[ad_1]

What every week it’s been.

First, the midterm elections failed to provide the “pink wave” that the majority pollsters and pundits predicted, and as I write this, it’s nonetheless unclear which social gathering could have management of the Home and Senate subsequent 12 months.

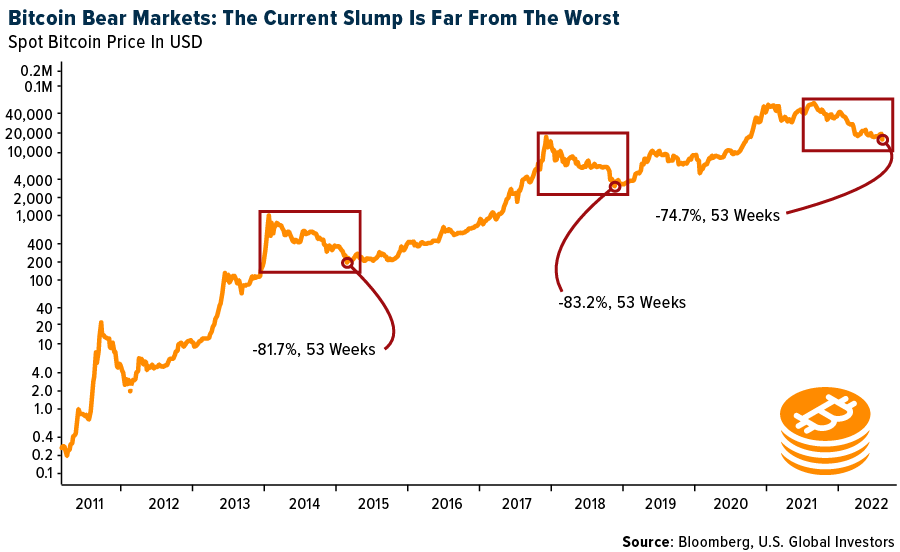

And second, the crypto trade might have skilled its very personal Lehman Brothers second.

FTX, till just lately the world’s second-largest crypto change, filed for chapter as its embattled founder, Sam Bankman-Fried, stepped down as CEO following a liquidity crunch that uncovered the agency’s improper use of buyer belongings. FTX’s stunning demise comes inside months of the collapse of Terra’s Luna coin, which triggered the bankruptcies of crypto companies Celsius Community, Voyager Digital and Three Arrows Capital.

The query on many traders’ minds is: How far and for a way lengthy will the contagion unfold?

Largest Midterm Upset in Many years?

It’s widespread information that midterm outcomes haven’t at all times been variety to the incumbent president. President Barack Obama’s agenda was famously sidelined by a Tea Celebration “shellacking” in 2010, and Republicans misplaced management of Congress halfway by way of President Donald Trump’s time period.

It’s additionally a on condition that previous efficiency doesn’t assure future outcomes. As former Secretary of the Treasury Larry Summers tweeted on Wednesday, the final Democratic president to have such a positive midterm end result as Joe Biden did was John F. Kennedy, in 1962.

It seems like you need to return to JFK to discover a Democratic president whose first midterm election went in addition to @POTUS @JoeBiden did final night time.

— Lawrence H. Summers (@LHSummers) November 9, 2022

To be clear, the GOP might find yourself successful again a (very slim) majority in a single or each chambers of Congress as soon as each vote is counted, however the victory, if we are able to name it that, is a Pyrrhic victory. In lots of contests throughout the U.S., voters rejected probably the most excessive types of Trumpism, placing the previous president’s 2024 ambitions into query.

Wall Road Loves Washington Gridlock

The large winner of the election was Wall Road. As I’ve identified earlier than, legislative gridlock has traditionally been constructive for shares, since sweeping coverage adjustments turn into unlikely and there’s much less danger to particular person sectors.

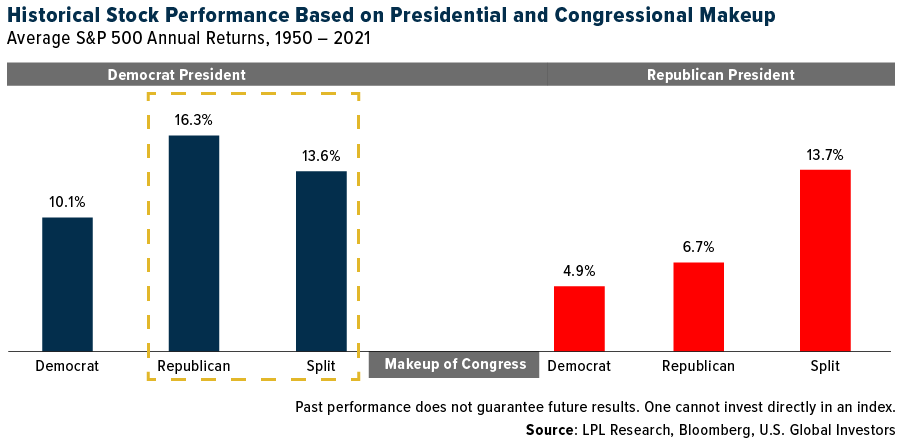

Newly-installed Twitter boss Elon Musk was criticized earlier within the week for recommending that individuals vote for a Republican Congress, writing that “shared energy curbs the worst excesses of each events.” Like him or not, the billionaire entrepreneur is true. Since 1950, the S&P 500 has delivered the best common returns when the White Home was held by a Democrat and Congress by Republicans, in response to LPL Analysis. Returns have additionally been higher-than-average when Congress was break up, no matter which social gathering occupied the Oval Workplace.

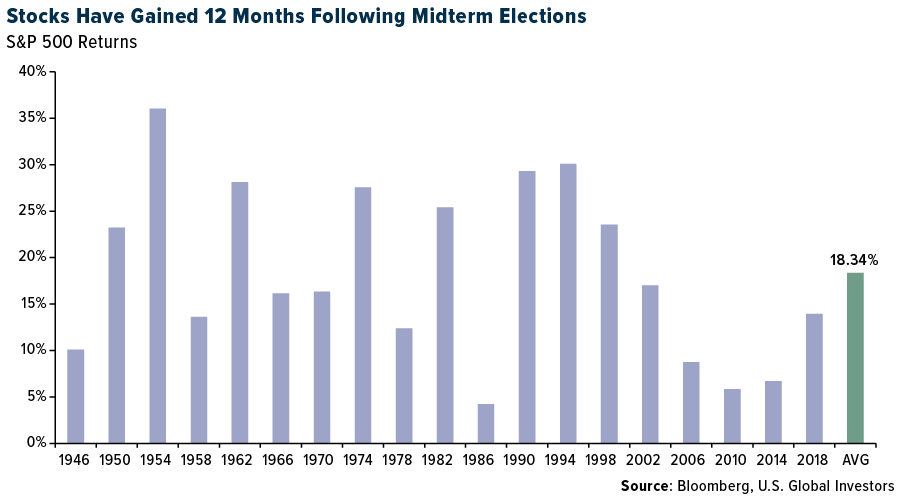

If 2022 ended right this moment, it might be the worst 12 months for shares since 2008. However trying forward, situations seem brighter, if historical past is any indication. The S&P 500 was optimistic 12 months in spite of everything 19 midterm elections between 1946 and 2018, with a median return of over 18%.

