[ad_1]

The European gasoline market stays on a knife edge as winter approaches. 4 key elements are set to drive market dynamics throughout winter:

Russian gasoline flows

European gasoline storage ranges

European gasoline demand

LNG imports.

Russian gasoline flows have restricted flex to go decrease following the shutdown of NordStream 1. EU Storage ranges are actually barely above the 5 12 months vary (as we checked out in a current snapshot). Fuel demand stays a key driver given uncertainty round gasoline demand reductions in response to each coverage and pricing. The opposite key variable is LNG imports – that is what we concentrate on at the moment.

Excessive European LNG imports proceed

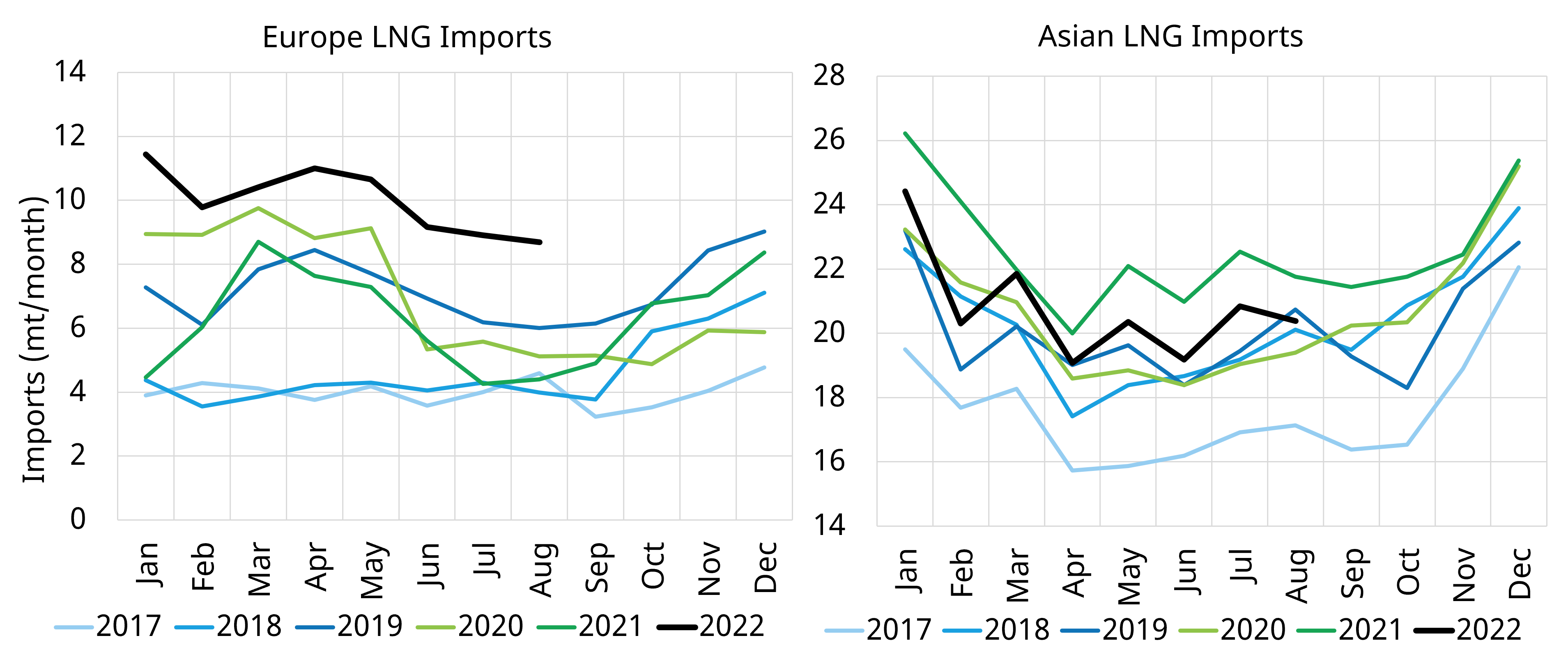

European LNG imports in August 2022 continued the upwards pattern of historic month-to-month highs vs earlier years (as seen within the left hand panel of Chart 1).

August noticed a rise of 5.8 mt 12 months on 12 months (253 mcm/d larger 12 months on 12 months) to assist steadiness decrease Russian flows. Russian provide was 250 mcm/d decrease in August (12 months on 12 months) by means of the three conventional pipeline provide routes into Europe.

Greater LNG imports in 2022 have been enabled by vital demand destruction in different regional markets given excessive value ranges. Asian imports had been down 1.9 mt in August vs final 12 months, whereas South American imports had been down 1.6 mt.

