[ad_1]

MPLX LP administration mentioned sturdy pure fuel demand is offering optimism for continued quantity progress on its midstream programs in 2023 regardless of a gentle decline in costs because the summer time.

MPLX has put aside $800 million of progress capital for the yr, with a selected concentrate on debottlenecking and enlargement initiatives within the Permian Basin in addition to within the Marcellus and Bakken shales. One other $150 million earmarked for upkeep.

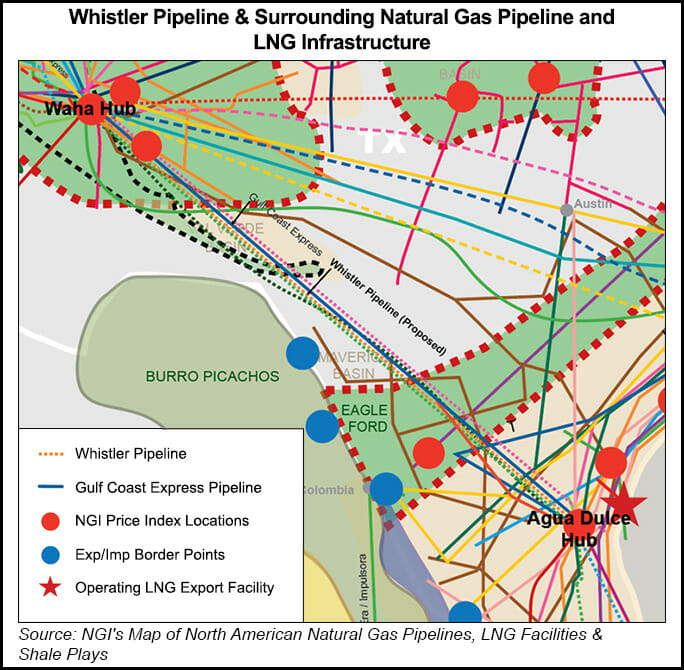

Within the Logistics and Storage enterprise unit, the midstream firm is working with its companions to develop Permian takeaway with the addition of three compressor stations alongside the Whistler Pipeline. The additions would enhance pipeline capability to 2.5 Bcf/d from 2.0 Bcf/d, with in-service focused for the third quarter.

[2023 Natural Gas Price Outlook: How will the energy industry continue to evolve in 2023? NGI’s special report “Reshuffling the Deck: High Stakes for Natural Gas & The World is All-In” offers trusted insight and data-backed forecasts on U.S. natural gas and the global LNG markets. Download now.]

Work additionally continues on the related ADCC Pipeline lateral, a 43-mile, 42-inch diameter pure fuel extension from the Agua Dulce Hub in South Texas to Corpus Christi LNG. Cheniere Power Inc., which has a 30% stake within the pipeline, sanctioned the third stage of the Corpus liquefied pure fuel export mission final summer time.

MPLX’s Shawn Lyon, vp of operations, informed traders on the quarterly earnings name final month that volumes and commitments to the Whistler system have remained sturdy regardless of the current decline in pure fuel costs.

“We anticipate these all to proceed on into ‘23,” he mentioned. “You’re going to see volatility up and down on pure fuel, however once more, there’s sturdy quantity demand for the fuel takeaway out of the Permian.”

MPLX recorded a median 6.2 Bcf/d in gathered volumes in the course of the fourth quarter of 2022, a rise of 14% yr/yr. Processed volumes rose 1% to a median 8.6 Bcf/d. Fractionated volumes averaged 583,000 b/d, up 6% yr/yr.

MPLX is also a accomplice within the greenfield Matterhorn Categorical mission within the Permian. The 42-inch diameter pipeline would traverse 490 miles, with direct connections to processing services within the Permian Midland sub-basin. It additionally would have a direct connection to the three.2 Bcf/d Agua Blanca Pipeline, a three way partnership between WhiteWater Midstream LLC and MPLX.

COO Gregory Floerke mentioned crude oil, pure fuel and pure fuel liquids (NGL) costs in 2022 had been “very supportive of elevated drilling exercise” by exploration and manufacturing firms throughout all basins. The elevated drilling, together with completions heading into 2023, are what’s driving administration’s increased quantity outlook for the yr, in line with the chief. Due to this fact, short-term value swings will not be at present anticipated to influence volumes as a lot.

“Actually, there was value volatility. We’ve seen costs over $10/MMBtu in the summertime… and now we’re sort of again to extra of a traditional stage,” Floerke mentioned. However within the Permian and Bakken, “the drilling is actually tied to the crude value, and we see the advantages of related fuel and NGLs that come off of that.”

The COO mentioned the MPLX administration workforce is speaking with producer prospects and whereas forecasts can change, “at this level, we nonetheless really feel bullish about quantity this yr.”

As such, the midstreamer continues to work towards bringing on-line its sixth 200 MMcf/d processing plant within the Permian, Preakness ll, within the first half of 2024. MPLX introduced on-line its 200 MMcf/d Torñado ll processing plant in 4Q2022.

Within the Marcellus, MPLX is progressing Harmon Creek ll, a 200 MMcf/d processing plant that is also anticipated on-line by June 2024.

Gathered volumes within the Marcellus averaged 1.4 Bcf/d in 4Q2022, down 1% from a yr in the past. Processed volumes averaged 5.5 Bcf/d for the quarter, off 2%, whereas fractionated volumes averaged 518,000 b/d, up 7%.

“Even exterior of the Marcellus, I believe all people realizes now there’s a structural change in fuel from a variety of views,” CEO Michael Hennigan mentioned. “You’re beginning to see rigs in different basins exterior of the Marcellus that haven’t had a variety of exercise. General, individuals are recognizing a structural change in fuel now.”

MPLX reported web revenue of $816 million (78 cents/share) for 4Q2022, in contrast with $830 million (78 cents) within the year-earlier interval. Full yr 2022 web revenue was $3.94 billion ($3.75/share), up from $3.08 billion ($2.86) in 2021.

[ad_2]

Source_link