[ad_1]

If European Union (EU) international locations determine to restrict Russian LNG imports, the choice might lead to doubtlessly disruptive outcomes for international pure fuel markets, in response to analysts.

Final month, European Commissioner for Vitality Kadri Simson urged EU members and corporations to cease shopping for Russian liquified pure fuel, and to not signal any new fuel contracts with Russia as soon as the prevailing contracts have expired.

EU vitality ministers have endorsed the proposal. They’ve requested particular person international locations to dam Russian firms from using Europe’s LNG import infrastructure. The choice to limit Russian LNG has been left as much as every member state, fairly than imposing sanctions, which requires settlement from all 27 EU members.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

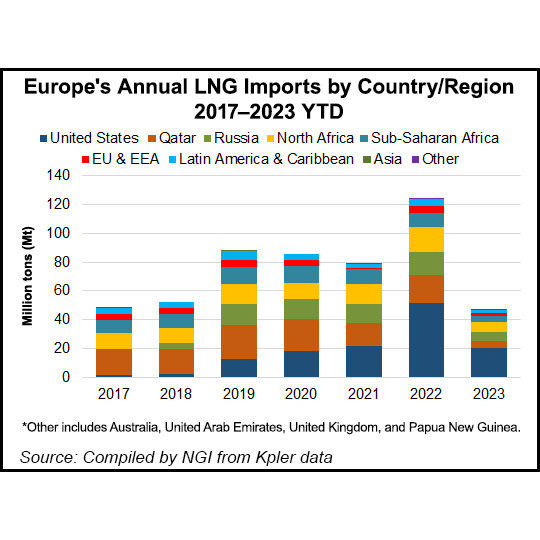

Though sanctions on Russian pure fuel pipeline imports had been applied final yr, Russian LNG imports to Europe have continued. Russian LNG deliveries to Europe elevated by a 3rd in 2022 to 19 billion cubic meters (Bcm), mentioned CGEP analysis scholar Anne-Sophie Corbeau in an evaluation launched earlier this month. Belgium, France, the Netherlands and Spain had been the highest importers.

“Halting Russian LNG imports to Europe is troublesome to approve unanimously, and –secondly– represented on a person and non-binding foundation, it’s technically not an precise ban,” Kpler analyst Ana Subasic advised NGI. “At this level, it’s troublesome to map out how this proposal might materialize in a cheap manner.”’

Jonathan Stern, a senior analysis fellow on the Oxford Institute for Vitality Research sees Europe proscribing Russian LNG as ineffective.

“EU international locations deciding whether or not to limit Russian LNG imports is political posturing as a result of, in contrast to pipeline fuel, if Europeans refuse to import Russian LNG it would merely go elsewhere, different LNG from the USA, Africa and Qatar will come to Europe, and the large winners would be the delivery firms,” Stern advised NGI.

CGEP estimates the EU is on observe to finish its Russian fuel dependence by 2027. However halting Russian LNG imports might lead to varied outcomes for the worldwide fuel market.

“Whether or not European international locations will sanction or restrict Russian LNG, politically there appears to be some incentive to take action, however it might be virtually and legally difficult to realize,” mentioned Rystad Vitality analyst Kaushal Ramesh.

“If applied, Rystad would anticipate it might jolt costs upwards primarily because of the logistical challenges of attracting LNG from additional away, presumably so far as Australia, and a few geopolitical danger premium from Russia reducing off the remaining pipeline provide,” Ramesh added.

Primarily based on present flows, CGEP mentioned mixed Russian pipeline fuel and LNG deliveries to the EU can be round 40 Bcm/yr, equal to round 25% of 2021 ranges, or 11% of the bloc’s estimated fuel demand.

If the EU stops importing 20 Bcm/yr of Russian LNG, a constructive final result can be a “good swap,” the place Russian LNG would largely move to Asia, and the “impression on fuel costs is restricted.”

A second much less constructive situation is “no good swap” of LNG provides, China’s LNG urge for food grows and Chinese language firms compete with spot LNG going to Europe. “Confronted with decrease LNG provides, Europe is compelled to weigh on demand whereas fuel costs improve,” Corbeau wrote.

Russia canceling each LNG exports and pipeline deliveries to Europe is a “way more worrying transfer.” Russia might lower off fuel pipeline volumes delivered via Ukraine and the Turkstream pipeline, eradicating round 20 Bcm/yr of pipeline fuel.

Yamal LNG volumes contracted by European firms might be lower by Russia shutting down one practice, or roughly 8.8 Bcm/yr, however Yamal deliveries to Asia might proceed.

Russian LNG, which totaled 45 Bcm in 2022, “is required for the worldwide fuel stability to keep away from a return of sky-rocketing spot LNG costs,” CGEP mentioned.

Some strikes have been made in Europe to restrict Russian imports. The UK and Lithuania stopped importing Russian LNG in 2022. Spain’s Deputy Prime Minister Teresa Ribera, answerable for Spain’s vitality coverage, not too long ago urged Spanish importers of the Russian super-chilled gasoline to not signal new contracts with Russia, in response to Bloomberg. High purchaser Spain has practically doubled Russian LNG imports since sanctions had been positioned towards Russia in February 2022.

Subasic mentioned though there are stories that the Netherlands has stopped signing new Russian LNG contracts this yr and is engaged on winding down current contracts, the choice has not been formally confirmed.

Up to now, no additional feedback, timelines, or proposals have come out of Brussels as Russian LNG deliveries to Europe proceed. From January to March, Russia delivered 4.66 million tons (Mt) of LNG to Europe, up from 4.06 Mt over the identical interval in 2021, based mostly on knowledge from Kpler.

[ad_2]

Source_link