Cash Provide Development Has Slowed to a Trickle

In fact, traders produce other considerations in addition to politics—specifically, inflation. Shares rallied 5.5% on Thursday after the patron worth index (CPI) report confirmed that annual inflation cooled for the fourth straight month in October, falling to 7.7%.

Though inflation stays stubbornly excessive, the decrease studying gave the market hope that the Federal Reserve might take its foot off the brake a little bit. I occur to not suppose this would be the case—we nonetheless have a option to go earlier than inflation returns to a “regular” 2%—however the pattern is headed in the correct route.

Driving a lot of the inflation of the previous two years has been runaway money-printing by world central banks in an effort to pump liquidity right into a pandemic-impacted financial system. The excellent news is that the speed of this money-printing has slowed dramatically to a trickle because the frenetic days of 2020 and 2021. At a 1.7% annual development fee at present, M2 cash provide is effectively beneath its 10-year common of round 5%.

Crypto Business Wants Affordable Regulation

Returning to the problem of FTX, I feel it’s vital for individuals to know that Sam Bankman-Fried, or SBF, was till just lately seen as a sensible, reliable wunderkind. Fortune journal referred to as him the “subsequent Warren Buffett.” Final 12 months, SBF mentioned that FTX may sooner or later purchase Goldman Sachs and the Chicago Mercantile Alternate (CME).

However because it did with Theranos’ Elizabeth Holmes (who simply this week requested to be sentenced with an 18-month at-home confinement), life has come at SBF quick. The 30-year-old entrepreneur’s internet price evaporated from an estimated $16 billion to lower than $1 billion—all inside an unprecedented 24-hour interval.

FTX and SBF’s unethical choices will inevitably contribute to many individuals’s lack of belief in Bitcoin and supply gas to its greatest critics, Senator Elizabeth Warren chief amongst them. I consider that for crypto (and Bitcoin particularly) to realize widespread adoption, levelheaded lawmakers must cross affordable, rational guardrails defending customers and traders from unhealthy actors within the nonetheless nascent crypto trade.

Miss this week’s GROW earnings name for the primary fiscal quarter of 2023? To get a replica of the replay, e-mail us at information@usfunds.com with the topic line “Earnings.”

Index Abstract

- The key market indices completed up this week. The Dow Jones Industrial Common gained 4.15%. The S&P 500 Inventory Index rose 5.90%, whereas the Nasdaq Composite climbed 8.10%. The Russell 2000 small capitalization index gained 4.60% this week.

- The Grasp Seng Composite gained 7.00% this week; whereas Taiwan was up 7.53% and the KOSPI rose 5.74%.

- The ten-year Treasury bond yield fell 34 foundation factors to three.814%.

Airways & Transport

Strengths

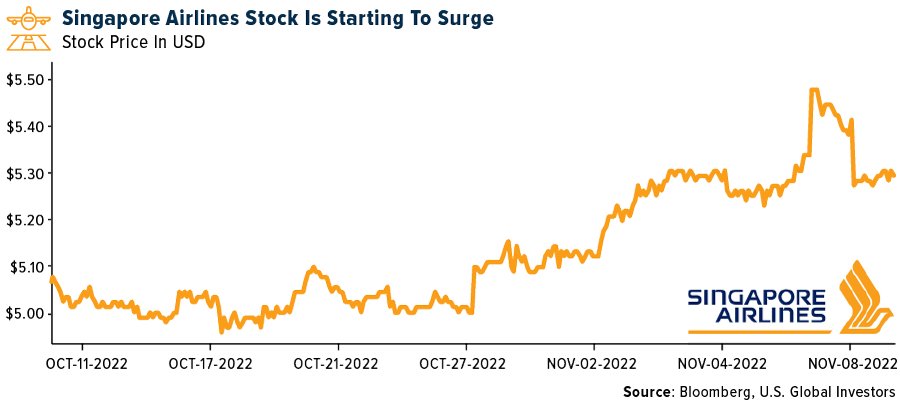

- The perfect performing airline inventory for the week was Wizz Air Holdings, up 29.77%. Singapore Airways reported second quarter 2023 internet revenue of S$557 million, up 50% quarter-over-quarter, effectively forward of consensus estimates. Whole income was S$4.5 billion, up 14% quarter-over-quarter due to steady enchancment in passenger income, offsetting the sequential decline in cargo income. Notably, passenger income was up 24% quarter-over-quarter due to improved journey demand, whereas passenger yield stays elevated.

- Maersk’s third quarter outcomes got here in robust, at 7% above consensus. The distinction versus consensus was primarily in Ocean, the place freight charges had been 1% forward of consensus. Whereas quantity was down 7.5% year-over-year, this was evenly break up between spot and contracted quantity, indicating there was not a mass exodus from contracts. Prices proceed to rise, supporting the view that the mid-term breakeven fee will likely be above 2019 ranges.

- In keeping with Morgan Stanley, maybe the most important takeaway from this earnings season was Solar Nation’s board of administrators’ authorization to repurchase as much as $50 million price of SNCY shares. This announcement marks an vital inflection level for SNCY (and for the trade) by way of attracting traders again to the house in addition to indicators of normalization.

Weaknesses

- The worst performing airline inventory for the week was Azul SA, down 21.18%. Air China, China Southern Airways and China Jap Airways all suffered wider internet losses year-over-year within the third quarter, attributable to dimmed demand restoration, oil worth hikes together with the weaker CNY. Home journey might even see gradual enchancment month-by-month within the fourth quarter, however the “Large Three” carriers may proceed to submit widened losses year-over-year.

