[ad_1]

By John Richardson

A SELECTIVE READING of the information is giving polyolefins market members confidence. They see the relief of zero-COVID restrictions in some Chinese language cities as an indication that the worst is over and that China’s shopper spending will quickly come roaring again.

When China ultimately will get previous zero-COVID there will likely be a lot of “revenge spending” as China’s consumers atone for misplaced time.

“Because of lockdowns and monetary volatility, residents added over 13tr yuan to their financial savings in 2022 in an economic system with one of many world’s highest financial savings charges. Family deposits totalled practically $17tr by October,” wrote Reuters on this 5 December article.

Reuters quoted Customary Chartered analysis which estimated that if city households drew down half of their extra financial savings collected since 2020, this is able to add one share level to GDP development in 2023.

However as I’ve been arguing since August 2021 following the Widespread Prosperity coverage pivot and as Reuters additionally factors out, the deflation of the property bubble will proceed after zero-COVID involves an finish as it is a long-term authorities goal.

One of many the explanation why financial savings charges have gone up is, after all, China’s coronavirus restrictions. One more reason is the tip of confidence within the authorities “put choice”- that Beijing would all the time intervene to make sure land and property costs wouldn’t fall.

So, sure, count on a bounce in shopper spending submit zero-COVID and will increase in polyolefins demand and pricing. However the finish of the property bubble, which is value a minimum of 29% of China’s GDP, will restrict the extent of the restoration.

And as I’ve been warning since Could this yr, once I quoted a Nature journal article on the China healthcare system, watch out what you would like for. A sudden leisure of the zero-COVID guidelines may, result in the variety of coronavirus circumstances requiring hospital therapy at 15.6 instances the capability of hospital beds in China, in line with Nature.

Though China managed to construct a 1,000-bed hospital in Wuhan in simply six days on the peak of the pandemic in 2020, this necessary Economist briefing warned that offering healthcare protection to take care of the wave of circumstances as China exited zero-COVID would take appreciable time.

Optimistic results of finish to zero-COVID is probably not felt till 2024

“Coaching new ICU [intensive care unit] medics takes years. Solely a small minority of Chinese language docs have seven-year medical levels. Certainly, 42% of docs would not have a college diploma of any type,” wrote the Economist in its 1 December briefing.

The journal stated that China had 4.3 ICU beds per 100,000 folks.Compared, this 1 September 2022 World Inhabitants Evaluate research discovered that the US had 34.7 ICU beds per 100,000 folks.

China was not prepared for an orderly exit from lockdowns, Yanzhong Huang of Seton Corridor College in America instructed the Economist.

Solely 40% of these over 80 had obtained three doses of native vaccines that offered good safety towards extreme signs, stated the journal.

“A marketing campaign to encourage the outdated to get jabbed, introduced on November twenty ninth, will take time. Giving everybody a fourth booster would enable for a a lot safer exit however work on that has barely begun,” wrote the Economist.

The effectiveness of native vaccines is reported to wane after six months. Politics seem like getting in the best way of constructing intensive use of longer-lasting overseas vaccines.

A sudden finish to zero-COVID would possible result in an unsustainable spike in deaths and hospital circumstances, forcing restrictions to be re-imposed.

Even a gradual winding again of zero-COVID may not be simple. The Economist warned that in the course of the exit part, “chaotic situations, if the transmission of the virus is allowed to proceed pretty quickly, may final for 3 months at a minimal.”

Ting Lu of Nomura, a Japanese financial institution, was quoted by the journal as saying that areas lined by lockdowns in the course of the exit part may account for as a lot as 40% of GDP, with output falling over one or two quarters.

“Even when China had been to finish zero-COVID instantly, the optimistic financial results would most likely not be felt till 2024, say analysts at Capital Economics,” the Economist added.

A barely revised outlook for PP demand in 2022

By no means say by no means, although, irrespective of how unlikely an occasion may be. This has led me to revise my 2023 outlook for China’s polypropylene (PP).

In a 23 November weblog submit, I projected that below the best-case final result, China’s PP demand would develop by 3% in 2023. Looking back, this is able to be a too-modest restoration in demand if zero-COVID had been to finish subsequent yr with no severe penalties.

The chart beneath entails a 6% enhance in China’s PP demand in 2023. This might be 5 share factors greater than the 1% development in 2022 demand instructed by the January-October knowledge. However as you’ll be able to most likely inform, I charge as low the probabilities of State of affairs 1 taking place.

State of affairs 1 would see China’s PP demand reaching 36.4m tonnes in 2023, up from this yr’s 34.3m tonnes. The 6% enhance would contain each the tip of zero-COVID and an enchancment within the world economic system. Stronger world situations would assist China’s exports which are value round 20% of GDP.

There are indicators that world inflation might have peaked as supply-chain shortages ensuing from the pandemic start to ease. Falling vitality costs have lowered gas and meals prices.

