied up in floating storage, which is taking out numerous ships from the overall freight market, which is making the freight market very tight.”

Looming insurance coverage ban on Russian crude

This similar ton-days issue is anticipated to be a key optimistic crude-tanker spot charge driver when the EU and U.Ok. ban on transport insurance coverage for Russian crude exports comes into impact in two weeks.

Greater voyage distance — ton-miles — would be the largest issue, however not the one issue.

Wintertime Russian exports from northern ports are anticipated to be dealt with by smaller ice-class tankers that will probably be compelled to conduct time-consuming ship-to-ship transfers with bigger tankers, probably off the coast of Africa. Tankers loading Russian crude within the Black Sea might additionally face transit delays as insurance coverage is vetted previous to passage by way of the Bosporus Strait.

Contango and ton-days

Spot transport charges are pushed by commodity costs in at the least two methods. First, associated to ton-days, if the ahead commodity worth is excessive sufficient versus the present worth (often known as contango) to induce floating storage. Second, if the arbitrage income — the worth distinction between one area and one other — are exceptionally excessive.

The contango in crude pricing prompted the VLCC charge spike in spring 2020, growing ton-days. LNG costs in Europe are in contango now.

Kalleklev stated on the Marine Cash discussion board, “Not solely do we’ve got all this congestion in Europe, however there’s a glut of LNG coming into Europe, pushing immediate costs decrease, that means you get this large contango. Abruptly, there are two incentives for floating storage, congestion and contango, so charges have skyrocketed.”

Commodity worth impact on constitution markets

The second commodity-price issue — arbitrage income between areas — appears much more necessary to right now’s LNG spot charges, as a consequence of its impact on the long-term constitution market.

In any spot transport market, the speed depends upon what number of vessels are literally obtainable for spot enterprise. LNG ships obtainable for short-term employment are actually nearly nonexistent as a result of they’re all on long-term charters and people charterers are typically not subletting their vessels into the spot commerce.

LNG commodity costs have hit file highs this 12 months within the wake of the Ukraine-Russia warfare. At one level, pure fuel in Europe was priced on the equal of $600 per barrel of oil, stated Francisco Blanch, head of worldwide commodities at Financial institution of America.

Based on Clarke, “Within the present setting, LNG [commodity] costs are extra a figuring out issue on transport demand.”

Clarke defined: “Charterers are holding onto tonnage and never subletting their vessels out. They’re extra involved about getting access to tonnage. They’re extra centered on the [long] time period market than the spot market. So, after we learn these headlines of excessive [spot] charges, they’re largely irrelevant, as a result of there’s little or no liquidity.”

In different phrases, LNG ship charterers can make more cash by pocketing arbitrage income transferring their very own cargoes than from briefly subletting their vessels to others. As a result of there are so few ships left for spot buying and selling, LNG spot transport charges have risen to $450,000 to $500,000 a day as a consequence of lack of tonnage — however only a few vessel house owners really earn these charges.

“It’s not likely a market,” stated Kalleklev of the present spot LNG transport enterprise.

Parallel in container-ship leasing

This excessive emphasis on long-term charters doesn’t happen in dry bulk and oil tanker trades, as a result of possession is very fragmented, many homeowners preserve a considerable portion of their fleets on spot even in increase instances, and tankers are bulkers are largely in “tramp” trades (i.e., no fastened port pairs).

However there was a latest parallel in container-ship leasing.

In 2021 and the primary half of 2022, container-ship house owners selected to lease out tonnage on traditionally profitable multiyear offers. Liners agreed to pay exceptionally excessive charges for prolonged durations. Just about each ship obtainable for lease was leased out.

As in LNG transport, container-ship house owners opted for long-term offers over short-term ones regardless that short-term charges had been a lot greater, as a result of a chicken within the hand is value greater than two within the bush. In the meantime, liners didn’t sublet the ships they chartered, as a result of they might earn rather more utilizing the chartered ship to move containerized cargo than they might from sublet earnings.

This severely restricted container-ship tonnage obtainable for short-term, multi-month charters, inflicting short-term leasing charges for a really small variety of vessels to spike to $200,000 per day.

Add all of it up and the takeaways are: For LNG transport and container-ship leasing, deal with long-term charges, not the short-term charges that get the headlines, and for all transport markets, assume much less about ton-miles and extra about ton-days, which embody not solely voyage size but in addition loading and unloading delays.

Click on for extra articles by Greg Miller

Associated articles:

[ad_2]

Source_link