[ad_1]

Editor’s Word: This column is a part of a daily sequence by business veteran Brad Hitch for NGI’s LNG Perception devoted to addressing the complexities of the worldwide pure gasoline market.

It’s simple to neglect that China is a comparatively new member of the LNG importers membership.

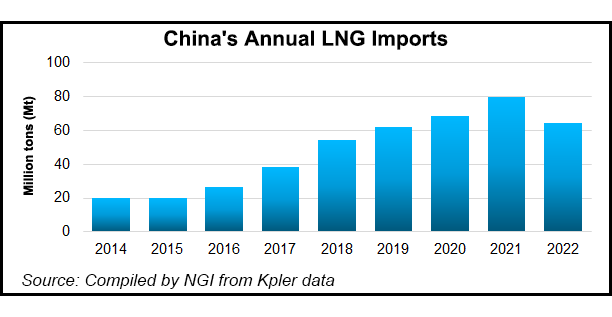

The primary liquefied pure gasoline cargo imported into China didn’t arrive till Guangdong LNG terminal in Shenzhen was commissioned in 2006. Remarkably, inside sixteen years, Chinese language LNG imports had grown to exceed 100 billion cubic meters (Bcm) yearly, or roughly 3.5 Tcf, overtaking Japanese imports in 2021 to briefly give China the title of world’s largest LNG importer.

Along with introducing the Chinese language progress juggernaut to the LNG world, the early Guangdong contract was additionally notable for its business construction and origins. The Guangdong enterprise orchestrated what was seemingly the primary profitable massive scale buy tender – forcing the big LNG exporters to compete on worth. This strategy was profitable in reaching an exceptional low worth that the producers finally requested to renegotiate.

This episode was removed from the final time that the Chinese language strategy to procurement would have a big affect on the worldwide LNG market. On this column and the subsequent, we’ll proceed with our sequence exploring totally different points of world gasoline fundamentals by wanting on the affect that China has on the LNG market in the US and elsewhere.

The subsequent column will look at the present state of play for Chinese language LNG imports, however first we’ll look at the structural framework that underpins the event of Chinese language demand for LNG.

Mannequin for Development

The story behind the fast ascension of the Chinese language gasoline market within the twenty first century is certainly one of gas displacement greater than the rest. Extra particularly, it’s a story of the federal government making certain a phased strategy to the displacement of coal by gasoline and renewables by using coverage instruments.

The sustained progress price of Chinese language LNG imports this century is nothing wanting breathtaking. Inside the first ten years of operation, Chinese language imports had reached 36.8 Bcm/12 months, at that time lagging solely Japan and South Korea. It solely took two extra years for imports to double from that elevated degree, hitting 73.8 Bcm by 2018, earlier than cooling all the way down to 16% annual progress by 2021. Even pandemic shutdowns in 2020 solely managed to sluggish progress to 10% year-over-year.

What’s extra exceptional is that LNG imports solely account for about one third of the overall improve in gasoline provide. China’s gasoline consumption grew by over 300 Bcm/12 months, or greater than 10 Tcf, between 2006 and 2021. Over half of the demand improve was met by progress in home manufacturing and roughly 15% was met with imports from neighboring international locations that began in 2010.

Throughout the first fifteen years of LNG imports, progress in Chinese language gasoline consumption considerably outpaced progress in major vitality consumption. Throughout this era, progress charges in gasoline utilization have been sometimes between 5% and 15% larger than major consumption progress charges, with the distinction largely made up by declines in coal utilization. Coal consumption as a share of China’s vitality combine declined from 72.6% in 2006 to 54.6% in 2021. Barely lower than two thirds of coal’s misplaced share went to renewable and nuclear vitality, whereas slightly below a 3rd went to gasoline.

5 Yr Plans

There is no such thing as a query that China has turn into one of the vital vital world gasoline markets. It additionally represents one of many bigger analytical challenges for U.S. market members in search of to anticipate world gasoline flows and their potential affect on U.S. exports.

