[ad_1]

Petronet LNG (NSE:PETRONET) Second Quarter 2023 Outcomes

Key Monetary Outcomes

- Income: ₹159.9b (up 48% from 2Q 2022).

- Web earnings: ₹7.86b (down 3.9% from 2Q 2022).

- Revenue margin: 4.9% (down from 7.6% in 2Q 2022). The lower in margin was pushed by increased bills.

- EPS: ₹5.24 (down from ₹5.45 in 2Q 2022).

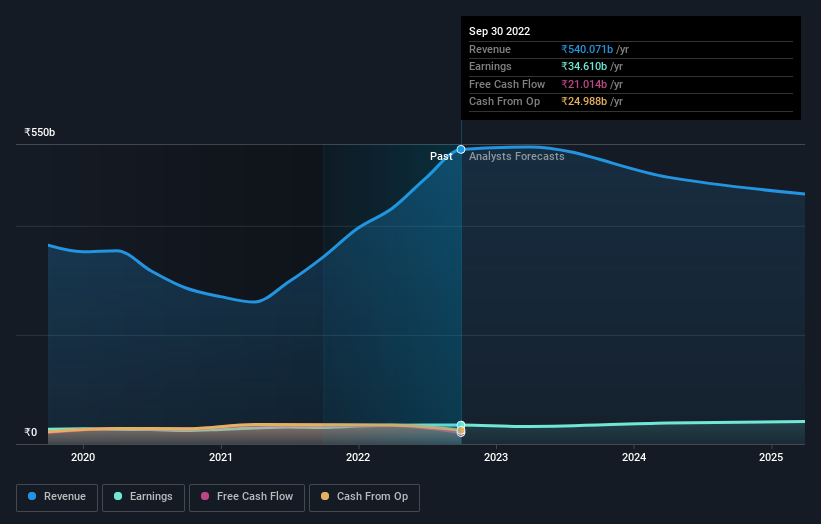

All figures proven within the chart above are for the trailing 12 month (TTM) interval

Petronet LNG Revenues Beat Expectations, EPS Falls Quick

Income exceeded analyst estimates by 11%. Earnings per share (EPS) missed analyst estimates by 1.6%.

Wanting forward, income is predicted to say no by 7.2% p.a. on common through the subsequent 3 years, whereas revenues within the Oil and Gasoline trade in India are anticipated to develop by 4.2%.

Efficiency of the Indian Oil and Gasoline trade.

The corporate’s share worth is broadly unchanged from per week in the past.

Threat Evaluation

What about dangers? Each firm has them, and we have noticed 1 warning signal for Petronet LNG it is best to learn about.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Petronet LNG is doubtlessly over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to deliver you long-term centered evaluation pushed by basic information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source_link