[ad_1]

Pure gasoline ahead beneficial properties have been widespread in the course of the Dec. 8-14 interval as forecasts confirmed Arctic chills sweeping by means of the jap two-thirds of the Decrease 48 heading into the again half of December. In the meantime, already-elevated western hubs noticed costs average, based on NGI’s Ahead Look.

Because the market locked onto the approaching chilly blast and a looming spike in heating demand, Henry Hub fastened value forwards rallied 70.7 cents in the course of the Dec. 8-14 interval to complete at $6.440/MMBtu. That set the tone for fastened value beneficial properties for many Decrease 48 hubs in the course of the week.

The notable exceptions have been out West, the place fastened costs remained elevated however declined sharply week/week. Malin January fastened costs tumbled $5.622 to $13.287 in the course of the interval.

Nymex futures, in the meantime, typically strengthened in the course of the interval, buoyed by the prospect of a flip towards a lot chillier temperatures following underwhelming weather-driven demand to open December. The January Nymex contract rallied 54.0 cents Thursday to settle at $6.970.

[Shale Daily: Including impactful news and transparent pricing for shale and unconventional plays across the U.S. and Canada, Shale Daily offers a clear snapshot of natural gas supplies for analysts, investors and global LNG buyers. Learn more.]

Western Foundation Moderates

By way of regional foundation shifts, the most important swings occurred within the western Decrease 48 in the course of the Dec. 8-14 interval, Ahead Look knowledge confirmed. In California, PG&E Citygate January foundation shed $5.999 to finish at plus-$8.007. SoCal Citygate entrance month foundation dropped $5.037 to finish at a $10.259 premium to Henry Hub.

Elevated bodily pricing in California this month displays “a poorly-timed spike in demand, alongside upstream provide worries as we head into the thick of the winter season,” Wooden Mackenzie analyst Quinn Schulz advised shoppers in a latest observe.

Current attracts have left inventories on each the PG&E and Southern California Fuel programs lagging the prior five-year common, the analyst mentioned.

“Current upstream constraints additionally assist to additional tighten the area,” Schulz mentioned. “The primary and most long-term constraint is a barrage of upkeep occasions” on the North Mainline of the El Paso Pure Fuel (EPNG) system. “These occasions have collectively lower westbound flows by 277 MMcf/d since Nov. 28 and can final till the tip of December.

“…Given these circumstances, unanswered questions in regards to the return-to-service date for EPNG’s Line 2000 are additional dampening confidence in California’s winter provide.”

The Power Info Administration (EIA) Pacific area withdrew 14 Bcf from storage for the week ending Dec. 9, leaving stockpiles within the area at 203 Bcf. That’s a 26.4% deficit to the five-year common of 276 Bcf, EIA knowledge present.

