[ad_1]

Pure gasoline futures discovered contemporary footing Monday, posting double-digit good points as forecasts pointed to seasonally sturdy heating demand that greater than offset losses late final week. The April Nymex gasoline futures contract settled at $2.606/MMBtu, up 17.6 cents day/day. It had shed 11.3 cents on Friday. Might climbed 16.7 cents on Monday to $2.726.

At A Look:

- Immediate month good points 17.6 cents

- Cool situations to drive demand

- Manufacturing, storage nonetheless strong

NGI’s Spot Fuel Nationwide Avg. gained 28.0 cents to $2.890.

Manufacturing hovered round 100 Bcf/d to start out the week, in response to Bloomberg estimates, on par with the highs of the yr. However NatGasWeather famous forecasts pointed to a “reasonably bullish total U.S. sample” for the 15-day projection interval – sufficient to ship merchants on a cut price shopping for spree Monday.

“As well as, longer-range climate maps proceed to favor a cool begin to April, though topic to giant adjustments this far out,” NatGasWeather mentioned.

Colder-than-normal temperatures for the second half of March ought to shrink the storage surplus to the five-year common again towards the 300-plus Bcf mark, in response to NatGasWeather. Bearish stock information has dragged down futures by way of most of 2023, following benign climate in lots of areas throughout January and February. Immediate pricing remains to be lower than half of the place it was late in 2022.

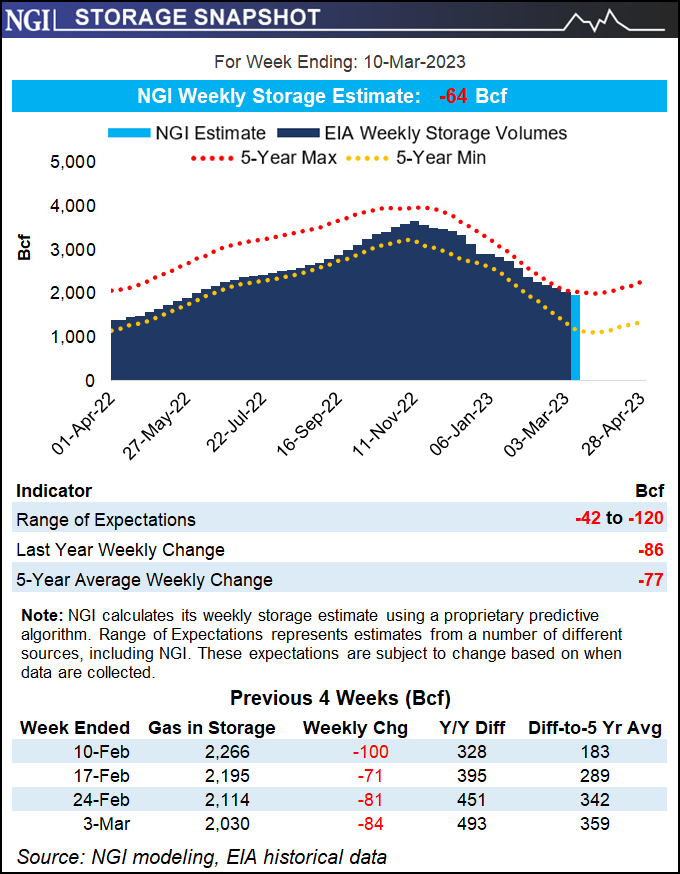

The Vitality Info Administration (EIA) most just lately reported an 84 Bcf withdrawal from pure gasoline storage for the week ended March 3. EIA recorded a 126 Bcf decline for the comparable week final yr, and the five-year common was a decline of 101 Bcf.

Whole working gasoline in storage as of March 3 was 2,030 Bcf – 493 Bcf above year-ago ranges and 359 Bcf above the five-year common, in response to EIA.

“Regardless that we at the moment are four-fifths of the best way by way of winter, the market has delivered solely 71% of final summer season’s 2.262 Tcf refill,” analysts at The Schork Report mentioned Monday.

