[ad_1]

Fossil-fuel delivery goes from power to power and reveals no indicators of peaking. Charges for some very giant gasoline carriers (VLGCs) have now topped $100,000 per day. Liquified pure gasoline (LNG) carriers crossed into six-digit territory months in the past. Essentially the most fuel-efficient very giant crude carriers (VLCCs) have now crossed that threshold as properly.

It’s at all times a sentiment increase when commodity delivery spot indexes cross from 5 to 6 figures, simply as, in the wrong way, it feels extra ominous when the Dow drops 1,000 factors than when it falls 900.

This sentiment increase is regardless of the truth that most ships on the water loaded cargo weeks earlier than — in some instances many weeks earlier than — at a time when charges had been 5 digits. Main strikes in spot indexes don’t present up in commodity delivery earnings reviews till the next quarter.

VLGC charges ‘elevated dramatically’

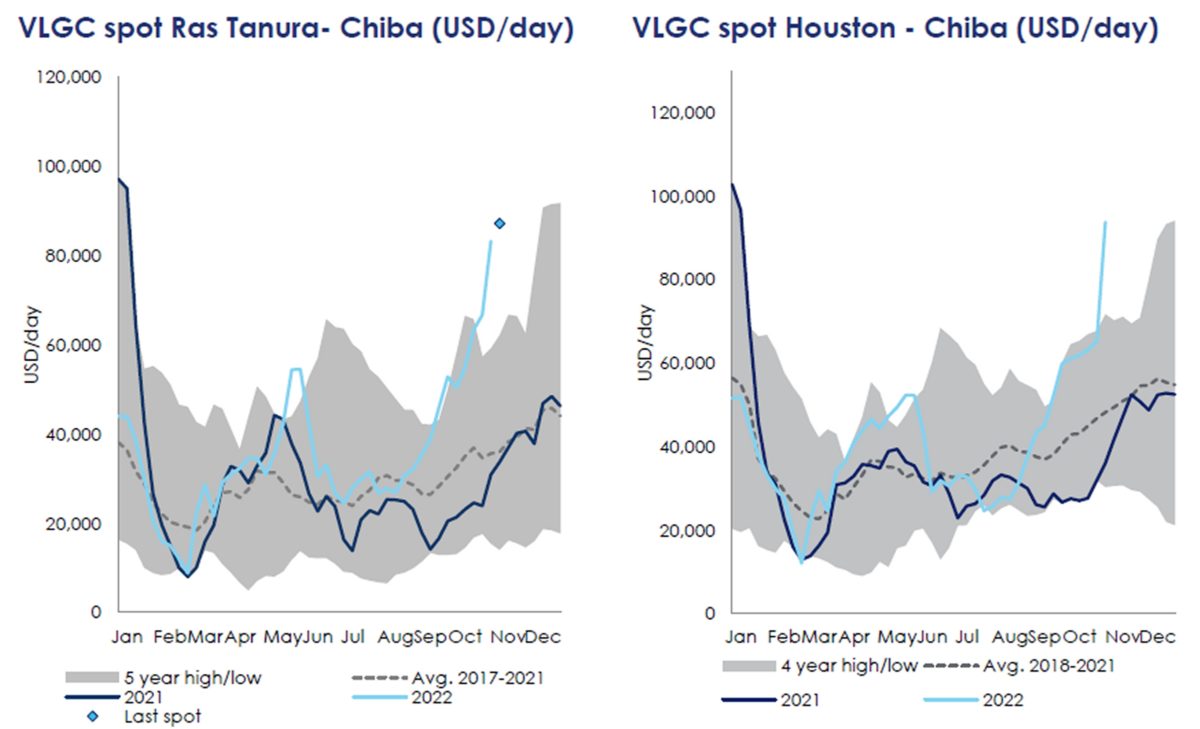

VLGCs carry liquefied petroleum gasoline (LGP): propane and butane. The most important-volume trades are U.S.-Asia and Center East-Asia, with flows to Europe changing into more and more vital.

On Monday, Clarksons Securities assessed the typical spot fee for U.S.-Europe VLGC voyages at $103,000 per day, up 63% month on month. (Vessel homeowners earn in {dollars} per ton of cargo; that is then translated by index suppliers and analysts right into a day fee primarily based on assumptions on gas prices and different elements.)

Clarksons put the worldwide VLGC common at $93,700 per day, up 65% month on month. VLGCs with exhaust gasoline scrubbers — which may burn inexpensive high-sulfur gas oil — are incomes a premium of $10,000 per day (as a result of day-rate assessments are internet of gas prices). This pushes common international spot-rate assessments for scrubber-equipped VLGCs to 6 figures.

As is the case with crude and product tankers and LNG carriers, the Ukraine-Russia battle is boosting VLGC charges.

Throughout a convention name on Wednesday, John Hadjipateras, CEO of VLGC proprietor Dorian LPG (NYSE: LPG), defined, “In Europe, there may be some substitution of LPG for LNG.” The corporate additionally famous in its quarterly launch that Russian exports to Europe are “subdued” and being changed by European imports from the U.S. Gulf.

Tim Hansen, Dorian’s chief business officer, mentioned on the decision that “demand in Europe, as a result of unlucky battle in Ukraine, helps our markets.”

LPG demand in Asia can be sturdy. Clarksons Securities analyst Frode Mørkedal mentioned on Monday: “The VLGC market within the West elevated dramatically final week. Wholesome cargo ranges and a tonnage scarcity prompted charges to skyrocket. A widening of the U.S.-Asian propane arbitrage and a seasonal enhance in LPG demand have aided the surge.”

VLCC charges proceed to climb

Clarksons’ VLCC index covers normal crude tankers, these with extra fuel-efficient “eco” design, and those who have exhaust-gas scrubbers.

As of Monday, Clarksons assessed the typical spot fee for an eco-design, scrubber-equipped VLCC at $101,600 per day, up 66% month on month. It put the worldwide weighted common for all VLCC sorts at $90,800 per day.

Price power for VLCCs and different tanker segments has come even earlier than the EU ban on Russian crude imports beginning Dec. 5.

Based on Mørkedal, “Though it’s nonetheless unclear how the precise embargo will play out, it’s going to inevitably end in larger voyage distances. The longer term seems extremely promising for tanker homeowners,” he mentioned, including that VLCC resale costs are rising “week after week.”

Stifel analyst Ben Nolan commented: “Asset worth momentum seems to nonetheless be accelerating, tanker charges are prone to transfer larger with sanctions, and the orderbook of latest tankers stays extraordinarily skinny. So, asset values … may actually and doubtless will proceed to maneuver larger, leaving room for comparable acceleration in … share costs. So, we imagine there may be nonetheless some hearth to go along with the smoke.”

LNG delivery charges in uncharted territory

With the surge in LNG commodity costs that started with the run-up to the battle and the restricted variety of out there spot LNG ships, LNG delivery spot charges have soared far above different commodity delivery classes.

Common spot charges for benchmark tri-fuel, diesel-engine (TFDE) LNG carriers first topped $100,000 per day again in mid-September. As of Monday, Clarksons put charges for TFDE vessels at $455,000 per day. That’s up 37% month on month and marks the very best spot-rate common in historical past for any class of commodity delivery.

That mentioned, the LNG delivery market is an excessive instance of the disconnect between spot-rate indexes and shipowner earnings. The spot marketplace for LNG vessels is extraordinarily skinny. The overwhelming majority of LNG carriers are on contract charges at considerably decrease — albeit nonetheless extremely worthwhile — ranges.

Click on for extra articles by Greg Miller

Associated articles:

[ad_2]

Source_link