Underneath State of affairs 2, zero-COVID restrictions would keep in place, however world financial situations would enhance. This situation entails PP demand contracting by 1% over 2023, leaving the market at round 34.6m tonnes.

The worst-case final result, State of affairs 3, would see subsequent yr’s demand fall by 3% to 33.3m tonnes. Zero-COVID restrictions would stay as the worldwide economic system worsened.

Power has typically been used a geopolitical weapon. However in current months, the usage of the weapon has elevated. Some 16% of European liquefied pure fuel (LNG) imports come from Russia. What would occur if these provides had been diverted elsewhere, as an example?

In different phrases, the worldwide economic system may deteriorate subsequent yr.

Even when demand development is 6% in 2023, simply take a look at the impact on internet imports

Now let’s take a look at what may occur to China’s PP internet imports or internet exports in 2023.

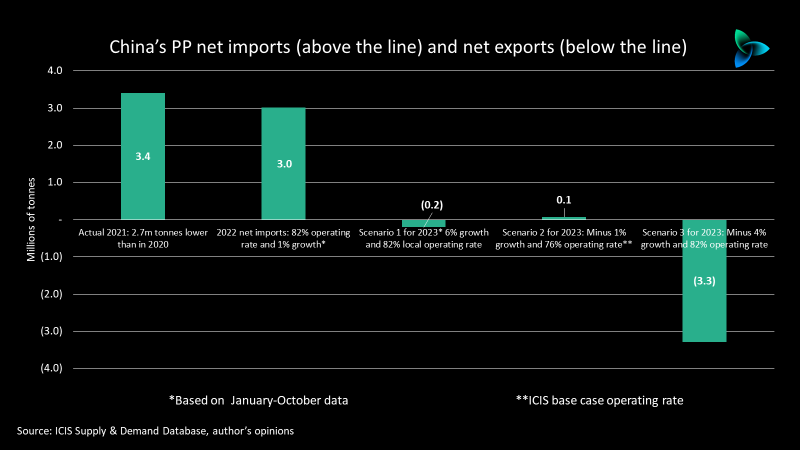

This yr’s internet imports look set to be round 3m tonnes based mostly on the January-October China Customs division knowledge. Precise 2021 internet imports had been 3.4m tonnes – 2.7m tonnes decrease than in 2020.

Even factoring in 2023 demand development of 6%, the prospects for subsequent yr’s export commerce to China don’t look good.

The reason being the 17% enhance in China’s capability that we forecast for 2023 over this yr to 44.6m tonnes/yr. This might comply with earlier years of huge capability will increase, that are a part of the federal government’s push to realize a lot better self-sufficiency in chemical substances and polymers.

If demand development had been to achieve 6%, it appears affordable to imagine that 2023 working charges could be round their degree up to now this yr – 82%. Larger demand development would enhance PP profitability as it will be accompanied by stronger pricing.

State of affairs 1 subsequently entails 6% development, an 82% working charge and all the brand new capability we forecast coming on-line. China would swing right into a internet export place of round 200,000 tonnes.

Underneath State of affairs 2, I assume that the bottom case working charge for 2023 within the ICIS Provide & Demand Database – simply 76% – occurs.

Mix this with demand development at minus 1% and China would find yourself with internet exports of some 100,000 tonnes, once more assuming all the brand new capability comes on-stream on schedule.

The worst-case final result, State of affairs 3, assumes that even within the weakest demand development final result of minus 3%, China nonetheless runs its crops at this yr’s working charge of 82%.

This might be in an effort to maximise export earnings, maybe supported by continued yuan weak point towards the US greenback. This final result would see China swing right into a internet export place of three.3m tonnes, as soon as once more assuming no delays in start-ups of recent crops.

As not too long ago as 2021, China accounted for at least 42% of whole world PP internet imports among the many nations and areas that imported greater than they exported.

The chart beneath exhibits our estimates of the remaining large world internet import markets in 2023.

Conclusion: Key takeaways for 2023

Don’t get sucked below the tide of optimisms washing by way of polyolefins markets ensuing from the relief of zero-COVID restrictions in some Chinese language cities. This doesn’t imply that China is wherever near transferring past its challenges.

Your base case for PP manufacturing and gross sales targets for 2023 should contain a protracted exit from zero-COVID. No financial advantages from the gradual unwinding of restrictions needs to be anticipated till 2024.

And even in 2024, the restoration will likely be restricted by the Widespread Prosperity financial reforms. The deflation of the property bubble will limit PP demand development.

China’s demand for PP imports will decline additional subsequent yr. In case you are one of many main PP exporters within the Center East, South Korea, Singapore and Thailand, you need to focus extra on the remaining large import markets listed within the slide instantly above.

[ad_2]

Source_link