[ad_1]

Germany is getting ready for its first of a number of new LNG import terminals to reach offshore close to the top of the week, marking a milestone in its plan to extend import capability and minimize reliance on Russian pipeline gasoline.

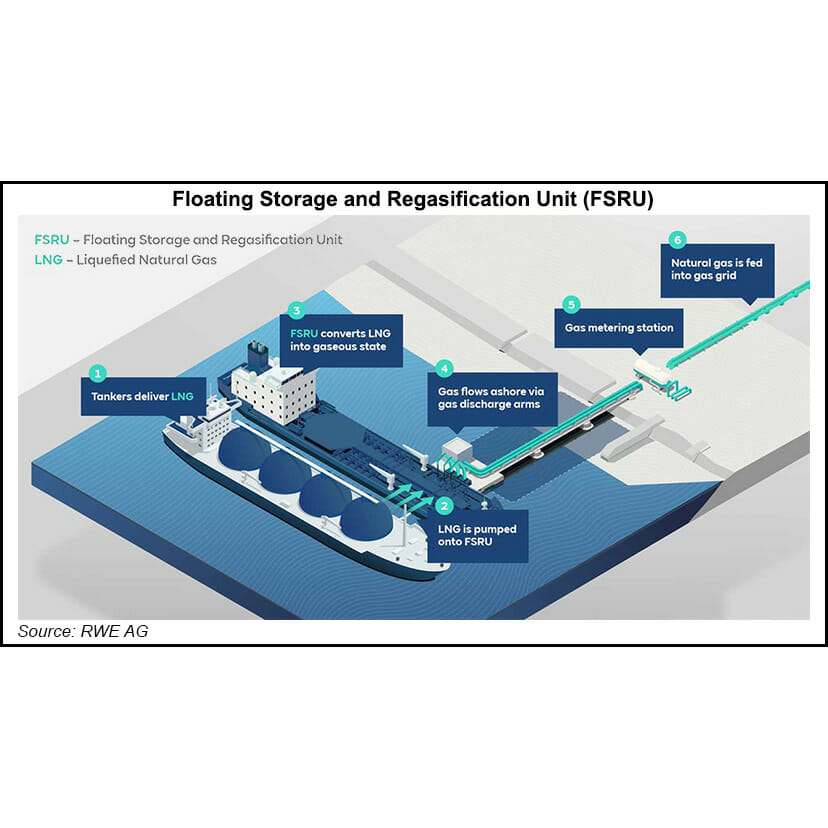

The Hoegh Esperanza, a floating storage and regasification unit (FSRU) owned by Höegh LNG AS, is anticipated to reach at Wilhelmshaven on Germany’s northwestern coast Saturday. It left port from Sagunto, Spain, on Dec. 1, in accordance with information from Kpler, after being loaded with round 165,000 cubic meters of liquefied pure gasoline.

As soon as docked, the FSRU shall be a part of an 11 million metric ton/12 months import terminal operated by utility Uniper SE till at the least 2029.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

Uniper’s Holger Kreetz, chief operations officer of asset administration, mentioned the agency nonetheless has “loads to do earlier than the primary gasoline can stream in a number of days” however the arrival is a feat of cooperation and work between a number of German companies and authorities businesses after the import initiative was launched in March.

The Wilhelmshaven terminal is anticipated to be adopted by the ramp-up of an FSRU-integrated terminal at Brunsbüttel later within the month. Dubbed German LNG, the challenge is a collaboration between the German authorities, NV Nederlandse Gasunie and RWE AG. RWE is anticipated to obtain its first cargo from the Abu Dhabi Nationwide Oil Co. (ADNOC) this month beneath a provide contract introduced in September.

Germany can be growing a 3rd FSRU-based terminal at Lubmin, which was delayed earlier within the month. An LNG terminal at Stade, which is deliberate to later import and distribute hydrogen, may additionally enter operations someday in 2026.

After months of stress-free charges as a result of a gentle begin to the heating season and excessive storage ranges, European gasoline and energy costs have began ticking up once more as a chill settles over the continent. The immediate Dutch Title Switch Facility closed at round $42/MMBtu Thursday, up by about 2.5% from Wednesday.

Whereas the deployment of extra import capability may assist Germany cut back bottlenecks and ready occasions for distribution of LNG, analysts at Poten & Companions have questioned whether or not the arrival of FSRUs may add swift reduction for its provide state of affairs.

Whereas round 424 Bcf of import capability is anticipated to return on-line within the subsequent few months, the analysts wrote two of the initiatives nonetheless lack contract cargo volumes, making it seemingly that German companies should faucet “present portfolio volumes in addition to spot cargoes” to satisfy demand.

[ad_2]

Source_link