- Worldwide Seaways reported an adjusted third quarter EPS of $2.28, beneath the road consensus of $2.32. Charges got here in decrease than consensus nearly throughout the board apart from the LR1 vessels. Though third quarter numbers had been in need of expectations, fourth quarter bookings are universally fairly a bit increased than the present consensus.

- China’s home air visitors fell to simply 26% of 2019 ranges within the second half of October, down from 35% within the first half of that month, the worst degree because the lockdowns in Wuhan (Feb. 2020) and Shanghai (Apr. 2022). Unsurprisingly, Beijing’s home visitors was most disrupted at solely 10% of 2019 ranges within the second half of October as a result of political conferences, however different main cities like Shanghai and Guangzhou had been simply at 30% of regular visitors.

Alternatives

- In keeping with Morgan Stanley, for Boeing, the group was positively stunned that the corporate supplied extra particulars relating to its 2022, 2023, and 2025/2026 free money move outlook. The surprising supporting particulars present a visual and credible path to $10 billion of free money move in 2025/2026. Despite the fact that sell-side consensus estimates are already at $10 billion in 2025, skepticism from the buy-side signifies that administration’s outlook was acquired positively by the market.

- AD Ports introduced signing an settlement to accumulate an 80% stake in Dubai-based container delivery firm International Feeder Transport for AED 2.9 billion. The transaction is anticipated to be closed in within the first quarter of the brand new 12 months and can then make the group the biggest single supplier of feeder delivery providers within the area (with a fleet of 35 vessels) and the third largest globally by volumes carried (with a complete container capability of 100,000 tons).

- China is planning to scrap penalties for airways when deplaned passengers take a look at optimistic for Covid after coming into the nation. Presently, China bans airways from working a route for one to 2 weeks relying on the variety of optimistic checks. As well as, there’s hypothesis that China might ease Covid guidelines in March.

Threats

- Spirit Airways famous pilot attrition stays elevated, which contrasts with commentary from Frontier Airways. One would count on comparatively better hiring/attrition points at Spirit versus Frontier attributable to seniority checklist integration uncertainties associated to the pending merger. Whereas most forecasts assume new pilot contracts by 2023, the exceptions are Frontier (2025) and JetBlue (2024).

- The broadly watched U.S.-West Coast Worldwide Longshore Warehouse Union negotiations stay unresolved, regardless of no main disruptions posed thus far after its contract expiration on July 1. Extra just lately, longshoremen on the Port of Oakland in California walked off the job as they search to get again to the bargaining desk. The negotiations are approaching a tipping level with port labor disputes and employee slowdowns doubtlessly materializing after the U.S. November mid-term elections.

- JetBlue and Alaska Air steering implies a 3-5% level income slowdown relative to 2019. JetBlue has some distinctive headwinds (loyalty comp and Caribbean hurricane impacts) whereas Alaska has increased expertise publicity and guided sooner than different leisure carriers. Each carriers might have been conservative of their steering and there might be income upside if the leisure power persists.

Rising Markets

Strengths

- The perfect performing nation in rising Europe for the week was Romania, gaining 5.7%. The perfect performing nation in Asia this week was Taiwan, gaining 7.3%.

- The Czech koruna was one of the best performing foreign money in rising Europe this week, gaining 4.3%. The South Korean received was one of the best performing foreign money in Asia this week, gaining 6.7%.

- Semiconductor and expertise shares in Taiwan and South Korea outperformed this week. Taiwan Semiconductor Manufacturing Firm (TSMC), the world’s largest contract chipmaker, posted a 56% improve in gross sales in October. TSMC mentioned this week it was making ready for an additional U.S. plant, along with the $12 billion complicated already constructing in Arizona, which is an indication of confidence in the course of the correction amongst expertise names. 12 months-to-date, shares of TSMC declined 41%.

Weaknesses

- The worst relative performing nation in rising Europe for the week was Hungary, gaining 2.5%. The worst relative performing nation in Asia this week was China, because the Shanghai Inventory Alternate gained 0.5%.

- The Turkish lira was the worst relative performing foreign money in rising Europe this week, gaining 0.1%. The Hong Kong greenback was the worst relative performing foreign money in Asia this week, gaining 0.2%.

- China exports shrank unexpectedly in October, falling 0.7% year-over-year in greenback phrases from up 5.7% in September. Imports additionally contracted by 0.7% versus forecasts of 0.1% development. Commerce steadiness dropped to $85.15 billion from $95.95 billion within the prior month.

Alternatives

- There’s a rising enthusiasm about Chinese language equites following rumors that China leaders are contemplating steps towards reopening its financial system however are continuing slowly and don’t have a timeline. The zero-Covid coverage will doubtless not be relaxed this 12 months, however China may approve its domestically developed Covid-19 vaccine primarily based on mRNA expertise, which is believed to be the best safety towards illness.

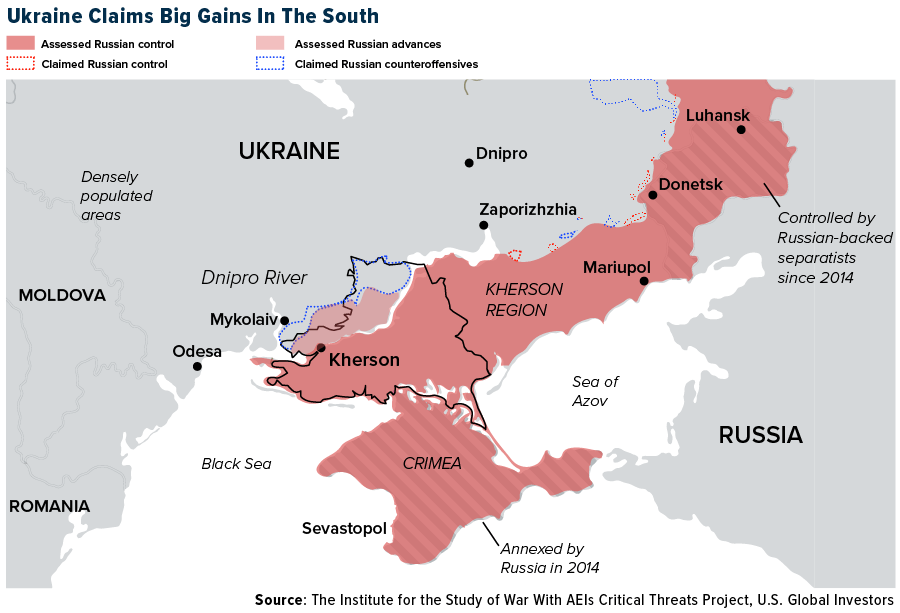

- Russia introduced its withdrawal from the occupied Ukraine metropolis of Kherson, which is among the greatest navy setbacks for Russia since its invasion started in February. Russia would nonetheless retain management of 60% of the Kherson area, together with the shoreline alongside the Sea of Azov. The President of Ukraine reiterated that his nation would proceed to retake territory from Russia. There’s a chance that world leaders throughout subsequent week’s G-20 assembly in Indonesia might focus on choices on initiating peace talks between Russia and Ukraine.

