[ad_1]

Pure gasoline costs, underneath persistent downward strain early in 2023 amid stout provides and weak demand, dropped in March greater than some other class measured by the federal authorities’s key inflation studying.

Slumping costs – each within the futures and money markets – resulted in a 7.1% drop in client pure gasoline costs in March from the prior month, the U.S. Bureau of Labor Statistics’ Shopper Worth Index (CPI) confirmed. That adopted an 8.0% slide in February, which additionally marked the most important month-to-month decline amongst all classes.

The broader power index fell 3.5% in March after lowering 0.6% in February.

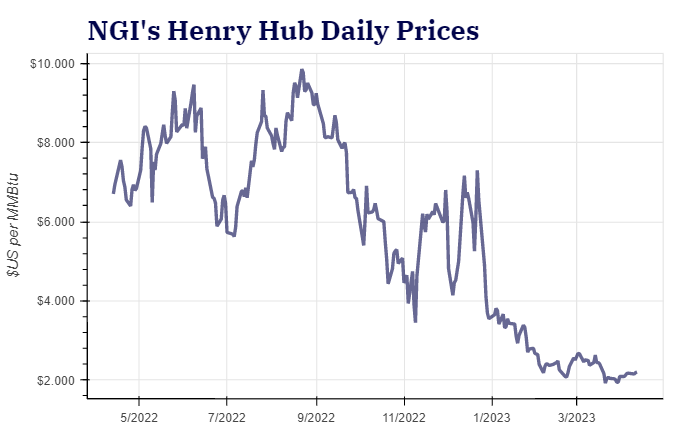

Total client inflation peaked at a 40-year excessive of 9.1% final summer season, when pure gasoline futures approached $10/MMBtu, however the annual tempo of inflation has eased in latest months. Shopper costs elevated 5% in March from a yr earlier, federal knowledge launched Wednesday confirmed. That was down from 6% the prior month however nonetheless greater than twice the two% degree the Federal Reserve (Fed) mentioned is wholesome for the U.S. financial system. On a month/month foundation, the CPI elevated solely 0.1% in March.

The Fed started elevating rates of interest in March 2022 and it has stayed on that path into 2023. Its goal fee is now 4.75-5%, up from close to zero firstly of 2022. Futures markets and analysts broadly anticipate the Fed to spice up its benchmark fee via no less than Could to additional tamp down inflation.

“We anticipate the Fed to extend the goal vary for the fed funds fee by 25 foundation factors in each Could and June after which pause via the rest of this yr,” mentioned Oxford Economics’ Ryan Candy, chief U.S. economist.

New York Mercantile Change pure gasoline futures have this yr hovered between $2 and $3 – a fraction of the highs reached in 2022, when excessive summer season warmth intersected with comparatively gentle provides. NGI’s Spot Gasoline Nationwide Avg. has traded in the same vary this yr, removed from the highs of 2022.

U.S. manufacturing final summer season, hanging within the mid-90s Bcf/d, was additionally feeding report demand for American exports of LNG. Europe had boosted its requires liquefied pure gasoline to offset Russian provides misplaced amid the Kremlin’s invasion of Ukraine.

LNG demand stays robust, however home consumption has tapered off considerably. First, a gentle winter throughout the jap United States dampened heating demand. Now the market has entered the spring shoulder season, a interval by which heating demand plummets and cooling demand solely begins to assemble momentum.

Sturdy Manufacturing

On the identical time, manufacturing is comparatively sturdy. Producers ramped up output to fortify provides late final yr. Manufacturing topped 102 Bcf/d late in 2022, a report degree. Output held across the 100 Bcf/d degree in the course of the first quarter, together with March.

The end result: Stout provides in storage and broad notion amongst merchants that demand is trailing manufacturing. Costs have dropped in response.

The Vitality Info Administration (EIA) on Thursday printed a 25 Bcf injection into pure gasoline storage for the week ended April 7. It marked the primary enhance of the refill season. Gasoline in storage stood at 1,855 Bcf, 19% above the five-year common.

Wanting forward, forecasts level to largely benign temperatures throughout the Decrease 48 via the remainder of April and into Could.

Marex North America LLC’s Steve Blair, senior account govt, instructed NGI that absent an early arrival of summer season or extended upkeep occasions that slash manufacturing, bearish pure gasoline value situations are more likely to prevail via the spring months.

Robust export exercise is encouraging, Blair mentioned, however domestically, “it is advisable to see that climate demand.”

The Crude Issue

Elevated ranges of related gasoline manufacturing within the Permian Basin – a byproduct of oil output– additionally has bolstered total gasoline provides. This developed following will increase in crude output within the second half of 2022 and thru March. Oil output has held robust into April, too.

U.S. exploration and manufacturing corporations generated 12.3 million b/d of oil for the week ended April 7, based on EIA’s Weekly Petroleum Standing Report on Wednesday. That was up 100,000 b/d from the earlier week and matched the excessive level of 2023 and the pandemic-era peak.

“First quarter 2023 retrospectives have arrived as the intense heat to start out the yr — January and February had been the second warmest up to now 4 many years — resulted in extreme market penalties,” mentioned EBW Analytics Group’s Eli Rubin, senior analyst. Together with regular manufacturing, weak demand despatched pure gasoline costs “crashing.”

Nonetheless, Rubin mentioned, long-term LNG demand may revive costs. A spate of recent U.S. export services are scheduled to come back on-line in 2024 and past. Europe’s want for American provides is broadly anticipated to endure as international locations throughout the continent have vowed to wean themselves off Russian power. Previous to the conflict, Europe trusted Russia for about one-third of its pure gasoline.

Moreover, Asian demand for U.S. LNG is projected to speed up via this decade as burgeoning economies there look to pure gasoline to displace coal.

Such developments may show optimistic for producers’ profitability, mentioned Samco Capital Markets’ Jacob Thompson, managing director. Whereas output is holding near 100 Bcf/d, he mentioned, sturdy provides could in the end be wanted to satisfy world demand as quickly as the following winter season.

“Whole demand is in the end going to rebound, and costs are inclined to comply with,” he instructed NGI.

[ad_2]

Source_link