Chart 1: European & Asian LNG imports

Supply: LNG Limitless, Timera Power

Main regas constraints in Europe

The principle issue constraining larger European imports over the previous few months has been infrastructure. This contains each regas & pipeline capability constraints (e.g. constraining flows of gasoline out of Spain & the UK).

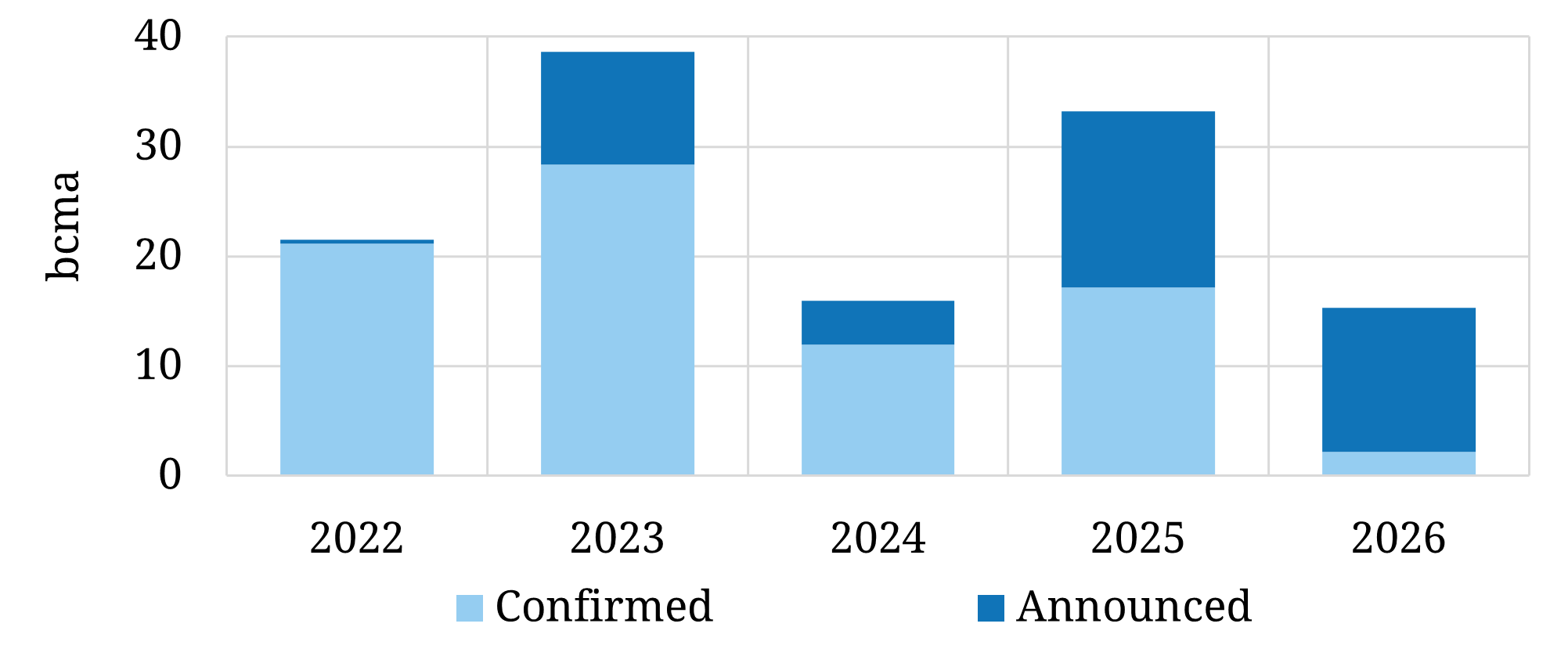

There’s some excellent news on the regas entrance. The Floating Storage & Regas Unit (FSRU) at Eemshaven acquired its maiden cargo final week, with extra FSRUs set to return on-line in Germany this winter. Chart 2 exhibits the incremental pipeline of confirmed & introduced regas capability additions in Europe.

Chart 2: European regas additions

Supply: Timera Power

Regas capability doesn’t assure incremental LNG provide (which depends upon world provide and relative regional pricing). Nevertheless it does begin to handle the extreme constraints at present driving locational gasoline value divergence throughout Europe.