Though there may be an excessive amount of consideration paid to Chinese language demand by commerce publications and information media, the extent of clear day by day basic info printed for Europe and the US just isn’t available. Compounding this problem is the truth that it’s simple for seasonal spot fundamentals to be overwhelmed by the affect of presidency planning targets.

One of many fascinating points of Chinese language pure gasoline improvement is how the nation has utilized the LNG spot market over time. LNG imports in China play the traditional business function that one would anticipate versatile pure gasoline provide to play. LNG spot cargoes can be utilized in worth pushed optimization of storage or versatile pipeline contracts; their ranges could be anticipated by monitoring chilly climate and can be utilized to evaluate the general well being of commercial demand.

LNG spot volumes have additionally been used as an instrument to tie issues collectively when authorities targets run forward of infrastructure or contracting actuality.

China is at present midway by its 14th 5 Yr Plan (2021 to 2025) for Nationwide Financial and Social Growth of the Individuals’s Republic of China. The 5 Yr Plans are fairly well-known in their very own proper, and up to date ones have more and more laid out a street map for vitality improvement that seeks to chop emissions with out compromising vitality safety.

We are going to look extra intently on the 14th 5 Yr Plan and its affect on the present spot market setup within the subsequent column. For the second, it’s price contemplating the affect of the Blue Skies Plan in 2017 to know the potential affect of presidency planning on the gasoline market and the knock on results for spot LNG.

In response to heightened sensitivity to air high quality points, the federal government issued the “Blue Sky Protection” plan to considerably cut back air pollution over a five-year interval from 2013. The plan set targets for refinery and coal plant upgrades however a lot emphasis was positioned on displacing coal with pure gasoline.

Notably, the plan included onerous caps on the phase-out of coal by the tip of 2017. With time operating out and unmet targets, sure regional governments started to mandate an abrupt alternative of coal with gasoline in boilers with out having thought of the provision of provide.

The following pull on spot LNG was great, with imports rising 44% year-over-year and a 30% spike in spot costs over 2016. Governments finally needed to permit the return of some coal heating however not earlier than the occasion had laid naked the dangers in onerous caps on coal. The occasion additionally laid naked the danger of managing spot LNG positions with out being attuned to Chinese language coverage targets.

China and the U.S.

Lastly, though the principal intention of this sequence is to look at the potential affect of short-term world fundamentals on an more and more interconnected U.S. gasoline market, it might be remiss to not be aware how Chinese language consumption has enabled the event of U.S. export infrastructure.

The vast majority of long-term U.S. contracts usually are not instantly with Chinese language entities, however Chinese language import progress from 2016 created house for 85 Bcm of the overall 95 Bcm that the U.S. was exporting by 2021.

The dedication to constructing Chinese language LNG infrastructure throughout the second half of the 2010s was great. Eight new import terminals have been constructed that added a bit below 4.5 Bcf/d of capability. Within the subsequent column we’ll decide up the thread by contemplating the investments being made in pure gasoline and storage infrastructure along with the close to time period outlook for LNG demand.

Brad Hitch has spent greater than 23 years working in LNG and pure gasoline buying and selling from London and Houston. He at present works as an adviser to new market entrants, and he has held senior buying and selling and origination positions at Barclays, Cheniere Vitality Inc., Enron Corp., Merrill Lynch and Williams. With expertise that features establishing one of many first LNG buying and selling desks, he has participated in numerous phases of the worldwide gasoline market’s evolution. Throughout his time at Merrill Lynch, he labored as head strategist on the European gasoline desk and led an initiative to enter the LNG buying and selling market. Previous to returning to Houston, he labored for Cheniere in London and was primarily chargeable for establishing and managing a by-product buying and selling operate. He holds an MBA from the Wharton College on the College of Pennsylvania and a BA from the College of Kentucky.

[ad_2]

Source_link