- Bloomberg reported onshore Chinese language traders have been internet patrons of Hong Kong-listed shares for twenty-four consecutive buying and selling periods by way of Tuesday, spending round HKD118 billion ($15 billion). Tencent alone accounted for round 1 / 4 of all move, adopted by Meituan and Wuxi Biologics.

Threats

- China continues to report increased Covid instances. Its nationwide Covid rely elevated to greater than 9,000 on Wednesday; a number of main cities despatched a number of districts beneath lockdowns. Beijing is rising as a hotspot with town discovering 95 new instances on Wednesday, a five-month excessive. A handful of instances had been present in Shanghai and Shenzhen as effectively.

- The President of Ukraine, Zelensky, prolonged the length of martial legislation and basic mobilization in anticipation that there won’t be a fast answer to the battle within the area. The final extension was applied on August 15 for 90 days (till November 23). The warfare in Europe, which erupted February 24 and induced lack of life on each ends, has displaced hundreds of thousands and disrupted world markets.

- Buyers might even see a rise in volatility in buying and selling because the greenback continues to right. This week, inflation information in the USA got here out weaker than anticipated, pushing rising market equites and currencies increased. This week’s outperformance in rising markets supported by a weaker greenback could also be quick lived as extra constant financial information is required to conclude that CPI is on a down pattern, towards the two% desired by the Federal Reserve. Nonetheless, a 50-basis factors hike is anticipated in December.

Power and Pure Assets

Strengths

- The perfect performing commodity for the week was nickel, rising 8.99%, because it and different metals surged with the easing of Covid restrictions in China. The brand new Vogtle reactors in Georgia are the primary new reactors to obtain development approval in additional than 30 years, in response to the EIA. The Vogtle Items 3 and 4 venture items are set to come back on-line within the first quarter of 2023. The Division of Power had provided conditional commitments totaling $8.3 billion in mortgage ensures for the development of the 2 1.1K MW nuclear reactors, however the development was delayed as a result of lack of a correct home nuclear provide chain and expert workforce.

- The third quarter of 2022 reporting season for European Union Large Oils marks the seventh consecutive robust quarter for the sector (10% beat on company-compiled consensus earnings in mixture) and helps the view of ongoing optimistic earnings revisions, the re-ignition of the money move technology engine, double-digit money returns to shareholders on the again of buybacks, and rising dividends.

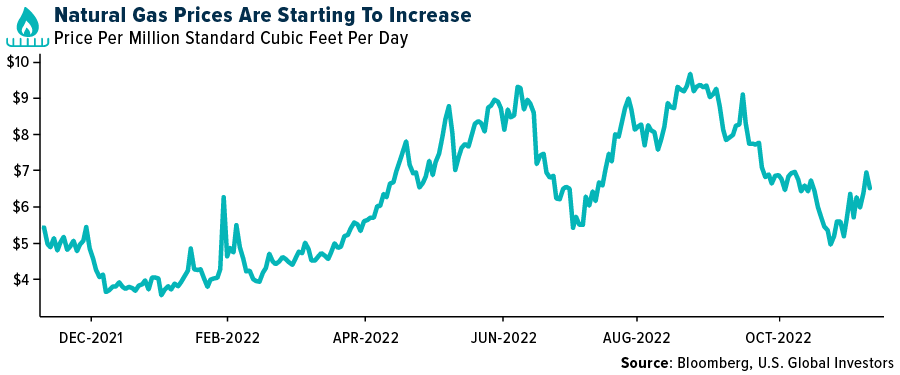

- U.S. pure fuel futures soared as a lot as 10% to start out the week as a winter storm hits the Pacific Northwest and frigid climate is anticipated throughout many of the nation subsequent week. Within the first main chilly snap of the season, air filtering throughout the West is pushing temperatures 15 to 25 levels Fahrenheit beneath regular ranges and can doubtless deposit two to 4 ft of snow by way of Tuesday within the Sierra Nevada mountains, in response to the Nationwide Climate Service. Nonetheless, there are rummers Freeport LNG will likely be delayed on reopening. The curtailed export capcity has resulted in stranded fuel and decrease home costs.

Weaknesses

- The worst performing commodity for the week was pure fuel, dropping 7.31%, over worries of stranded fuel resurfacing. Urea costs had been down this week as worldwide producers minimize costs, which sparked demand and lifted costs earlier than India introduced a shock tender. Potash costs had been down throughout all world benchmarks as competitors stays excessive and demand nonetheless comparatively sluggish.

- On the trade degree, U.S. shale development has usually fallen in need of market expectations by way of the post-Covid restoration. For the reason that begin of 2022, U.S. oil manufacturing has solely grown 200 million barrels per day, roughly one-tenth of the height development seen in 2018. Capital self-discipline and the extra transitory impacts of inflation and tight provide chains are definitely vital drivers of this pattern.

- The benchmark iron ore worth briefly dipped beneath $80 per ton final week earlier than rebounding to $88 per ton by the top of final week and into this week. Some Chinese language home iron ore producers have been chopping output, with utilization charges of 53% final week down from 65% in mid-August.

Alternatives

- In keeping with UBS, the long-term fundamentals for copper look compelling and arguably higher now than six to 9 months in the past attributable to accelerated spending on power transition and potential delays to new initiatives. Nonetheless, there’s an inconsistency between expectations of easing bodily tightness and consensus, suggesting costs won’t fall in 2023. Regardless of being extra cautious than consensus close to time period, the danger versus reward for copper/copper shares is enhancing.

- Following the U.Okay. and France, Japan established an formidable plan to restart as much as 17 nuclear energy vegetation starting in the summertime of 2023 and assemble nuclear vegetation to start out industrial operations within the 2030s. Poland plans to spend $40 billion to construct two nuclear energy vegetation and has chosen the U.S. authorities and Westinghouse as companions. The U.S. and Canada are additionally planning to journey the wave of nuclear renaissance momentum.