Worth alerts stay strained

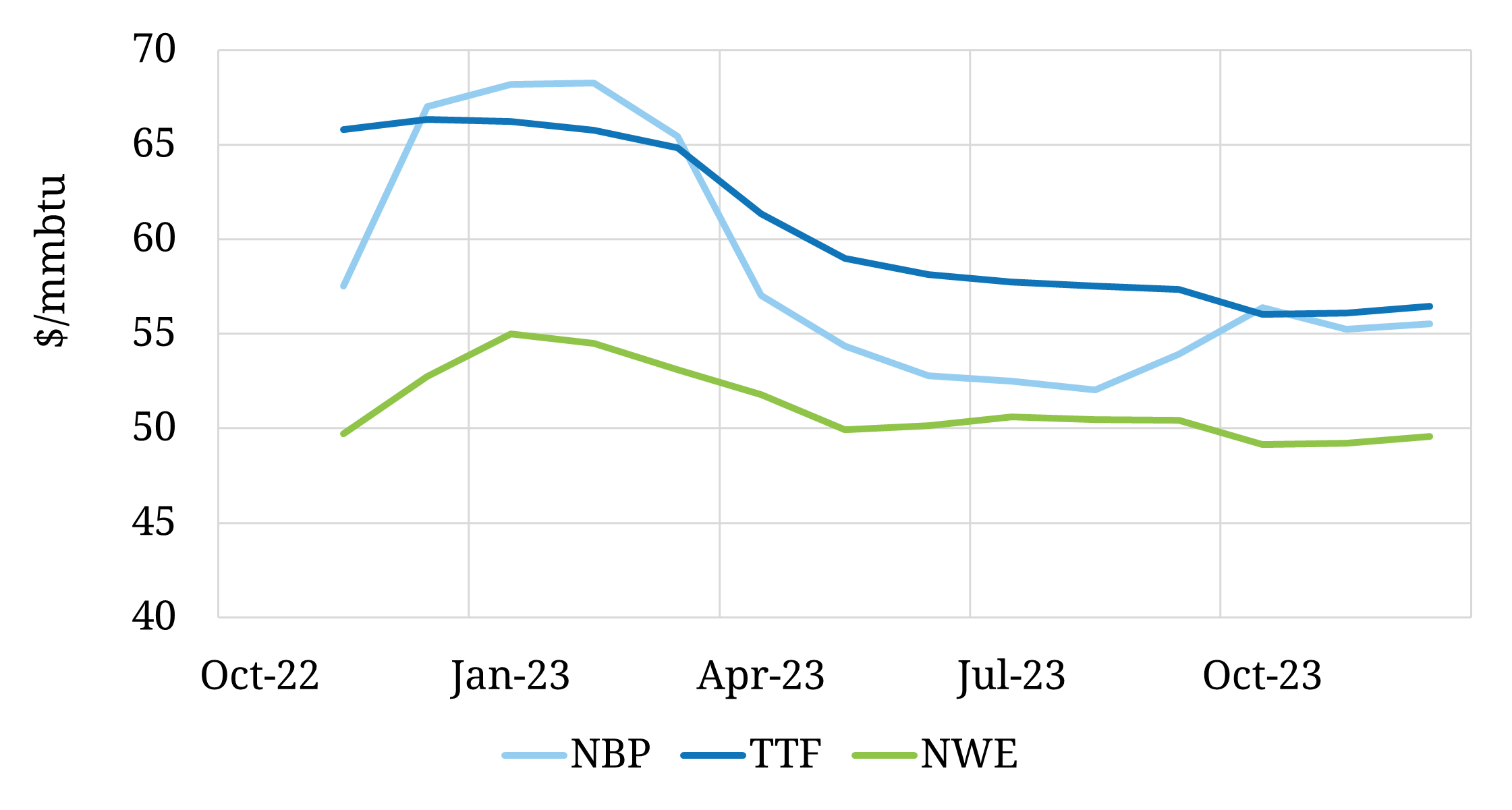

Ahead gasoline costs present that regardless of deliberate FSRUs, the market expects Europe to stay capability constrained. Chart 3 exhibits the Spark NW Europe DES value (inexperienced line) at a considerable low cost to TTF throughout 2023 (greater than 10 $/mmbtu throughout winter).

UK NBP ahead costs have a extra pronounced seasonal form than TTF. These are at a premium throughout winter because the UK fights for gasoline, earlier than swinging to a reduction subsequent summer time.

Chart 3: TTF vs NBP vs NW Europe DES

Supply: CME, Spark Commodities, Timera Power

The premium of European hub costs over different areas (e.g. Asian JKM) is signalling that European regas terminals can be working at close to most utilisation throughout the winter. Europe’s large threat stays a chilly winter in NE Asia which might drive fierce competitors for cargoes.

A chilly winter might see massive demand markets like China (LNG demand down 20% y-o-y in 2022) kick into motion. Cargo competitors might see LNG provide diverted from Europe and a renewed surge in costs.

The state of affairs in European vitality markets has began to enhance throughout the final 3 weeks as (i) coverage motion has taken form and (ii) rising proof of value induced demand response has emerged. Europe’s actual threat is now hostile climate.

We can be discussing this and different key dangers in additional element in our upcoming winter outlook.

Supply: Timera Power

[ad_2]

Source_link