[ad_1]

European pure fuel costs remained steady on Monday regardless of bitter chilly that’s gripping the northern a part of the continent.

Costs spiked briefly final week as colder climate descended, however ample storage shares and a gentle movement of LNG provides have stored a lid on each the Title Switch Facility (TTF) and the Nationwide Balancing Level (NBP).

TTF January costs closed Friday beneath their five-day common and completed one other 2% decrease Monday in what Engie EnergyScan mentioned is an “indication that the market is beginning to understand that European fuel fundamentals aren’t that tight.”

Beneath regular temperatures are anticipated throughout Germany, Italy, Poland, France and the UK this week, a development that’s anticipated to proceed over a 6-10 day interval, in line with Maxar’s Climate Desk.

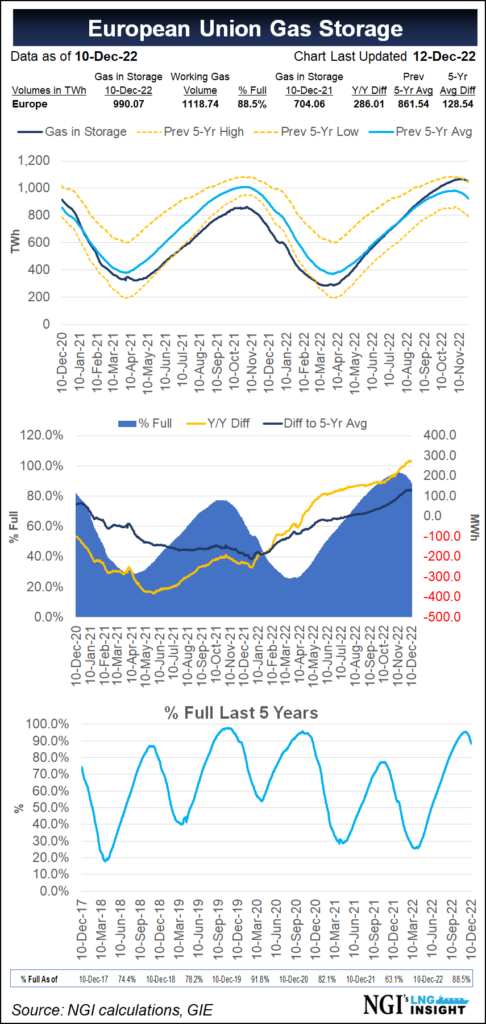

European fuel storage shares stood at 88.5% of capability on Monday, down from 92% every week in the past, however nonetheless above the five-year common.

“Storage withdrawal from the beginning of December this 12 months has been decrease than the extent seen throughout the identical interval final 12 months, easing provide considerations within the area,” mentioned Schneider Electrical analyst Nate Nuttapon Komsai.

Europe’s liquefied pure fuel imports stay robust too, hitting a report for the 12 months of 11.93 million tons (Mt) in November, in line with information from Kpler. The agency initiatives imports to achieve 11.62 Mt in December, up from 8.63 Mt on the similar time final 12 months.

LNG that’s been saved at sea by merchants awaiting stronger costs, which have risen in latest weeks, can be being unloaded.

“In delivery, extra vessels are opening up after discharge in Europe as storage capability is being depleted,” mentioned analysts at shipbroker Fearnleys AS. “These coupled with the accessible tonnage within the Atlantic from the Freeport outage, have resulted in extra immediate availability and an extra drop in” spot vessel charges.

The UK’s NBP additionally completed about 2% decrease Monday. Pure fuel from mainland Europe ramped up final week on one of many two pipelines linking Britain to the remainder of the continent.

Pipeline imports have been additionally up because the week bought underway. Each day Norwegian flows rebounded from 317 million cubic meters (MMcm) late final week after unplanned outages and have been confirmed Monday at 335 MMcm. A leap in French nuclear availability has additionally helped ease power provide considerations on the continent because the nation has continued to deliver on-line extra reactors in latest weeks.

Though Europe will face a take a look at with out important Russian fuel imports this winter, considerations proceed shifting to future winters. The Worldwide Vitality Company mentioned in a report Monday that the European Union faces a possible fuel provide shortfall of almost 30 billion cubic meters (Bcm), or roughly 1 Tcf, in 2023.

The company mentioned the continent should enhance power effectivity measures, deploy renewables, set up warmth pumps, promote power financial savings and improve fuel provides to keep away from shortages.

Chilly Climate Headed For Asia

Colder climate can be forecast for North Asia subsequent week. Maxar mentioned a chilly entrance is predicted to comb South Korea and Japan over the 6-10 day interval. Gasoline storage shares within the area additionally stay robust. The Japan-Korea Marker stays about $10/MMBtu beneath TTF.

Demand might get a lift after China’s choice to loosen up strict Covid-19 measures. Analysts at Jefferies mentioned the nation’s reopening might drive a spike in power consumption, notably within the oil market, however a lot is determined by the severity of any world recession, which is clouding the outlook.

In the USA, chilly forecasts and brutal winter climate out West have been pushing pure fuel costs greater Monday. The immediate Henry Hub contract surged above $7 in intraday buying and selling.

Climate fashions marketed a “solidly bullish” temperature outlook beginning Saturday and lengthening into the Christmas vacation, NatGasWeather mentioned in a observe to shoppers.

“The weekend climate information held a sequence of frigid chilly photographs advancing out of Western Canada and into the U.S.” throughout this timeframe, leading to chilly low temperatures and robust pure fuel demand nationally, NatGasWeather mentioned.

The Nationwide Oceanic and Atmospheric Administration’s 6-14 day forecast can be calling for colder temperatures to unfold throughout many of the Decrease 48.

Frigid temperatures and unusually heavy precipitation final week drove spot pure fuel costs on the West Coast above $50 final week.

The climate has fueled pure fuel demand within the area at a time when storage inventories are low, a drought has decreased hydroelectric energy provides and utilities are having hassle receiving coal deliveries.

[ad_2]

Source_link