- Within the Center East, there’s an ambition to develop manufacturing capability. Initiatives that had been mentioned in 2019 are actually reaching decisioning, however an entire new wave of initiatives is stacking up behind this one, making a fairly formidable venture checklist. In Qatar, along with 4 trains on the North Subject Enlargement, Qatar Gasoline appears very more likely to resolution two incremental trains from the North Subject South venture in 2023 however may fairly presumably increase this quantity to 4. The UAE is seeking to increase its manufacturing capability by 1MMbpd by way of elevated exercise in quite a lot of fields and can also be more likely to develop its Hail & Ghasha bitter fuel venture in addition to its personal potential LNG export facility.

Threats

- Extra U.S. SPR releases will likely be wanted given the implementation dangers across the forthcoming worth cap on Russian oil exports. There are a further 26 million barrels of congressionally mandated gross sales required in fiscal 12 months 2023 that runs from October 2022 by way of September 2023 and will likely be delivered within the first quarter of the brand new 12 months. On this situation, crude oil shares in SPR will exit the primary quarter of 2023 quietly at 348 million barrels, the bottom since July 1983, and nearly half of the shares a 12 months in the past.

- Asian LNG imports fell 9% year-over-year within the first 10 months of 2022 on excessive pricing stress and China’s Covid coverage. Excessive costs should still weigh on Asia’s imports subsequent 12 months, however this might be offset by a requirement rebound particularly in China following re-opening.

- The North American Electrical Reliability Company warned this week that a lot of North America will face potential provide shortfalls this winter if climate turns into extreme sufficient. Individuals are already paying report excessive electrical energy charges amid tight pure fuel and coal provides and competing for these fuels within the worldwide markets.

Luxurious Items

Strengths

- In keeping with Bloomberg, year-over-year inflation (CPI) within the U.S. decreased in October to 7.7% from 8.2% in September, versus the anticipated 7.9%. This represents a slight development in buying energy for shoppers within the U.S., one of many main luxurious items markets worldwide.

- Ralph Lauren reported a 30% rise in gross sales in China regardless of pandemic closures as a result of nation’s zero-Covid coverage and a 3rd of its shops being closed throughout the nation. The model attributes the optimistic outcomes to its reputation amongst youthful and wealthier shoppers within the Asian nation, in response to Patrice Louvet, Ralph Lauren’s CEO, experiences Bloomberg.

- Aston Martin Lagonda International, an organization that designs and manufactures cars, was one of the best performing S&P International Luxurious inventory for the week, gaining 41.76%. The corporate launched new merchandise, together with the 2023/24 sports activities/GT line-up renewal. The corporate’s inventory is increased for the seventh straight day (the longest successful streak because the firm went public in 2018), and it’s up greater than 60% from the November 2 low.

Weaknesses

- European shares of each luxurious and mining shares fell at the beginning of the week, experiences Reuters, after hopes of an easing in China’s strict Covid measures had been quashed over the weekend. LVMH, Kering, and Pernod Ricard all dropped between 0.7% and 1.6%. Well being officers in China reiterated their dedication to strict Covid curbs this weekend, the article explains, disappointing traders looking forward to aid. China is among the main markets for world luxurious items purchases, so it is a unfavorable for the area.

- The pinnacle of the posh analysis staff from Morgan Stanley mentioned the widening hole between a stronger greenback and different world currencies is impacting the posh items market, affecting main luxurious manufacturers like Burberry, Louis Vuitton, and Kering. Corporations from these industries have round a 35% worth hole in Europe versus China and round a 25% worth hole in Europe versus. the U.S. on common, nonetheless, now that is about 40% attributable to international foreign money actions. That is producing a grey market as a result of shoppers journey to nations with extremely devaluated native currencies in comparison with the U.S. greenback to purchase the identical merchandise however at decrease costs. Louis Vuitton and Kering mentioned, for now, they wouldn’t increase the costs in markets the place the native foreign money has considerably depreciated.

- Sensible Earth Group, an organization that designs and manufactures jewellery merchandise, was the worst performing S&P International Luxurious inventory for the week, dropping 20.05%. The corporate minimize its year-end gross sales outlook, and the inventory fell as a lot as 33%, (probably the most intraday since Could 13). JPMorgan lowered its worth goal for the corporate from $11 to $10.

Alternatives

- As reported by Vogue Enterprise, Kering is in superior talks to accumulate Tom Ford, the Wall Road journal famous on the finish of final week (with rumors nonetheless highlighted into this week). The French luxurious group, which owns manufacturers together with Gucci, Balenciaga, and Saint Laurent, may attain a deal quickly, the article continues, which cited unnamed sources. Information that Goldman Sachs was exploring a possible purchaser for Tom Ford was first reported this summer season. Kering is eager about Tom Ford’s magnificence enterprise which already holds the license. In June, Estée Lauder introduced its plans to develop this license right into a billion-dollar enterprise.

- In keeping with Bloomberg, Farfetch, one of many main luxurious items e-commerce manufacturers, will purchase a 47.5% stake in Yoox-Internet-a-Porter Group, a transfer that’s anticipated to finalize in 2023. This acquisition represents a big alternative for Farfetch to entry China’s prime retail websites, joint-venture money injections from Alibaba and Richemont, and ventures within the U.S. and on-line magnificence retailers.

- Over the weekend, Chanel constructed a cabana-lined, boardwalk-style runway – to stage a style present in early November, experiences Fashionista.com. Nonetheless, there was technically no new assortment to showcase. So, what’s the deal? In keeping with the article, that is an instance of a rising pattern amongst luxurious manufacturers, the place they primarily re-do a runway nearer to when the gathering arrives in retail. It’s not fairly see-now, buy-now, but it surely’s shut.

Threats

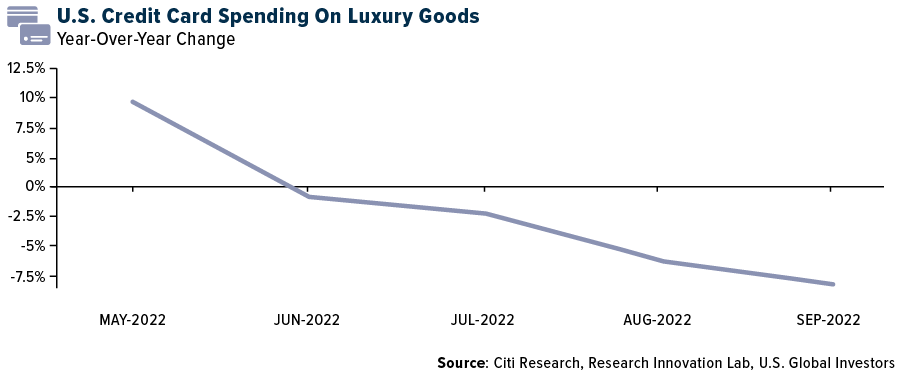

- Primarily based on a survey of two,200 U.S. adults by Morning Seek the advice of, credit-card information exhibits that spending on luxurious items slowed within the U.S. in latest months. As well as, 72% of shoppers are planning to search for cheaper alternate options this vacation season due to the excessive inflation ranges. They count on fewer vacation gross sales over the following two months, predicting a rise of round 6% and eight% from a 12 months in the past, after a 13.5% bounce final 12 months.