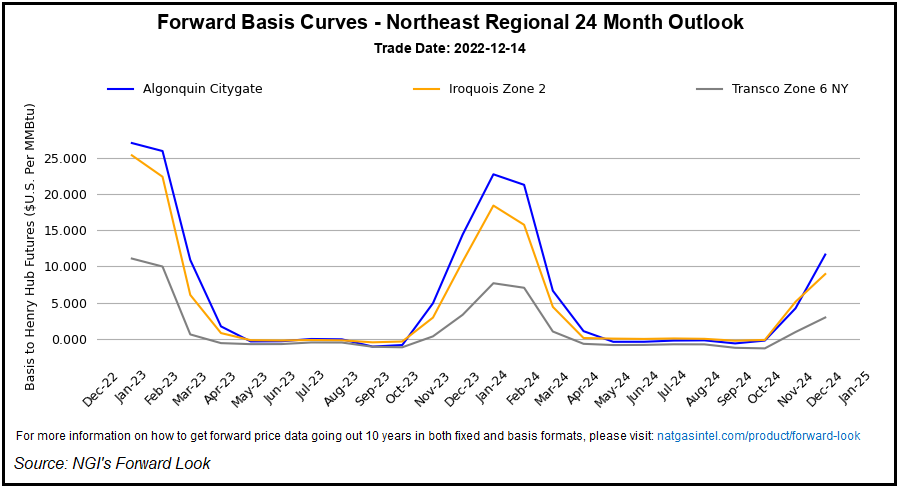

In the meantime, foundation strengthening was widespread alongside the East Coast in the course of the Dec. 8-14 interval as merchants assessed the impacts of what’s shaping as much as be a frigid stretch for the jap Decrease 48 heading into the Christmas vacation.

The most recent six- to 10-day forecast (subsequent Tuesday by means of Dec. 24) from Maxar’s Climate Desk Thursday confirmed an “Arctic air mass settling” into the central Decrease 48 “in the course of the early half earlier than increasing additional south and eastward from mid to late interval. Temperatures are strongly beneath regular in affiliation.”

The 11- to 15-day interval (Dec. 25-29) was anticipated to hold over “widespread a lot and powerful belows within the Japanese Half. Belows wane over the course of the interval as aboves broaden within the West,” based on the forecaster.

Transco Zone 5 January foundation surged $2.730 greater week/week, ending at a $11.121 premium to Henry Hub. Cove Level jumped $2.730 to plus-$11.178.

Farther north in New England, hubs maintained or added to already hefty January premiums. Tenn Zone 6 200L completed at plus-$27.018, a 79.3-cent acquire week/week, Ahead Look knowledge confirmed.

‘Slightly Intimidating’ Chilly

The most recent EIA report Thursday revealed a lighter-than-average internet 50 Bcf withdrawal from U.S. pure gasoline storage for the week ending Dec. 9, although merchants are more likely to be extra all in favour of how inventories fare with late December chilly.

“The market has appeared reticent following latest high-profile forecast busts,” EBW Analytics Group LLC analyst Eli Rubin advised shoppers. “If the chilly blast delivers, nevertheless, 225 Bcf-plus weekly storage attracts might ship January taking pictures greater.”

Nonetheless, within the larger image, a chilly blast to shut out 2022 is unlikely to usher in urgent storage adequacy considerations, based on the analyst.

“On a seasonal foundation, the winter storage trajectory seems adequate, and downward stress on Nymex futures might resume as quickly because the market can see by means of the upcoming chilly blast to hotter temperatures forward,” Rubin mentioned.

Noon climate knowledge from the American mannequin trended colder Thursday, together with by suggesting frigid temperatures could be “slower to erode or average” in the course of the Dec. 27-30 timeframe, based on NatGasWeather.

“Most significantly, the noon knowledge remained impressively chilly this weekend by means of subsequent week as a number of frigid pictures sweep throughout the U.S.,” the agency mentioned. “…The primary in a sequence of frigid blasts will sweep throughout the U.S. this weekend” with lows starting from beneath zero to the 20s over the northern Decrease 48 and within the teenagers to 30s farther south, sufficient to drive “robust nationwide demand.”

Subsequent “reinforcing Arctic blasts” set to reach subsequent week appeared “reasonably intimidating” within the newest forecasts, NatGasWeather added. They’re anticipated to ship extraordinarily frigid circumstances for the Midwest and Plains earlier than the chilly would unfold farther south and to the east.

Freeport Restarts When?

In the meantime, as residential/industrial demand is ready to rise sharply into late December, the timing of the Freeport LNG terminal’s return to service stays a “crucial basic piece of the demand equation,” based on Rystad analyst Ade Allen.

Current information of a prolonged request for data from federal regulators directed on the Freeport LNG terminal “has added to hypothesis that the timeline might probably shift once more,” the analyst added.

Even so, “the present short-term climate forecast is powerful sufficient to offset the shortage of exports and supply buoyancy to the general winter demand image,” based on Allen.

[ad_2]

Source_link