Trying to the following EIA print, protecting the week ended March 10, NGI modeled a withdrawal of 64 Bcf. Early survey outcomes ranged from pulls of 42 Bcf to 120 Bcf. The five-year common for the interval is a draw of 77 Bcf.

The Bull Case

EBW Analytics Group mentioned climate is on bulls’ facet within the close to time period, although it cautioned that forecasts this yr have typically proved colder than the eventual actuality, and manufacturing stays sturdy.

“Basic drivers are topic to the next stage of uncertainty than in recent times. Climate forecasts for cold situations have repeatedly confirmed deceptive this winter,” EBW analyst Eli Rubin mentioned.

“Though we anticipate elementary tightening and narrowing storage surpluses to supply assist into early April, after a number of bullish false begins this winter the market might await supportive information to emerge earlier than edging increased” in coming periods, Rubin added.

That famous, the Freeport LNG export plant in Texas, pressured offline in June following a hearth, is now within the strategy of ramping as much as almost 2.4 Bcf/d of capability, including to the demand image.

Rubin mentioned feed gasoline demand from export vegetation steadied close to 13.0 Bcf/d over the weekend – “midway between data above 14.1 Bcf/d and final week’s lows at 12.2 Bcf/d. Whereas each day demand stays extremely variable,” he mentioned, “LNG might common increased into spring as Freeport flows improve.”

Demand for U.S. liquefied pure gasoline, pushed by rising economies in Asia and Europe’s thirst for imports amid Russia’s conflict in Ukraine, is predicted to endure, supporting each European and U.S. costs over time, mentioned Goldman Sachs Group analyst Samantha Dart. Russia lower off a lot of the gasoline it had despatched to Europe previous to the conflict.

Whereas storage ranges in Europe are presently wholesome, largely due to LNG, “we warning that the structural deficit in European pure gasoline balances created with the interruption of Russian flows has but to be resolved, presenting upside danger to European gasoline costs, not simply later this yr, however notably in 2024, once we might simply see summer season costs greater than double,” Dart mentioned. This might drive demand for U.S. LNG by way of this yr and subsequent, including Henry Hub worth assist.

“What now seem like well-supplied gasoline inventories might begin to look totally different later in the summertime as low costs incentivize a rebound in demand,” Dart mentioned of Europe specifically. “Additional, even when gasoline inventories stay at snug ranges all yr, bodily storage capability limits forestall the availability abundance from this yr being carried by way of to 2024. Because of this, something nearer to a standard winter going ahead will indicate a year-on-year tightening of gasoline balances in Europe, suggesting that 2024 vitality costs are very more likely to be up.”

Bodily Costs Climb

Spot gasoline costs superior in almost each area of the nation, with widespread chilly settling in early this week and anticipated to final by way of the top of the month.

Algonquin Citygate close to Boston jumped $1.460 from Friday to common $4.235, whereas Chicago Citygate climbed 15.5 cents to $2.550 and Houston Ship Channel added 14.5 cents to $2.255.

NatGasWeather mentioned wintry techniques had been anticipated to comb throughout the Decrease 48 early this week, delivering lows from round zero to the 30s “for sturdy demand.” This shall be aided by cooling into parts of Texas and the South, with lows of 30s-40s, the agency mentioned.

Costs throughout the South additionally superior Monday. Florida Fuel Zone 3 gained 25.5 cents to $2.630 and Columbia Gulf onshore rose 18.0 cents to $2.560.

Out West, SoCal Citygate spiked 50.5 cents to $6.520.

A milder break between chilly photographs will arrange from Texas to the Ohio Valley late this week, NatGasWeather mentioned, however colder-than-normal situations had been anticipated to return over a lot of the nation by this weekend.

Subsequent week, the forecaster added below-average temperatures are once more projected to rule a lot of the USA most days, with lows under zero at occasions within the northern reaches of the nation.

[ad_2]

Source_link