- Bloomberg economists predict that China’s year-over-year retail gross sales will lower from 2.5% in September to 0.7% in October attributable to Covid restrictions. China continues to report a spike in Covid instances, and extra lockdowns are anticipated. The gross sales information will likely be launched subsequent week on November 14.

- China’s authorities reiterated its zero-Covid coverage and has requested for extra exact Covid management measures. This might imply extra lockdowns and the shut of various industries throughout the nation, impacting the manufacturing chain of many worldwide firms whose manufacturing base is situated in China.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, one of the best performer for the week was PAX Gold, rising 5.66%. Oil and fuel big Shell introduced Thursday that it signed a two-year convention sponsorship with Bitcoin Journal, a number one crypto publication, experiences the media outlet. Representatives from Shell will converse on the mining stage about enhancing the power prices of Bitcoin mining, utilizing the corporate’s personal lubricant and cooling options.

- BingX, the main crypto social buying and selling change, launched a brand new bug bounty program on HackenProof. HackenProof is a web3 bug bounty platform trusted by the crypto market that connects its prospects with the worldwide hacker group to uncover safety points of their merchandise. This program rewards each customers and safety researchers to search out and report bugs in its ecosystem with money.

- U.S. Senators John Boozman and Debbie Stabenow put out separate statements on Thursday highlighting their arguments within the wake of the turmoil at Sam Bankman-Fried’s FTX change and sister buying and selling home Alameda Analysis. Lead sponsors of the laws would give the Commodity Futures Buying and selling Fee sweeping powers to manage crypto belongings instantly whereas the FTX disaster underscores the necessity for better oversight of the trade.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was FTX Token, dropping 89.33%. Bloomberg experiences that this week’s rout in cryptocurrencies deepened, with Bitcoin tumbling to the bottom ranges in two years, with the collapse of FTX.com. Bitcoin, the biggest token by market worth, fell as a lot as 16% to $15,731.30 on Wednesday, the bottom since November 2020. That brings this week’s decline to about 20%. It reached a report excessive of virtually $69,000 a 12 months in the past. Almost each digital coin was struggling; Ether, Solana, Polkadot, and Avalanche all dropped. FTT, the utility token of the FTX Alternate, collapsed by greater than 40%, following a more-than-70% tumble on Tuesday.

- Core Scientific Inc., the Bitcoin miner that warned final month that it’d search chapter safety, mentioned its reserve of the digital token has dwindled to 62 cash as of October, from greater than 8,000 earlier this 12 months. Low Bitcoin costs, hovering power prices, and fierce competitors amongst miners have battered Bitcoin miners who took out billions of {dollars} of loans to fund their expansions in the course of the bull run beginning final November. Different miners, comparable to Argo Blockchain PLC and Iris Power, are additionally struggling to repay debt.

- Decentralized finance is feeling the ache of Binance’s proposed, however dropped, takeover of FTX.com, with traders yanking money from initiatives as uncertainty lingers about the way forward for one of many largest crypto exchanges. The full worth of money locked in DeFi dropped by greater than 12% in a single day, after hovering round $50 billion to $60 billion since June, in response to information tracker DeFi Llama. That quantity stood at greater than $180 billion final December.

Alternatives

- Singapore’s want to be a hub for the so-called web3 trade conflicts with the city-state’s proposed curbs on retail crypto buying and selling, Coinbase International Inc.’s Chief Government Officer Brian Armstrong mentioned. The nebulous time period “web3” refers to a imaginative and prescient of a decentralized web constructed round blockchains, crypto’s underlying expertise. Asian economies together with Singapore, Hong Kong and Japan are jostling to be on the forefront of the expertise, anticipating it may well support financial enlargement. Singapore is searching for to clamp down on retail-investor entry to crypto buying and selling to defend shoppers from a risky market that endured a $2 trillion rout over the previous 12 months.

- Bitcoin baseball staff Perth Warmth is now permitting followers to ship micropayments to gamers with Bitcoin by way of Lightning, experiences Bitcoin Journal. Final 12 months, the staff turned the primary sports activities membership to function on a Bitcoin Customary. The function was developed in collaboration with IBEX, the staff’s official Bitcoin Lightning processor, and will likely be out there beginning on Perth Warmth’s subsequent sport on November 11, 2022, the article explains.

- Cameron Crise, Bloomberg macro strategist, writes this week that the crypto crash reminded him of when Robert Heinlein popularized the phrase “there ain’t no such factor as a free lunch,” within the Sixties, however for a lot of the previous a number of years the crypto trade has tried to dispute it. The invoice, it appears, is now coming due. Typically talking, if one thing appears too good to be true, it often is. And when actors, supermodels, and sports activities stadiums are all telling at you to get excited a few monetary innovation that entails heavy possession of illiquid belongings…maybe think about strolling the opposite manner.

Threats

- Crypto markets face weeks of deleveraging within the fallout from the disaster at digital-asset change FTX.com, a interval of upheaval that would push Bitcoin all the way down to $13,000, in response to JPMorgan Chase & Co. strategists. A “cascade of margin calls” is probably going underway given the interaction between the change, its sister buying and selling home Alameda Analysis, and the remainder of the crypto ecosystem, a staff led by Nikolaos Panigirtzoglou wrote in a be aware. “What makes this new part of crypto deleveraging induced by the obvious collapse of Alameda Analysis and FTX extra problematic is that the variety of entities with stronger steadiness sheets capable of rescue these with low capital and excessive leverage is shrinking” within the crypto sphere, the staff mentioned Wednesday.

