[ad_1]

Editor’s Be aware: This content material is supplied courtesy of Unbiased Commodity Intelligence Companies (ICIS). Go to natgasintel.com/icis for extra info.

HOUSTON (ICIS) — Asia spot costs held comparatively regular this week, with the January ‘23 ICIS East Asia Index (EAX) up lower than 3% on 15 December from one week in the past.

In latest days the EAX was bolstered by the next ICIS TTF opening worth in addition to a colder temperature outlook in northeast Asia.

A lot of the market’s focus within the week has been on state main China Nationwide Offshore Oil Corp (CNOOC), and a strip purchase tender for February to December 2023 supply, which closed on 14 December.

Elsewhere, the unfold to the TTF benchmark for cargoes heading to Europe has narrowed with an uptick in February buy exercise over the past week. Nonetheless, consumers could also be taking a step again from spot February cargoes as a consequence of excessive costs.

December Climate Impression

Chilly climate may persist into the second half of the month, fuelling expectations of upper heating fuel demand in northeast Asia.

The Japan Meteorological Company has forecast a 60% and 40% likelihood of seasonally cooler temperatures in southern and northern Japan respectively over the month forward.

Apart from western China, the nation is predicted to expertise beneath regular temperatures till a minimum of 24 December, in response to a 15 December discover from the China Meteorological Company (CMA).

CMA additionally warned of sub-zero temperatures within the normally hotter southeast Chinese language provinces on 18 December, with temperatures doubtlessly breaching new lows in these areas and in Shanghai.

However native gamers in China and Japan recommend that the chilly spell has but to turn into a turning level in unlocking incremental winter demand.

South Korea’s climate company additionally issued a chilly wave warning for the day within the northern a part of the nation, with a 50% likelihood of cooler-than-average climate till 1 January.

Tenders

Center Japanese producer Oman LNG is providing an FOB cargo loading on 2-4 January by means of a young closing on 15 December.

One other Center Japanese provider, ADNOC LNG, may have provided a 23-29 April FOB cargo by means of a young closing on 16 December.

Angola LNG re-issued a promote tender on 9 December after beforehand closing a young on 8 December with out an award, adjusting its supply window. Time limit for bids is 15 December. Supply for the brand new tender issued on 9 December was revised to 8-17 January with supply as much as Pakistan and Bangladesh.

European Demand

Regardless of chilly climate, milder temperatures may mood demand later within the month. A robust roster of LNG cargoes can also be heading into Europe.

Shopping for from Europe for winter and even later months in 2023 has been lively over the past week, suggesting a slowdown may very well be coming within the run-up to imminent holidays within the area, and a response to an uptick in costs on the finish of the earlier week.

Hungary is in dialogue with Qatar concerning Qatari LNG provide to the Russian fuel dependent nation.

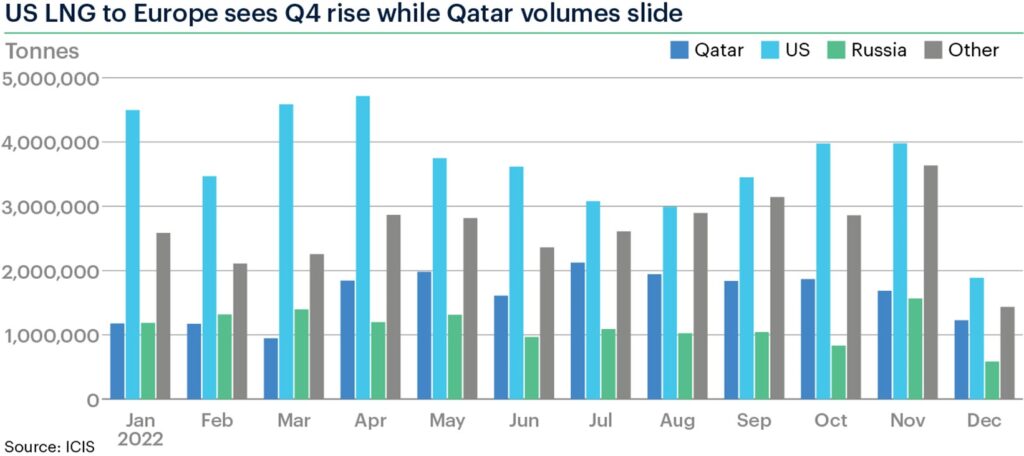

Europe general has seen regular US LNG imports all through the fourth quarter whereas Qatari volumes have dipped.

Australia Challenge Plans

The APLNG venture in Australia has launched a upkeep schedule for 2023, in response to the Australian Power Market Operator (AEMO).

The Curtis Island operation can have a half-train outage from 1-2 March; 28-29 March, 11-19 July and 29 August to six September subsequent 12 months, AEMO mentioned.

The Shell-operated Queensland Curtis LNG (QCLNG) facility in Australia has prolonged deliberate upkeep to 7-27 December on one LNG prepare.

Freeport Replace

Market sources mentioned the 12 December submitting by the US Federal Power Regulatory Fee (FERC) that sought engineering info from Freeport LNG was anticipated to have an effect on the restart timeline.

The submitting listed 48 questions publicly out of a complete of 64 inquiries and follow-ups, looking for further particulars and documentation on quite a few web site and issues of safety.

[ad_2]

Source_link