[ad_1]

The worldwide push to succeed in net-zero emissions and meet the world’s future power wants will value trillions of {dollars} and require way over renewable applied sciences, in response to power executives.

“We’re nonetheless at that very early part the place we make these grand pronouncements and we’ve tried to jumpstart the machine with out absolutely understanding, communally, the economics and all of that,” stated Societe Generale’s Karl Pettersen, chief sustainability officer for the Americas.

Who pays for decarbonization and the way finest to attain it are the power transition’s elementary questions, panelists stated late final month on the North American Gasoline Discussion board in Washington, DC.

“Right now, we nonetheless don’t have a solution to who truly pays for this,” Pettersen added. “Markets are designed to move prices on to shoppers. I don’t suppose that’s a good suggestion. We all know what the steadiness sheets of company America seem like, and it’s not going to occur.”

There have to be new “market mechanisms and political instruments to assist us allocate this sort of danger and the greenback funding” that’s required to determine pathways towards the longer term power combine, Pettersen stated.

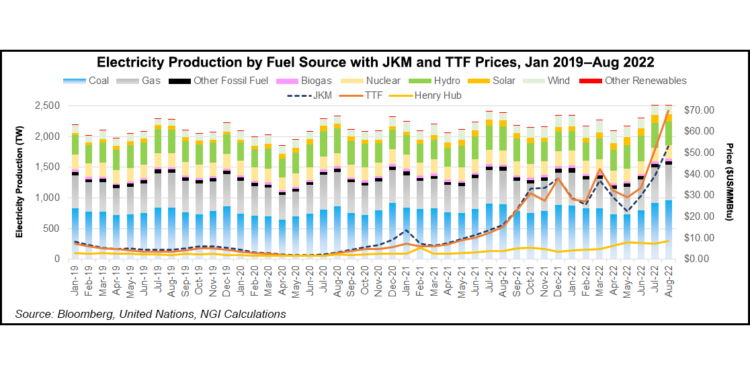

Commodity costs have been terribly risky this yr, whereas fossil gasoline shortages and an absence of renewable output at instances in Europe has helped push energy costs to document highs. The continent’s power disaster has reverberated all through international markets and solid a highlight on aggressive power transition plans which have partly curbed funding within the oil and fuel sector.

“The most important lie of the local weather motion is that we are able to get there with no worth enhance,” stated Tellurian Inc. CEO Octávio Simões. “For those who have a look at what must be accomplished in lowering emissions and including power for the world, it’s not going to be cheaper or the identical worth.”

He harassed that a possibility exists to decarbonize the oil and fuel trade in order that it may higher assist in lowering emissions and creating further power for shoppers internationally. However he added that the trade “has been starved of capital,” which has resulted in a scarcity of provides.

Tellurian is creating the 27 million metric tons/yr Driftwood LNG terminal in Louisiana. But it surely has but to sanction the venture. The corporate nonetheless doesn’t have financing to construct the power.

Quantum Vitality Companions CEO Will VanLoh stated there’s little doubt the world will want extra power sooner or later, which he stated is prone to embrace extra fossil fuels than right now.

Thirty years in the past, the world consumed 400 quadrillion Btu of power, VanLoh stated, citing the Vitality Info Administration’s Worldwide Vitality Outlook. By 2020, it consumed 600 quadrillion Btu. The world’s power wants are anticipated to succeed in 900 quadrillion Btu by 2050.

The quickest rising portion of the world’s power stack is wind and solar energy, stated VanLoh, who based the non-public fairness agency that has investments throughout the power worth chain.

“Any approach you wish to sort of slice it over the following three many years, we’re not going to have the ability to get wherever near supplying our total power deck with wind and photo voltaic,” he added. “As a matter of truth, we’ll in all probability be utilizing extra coal, extra fuel and extra oil 30 years from now than we’re utilizing right now.”

In that case, VanLoh harassed the crucial of decreasing the prices related to carbon seize expertise and stated the world should additionally begin planning to put in extra nuclear energy.

He stated that 60% of the world’s pure fuel provide have to be changed over the following 20 years, whereas 70% of its liquid gasoline wants have to be changed over the following 20 years. That might require important funding within the oil and fuel sector.

Finally, VanLoh estimated that the price of reaching net-zero emissions and discovering options to higher deal with local weather change vary from $100 trillion to $275 trillion.

“By some estimates, it might be 1 / 4 to a 3rd of all of the capital raised and obtainable for funding yearly globally,” VanLoh stated. “…How this performs out goes to have an effect on each trade, each human being on the planet in materials methods. The West has purchased into this. There isn’t a going again. So we’d higher determine how one can get there.”

[ad_2]

Source_link