- Crypto change FTX lent billions of {dollars}’ price of buyer belongings to fund dangerous bets by its affiliated buying and selling agency, Alameda Analysis, setting the stage for the change’s implosion, an individual acquainted with the matter mentioned. FTX Chief Government Sam Bankman-Fried (who stepped down Friday) advised an investor this week that Alameda owes FTX about $10 billion, the individual mentioned. FTX prolonged loans to Alameda utilizing cash that prospects had deposited on the change for buying and selling functions, a call that Mr. Bankman-Fried described as a poor judgment name, in response to the individual. The FTX.com fiasco has ensnared a number of the greatest names in finance.

- Bitcoin is at present buying and selling round its lows of the 12 months, which is feeding by way of into broader danger sentiment. It’s been mentioned that the crypto trade has tried to compress all of the errors of the previous few centuries of conventional finance into the span of some years– FTX and related firms allegedly encapsulate plenty of these errors themselves. It seems that the dearth of a reputable lender of final resort in decentralized finance may be a bug, relatively than a function.

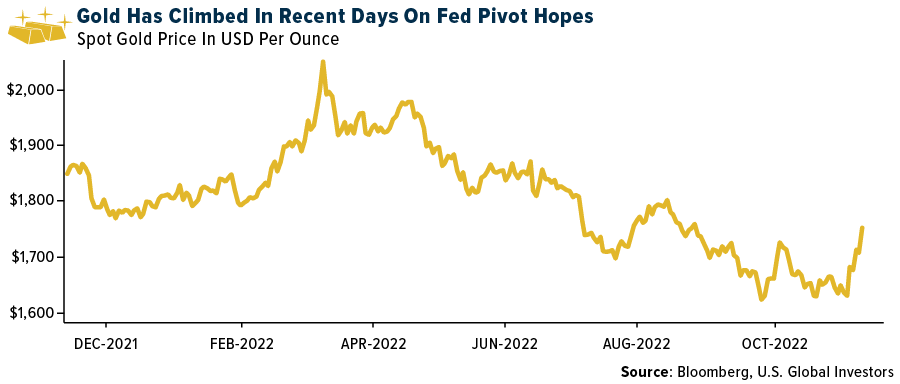

Gold Market

This week gold futures closed at $1,770.90, up $94.30 per ounce, or 5.62%. Gold shares, as measured by the NYSE Arca Gold Miners Index, ended the week increased by 14.88%. The S&P/TSX Enterprise Index solely gained 1.03%. The U.S. Commerce-Weighted Greenback sunk 4.06%.

| Date | Occasion | Survey | Precise | Prior |

|---|---|---|---|---|

| Nov-10 | CPI YoY | 7.9% | 7.7% | 8.2% |

| Nov-10 | Preliminary Jobless Claims | 220k | 225k | 218k |

| Nov-11 | Germany CPI YoY | 10.4% | 10.4% | 10.4% |

| Nov-14 | China Retail Gross sales YoY | 0.7% | — | 2.5% |

| Nov-15 | Germany ZEW Survey Expectations | -50.0 | — | -59.2 |

| Nov-15 | Germany ZEW Survey Present Scenario | -67.8 | — | -72.2 |

| Nov-15 | PPI Closing Demand YoY | 8.3% | — | 8.5% |

| Nov-17 | Eurozone CPI Core YoY | 5.0% | — | 5.0% |

| Nov-17 | Housing Begins | 1,415k | — | 1,439k |

| Nov-17 | Preliminary Jobless Claims | 220k | — | 225k |

Strengths

- The perfect performing valuable metallic for the week was palladium, up 10.46%. Allied Market Analysis revealed a report outlining 5.8% compounded development for world palladium markets by way of 2031. Barrick Gold reported third quarter 2022 adjusted earnings per share (EPS) of $0.13 versus consensus of $0.11. The beat versus consensus was on decrease depreciation, company prices, exploration, curiosity in addition to barely decrease copper prices. Money prices of $891 per ounce had been largely according to consensus of $892 per ounce, whereas all-in sustaining prices (AISC) of $1,269 per ounce was barely beneath consensus of $1,271 per ounce on decrease company allotted overheads.

- AngloGold Ashanti’s third quarter 2022 outcomes had been higher than forecast attributable to an improved manufacturing and unit value efficiency, which resulted in a ten% beat on EBITDA (earnings earlier than curiosity, taxes, depreciation and amortization). Money technology for the interval was $203 million higher than forecast, with administration highlighting that it continues to generate robust money flows from the Kibali JV, whereas the excellent value-added tax (VAT) steadiness in Tanzania was additional diminished by way of company tax offsets.

- Central banks purchased nearly 400 tons of gold within the third quarter, the biggest quarterly improve on report. 12 months-to-date purchases are already on the highest degree since 1967, and there have been eight consecutive quarters of internet shopping for. Particularly, the World Gold Council (WGC) famous an enormous improve in unreported shopping for, whereas reported purchases had been predominantly at rising market banks.

Weaknesses

- The worst performing valuable metallic for the week was silver, however nonetheless up 4.65% and is the strongest performer thus far this quarter. Sibanye-Stillwater’s third quarter 2022 working outcomes upset, with manufacturing lacking consensus by 6% on the SA PGM operations, 11% on the SA gold operations and 23% on the Stillwater mine. Group adjusted EBITDA for the interval declined 51% year-over-year to $496 million and missed consensus by 46%.

- Equinox Gold reported third quarter adjusted EPS lack of $0.09 towards consensus of a achieve of $0.01, and the Road estimate of a lack of $0.02. The disappointing quarter was punctuated by lowered manufacturing steering and elevated value steering for the complete 12 months 2022.

- Franco Nevada reported adjusted EPS of $0.83 versus consensus of $0.85; EPS was decrease than consensus on decrease income efficiency from valuable metals offset by stronger efficiency from the power division (Marcellus and Haynesville) versus consensus.

Alternatives

- Pan American Silver and Agnico Eagle delivered a definitive binding provide to accumulate Yamana, topping the bid from Gold Fields. This consolidates 100% possession of the Canadian Malartic mine, one of many world’s largest gold mines. The transaction would additionally create the main valuable metals producer in Latin America. The consideration consists of 153,539,579 widespread shares within the capital of Pan American; $1 billion in money contributed by Agnico Eagle; and 36,089,907 widespread shares within the capital of Agnico Eagle. Beneath the provide, every Yamana share can be exchanged for roughly US$1.04 in money, 0.1598 Pan American shares and 0.0376 Agnico Eagle shares, for an mixture worth of $5.02 per Yamana share.

