[ad_1]

Pipeline and environmental tasks will hearth up 2023 right into a progress 12 months in Canadian pure gasoline and oil investments, based on a significant business commerce group.

The Canadian Affiliation of Petroleum Producers (CAPP) is forecasting investments totaling US$30 billion complete this 12 months, up by $3 billion from 2022.

“The 12 months 2023 could also be one of the vital pivotal moments in time for Canada’s oil and pure gasoline business,” CAPP CEO Lisa Baiton stated. “With an rising liquefied pure gasoline export business, the anticipated completion of the Trans Mountain enlargement (TMX) and billions of {dollars} in emissions discount investments ready to be unlocked, Canada is positioned to play a a lot bigger position.”

TMX, now getting into last constructing levels, is to almost triple capability to 890,000 b/d on the nation’s westbound specific path to Vancouver harbor from an oil storage and dispatch hub close to the Alberta capital in Edmonton.

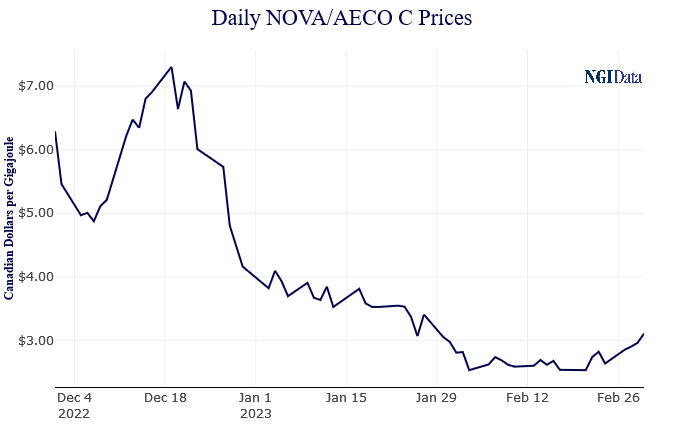

In British Columbia, the place a number of LNG export tasks are within the works, “altering and rising world markets for pure gasoline have translated into stronger pure gasoline costs over the previous 12 months,” CAPP famous.

“Producers in British Columbia are anticipated to develop funding within the province by about $730 million in 2023, reaching a complete of $5.3 billion. Funding within the province is anticipated to be helped by the latest agreements signed by the province of British Columbia with a number of Indigenous Nations, which satisfies the courts, establishes a course of to handle cumulative results and gives for useful resource growth authorizations and a path towards long-term sustainable growth.”

To seize the oil and gasoline alternatives, Baiton stated, “business and all ranges of presidency might want to work collaboratively on essential items of coverage to create the circumstances for Canada’s oil and pure gasoline business to proceed to thrive for many years to come back.”

As in the US, Canada’s exploration and manufacturing (E&P) firms are probably “to stay centered on disciplined funding with the elevated spending going towards upkeep and incremental progress tasks, whereas additionally managing inflationary pressures that are impacting the whole provide chain.”

The E&P sector’s environmental expenditures are also rising, particularly as work begins on carbon seize and storage grids to satisfy authorities net-zero greenhouse gasoline (GHG) emissions insurance policies.

Baiton cited BMO Capital Markets estimates that analysis led by emissions discount work grew by 17% to $1.05 billion in 2022 and should practically double by 2025. The GHG analysis will increase spending on land, air, water and wildlife safeguards that yearly exceeds $2.2 billion.

CAPP predicted oilsands spending this 12 months could be $8.6 billion, with oilfield providers spending of round $21.4 billion.

The whole Canadian 2023 oil and gasoline provide funding forecast of $30 billion stands out as a restoration that just about doubles the low of $16.5 billion that the business hit in 2020, through the Covid-19 pandemic.

[ad_2]

Source_link