- On Sunday night, SolGold introduced that it had entered into an settlement with Osisko Gold Royalties for a $50 million royalty financing on SolGold’s Cascabel copper-gold venture situated in northern Ecuador. Osisko has a 5% internet smelter return (NSR) royalty on the Canadian Malartic mine and 3-5% NSR royalties throughout the Odyssey underground venture. As well as, Triple Flag Treasured Metals agreed to purchase Maverix Metals for $606 million, elevating its profile and rising the liquidity of their shares with the acquisition.

- With one other jumbo fee hike final week, gold and the markets rebuked Powell’s hawkish tone final Friday and continued their narrative of defiance all through the previous week with additional worth good points fueled by China reopening steps. The adage that the Fed will increase charges till one thing breaks might have seen the primary shoe to drop with trillions eviscerated from crypto because the Fed modified coverage. Lower than every week after the newest hike, FTX collapsed in a matter of days, wiping out buyer accounts and one other $5 billion in primarily vapor belongings from firms related to crypto. This can be a part of why gold is now getting a firmer bid as traders ask… “The place is my cash safer?”

Threats

- Argonaut Gold reported roughly in line adjusted EPS of $0.00 however achieved lower-than-expected manufacturing (45,900 ounces gold) and higher-than-expected prices within the third quarter of 2022. Weaker outcomes at La Colorada and Florida Canyon had been largely what led to the consolidated manufacturing miss. For the second quarter in a row, the corporate has raised its money prices and AISC steering by roughly $100 per ounce.

- Gold Fields has rescinded its provide for Yamana Gold after two Canadian rivals teamed up with an unsolicited $4.8 billion bid to interrupt up an earlier merger settlement with the South African miner. Gold Fields CEO Chris Griffith famous that the corporate remains to be eager about belongings in Canada and isn’t deterred by its expertise in attempting to accumulate Yamana. Corporations like Wesdome Gold Mines or Fortuna Silver Mines may be extra palatable to accumulate.

- Petra introduced that the japanese wall of the tailings storage facility at its Williamson mine in Tanzania was breached. No fatalities or accidents have been confirmed. All mine manufacturing has been suspended pending additional investigation into the breach. Whereas Williamson solely represents 3% of Petra’s whole asset valuation, that is unlucky information from an environmental perspective and by way of potential impression to close by communities.

U.S. International Buyers, Inc. is an funding adviser registered with the Securities and Alternate Fee (“SEC”). This doesn’t imply that we’re sponsored, beneficial, or authorized by the SEC, or that our talents or {qualifications} the least bit have been handed upon by the SEC or any officer of the SEC.

This commentary shouldn’t be thought-about a solicitation or providing of any funding product. Sure supplies on this commentary might comprise dated data. The knowledge supplied was present on the time of publication. Some hyperlinks above could also be directed to third-party web sites. U.S. International Buyers doesn’t endorse all data provided by these web sites and isn’t liable for their content material. All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions might not be acceptable to each investor.

Holdings might change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Buyers as of (09/30/22):

Barrick Gold

AngloGold Ashanti

Franco Nevada

Agnico Eagle Mines

Yamana

SolGold

Osisko Gold Royalties

Argonaut Gold

Meituan

Tencent

Singapore Airways

A.P. Moeller Maersk

Solar Nation

Air China

Boeing

Alaska Air

Frontier Airways

JetBlue

LVMH

Kering

Alibaba Group Holdings

Cie Financiere Richemont

*The above-mentioned indices will not be whole returns. These returns replicate easy appreciation solely and don’t replicate dividend reinvestment.

The Dow Jones Industrial Common is a price-weighted common of 30 blue chip shares which might be usually leaders of their trade. The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 widespread inventory costs in U.S. firms. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq Nationwide Market and SmallCap shares. The Russell 2000 Index® is a U.S. fairness index measuring the efficiency of the two,000 smallest firms within the Russell 3000®, a well known small-cap index.

The Grasp Seng Composite Index is a market capitalization-weighted index that includes the highest 200 firms listed on Inventory Alternate of Hong Kong, primarily based on common market cap for the 12 months. The Taiwan Inventory Alternate Index is a capitalization-weighted index of all listed widespread shares traded on the Taiwan Inventory Alternate. The Korea Inventory Value Index is a capitalization-weighted index of all widespread shares and most well-liked shares on the Korean Inventory Exchanges.

The Philadelphia Inventory Alternate Gold and Silver Index (XAU) is a capitalization-weighted index that features the main firms concerned within the mining of gold and silver. The U.S. Commerce Weighted Greenback Index supplies a basic indication of the worldwide worth of the U.S. greenback. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose fairness weights are capped 25 p.c and index constituents are derived from a subset inventory pool of S&P/TSX Composite Index shares. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded firms concerned primarily within the mining for gold and silver. The S&P/TSX Enterprise Composite Index is a broad market indicator for the Canadian enterprise capital market. The index is market capitalization weighted and, at its inception, included 531 firms. A quarterly revision course of is used to take away firms that comprise lower than 0.05% of the load of the index, and add firms whose weight, when included, will likely be better than 0.05% of the index.

The S&P 500 Power Index is a capitalization-weighted index that tracks the businesses within the power sector as a subset of the S&P 500. The S&P 500 Supplies Index is a capitalization-weighted index that tracks the businesses within the materials sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base degree of 10 for the 1941-43 base interval. The S&P 500 Industrials Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the industrial sector as a subset of the S&P 500. The S&P 500 Client Discretionary Index is a capitalization-weighted index that tracks the businesses within the shopper discretionary sector as a subset of the S&P 500. The S&P 500 Info Know-how Index is a capitalization-weighted index that tracks the businesses within the data expertise sector as a subset of the S&P 500. The S&P 500 Client Staples Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the shopper staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the businesses within the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the businesses within the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the telecom sector as a subset of the S&P 500.

The Client Value Index (CPI) is among the most well known worth measures for monitoring the value of a market basket of products and providers bought by people. The weights of parts are primarily based on shopper spending patterns. The Buying Supervisor’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index is predicated on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment setting. Gross home product (GDP) is the financial worth of all of the completed items and providers produced inside a rustic’s borders in a particular time interval, although GDP is often calculated on an annual foundation. It consists of all non-public and public consumption, authorities outlays, investments and exports much less imports that happen inside an outlined territory.

The S&P International Luxurious Index is comprised of 80 of the biggest publicly traded firms engaged within the manufacturing or distribution of luxurious items or the availability of luxurious providers that meet particular investibility necessities.

M2 is a measure of the cash provide that features money, checking deposits, and easily-convertible close to cash.

[ad_2]

Source_link