[ad_1]

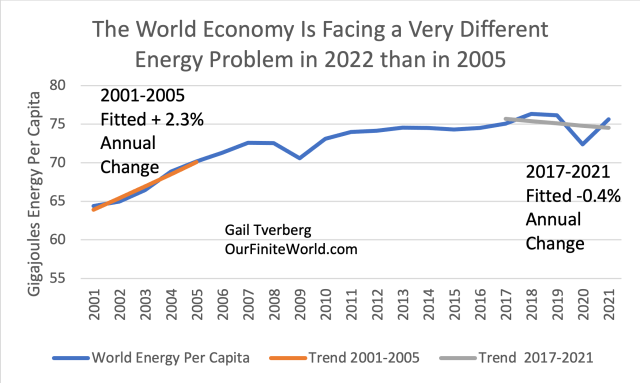

Again in 2005, the world financial system was “buzzing alongside.” World development in power consumption per capita was rising at 2.3% per 12 months within the 2001 to 2005 interval. China had been added to the World Commerce Group in December 2001, ramping up its demand for every kind of fossil fuels. There was additionally a bubble within the US housing market, introduced on by low rates of interest and free underwriting requirements.

Determine 1. World major power consumption per capita primarily based on BP’s 2022 Statistical Assessment of World Vitality.

The issue in 2005, as now, was inflation in power prices that was feeding by means of to inflation basically. Inflation in meals costs was particularly an issue. The Federal Reserve selected to repair the issue by elevating the Federal Funds rate of interest from 1.00% to five.25% between June 30, 2004 and June 30, 2006.

Now, the world is going through a really totally different downside. Excessive power costs are once more feeding over to meals costs and to inflation basically. However the underlying development in power consumption could be very totally different. The expansion charge in world power consumption per capita was 2.3% per 12 months within the 2001 to 2005 interval, however power consumption per capita for the interval 2017 to 2021 appears to be barely shrinking at minus 0.4% per 12 months. The world appears to already be on the sting of recession.

The Federal Reserve appears to be utilizing the same rate of interest strategy now, in very totally different circumstances. On this publish, I’ll attempt to clarify why I don’t suppose that this strategy will produce the specified end result.

[1] The 2004 to 2006 rate of interest hikes didn’t result in decrease oil costs till after July 2008.

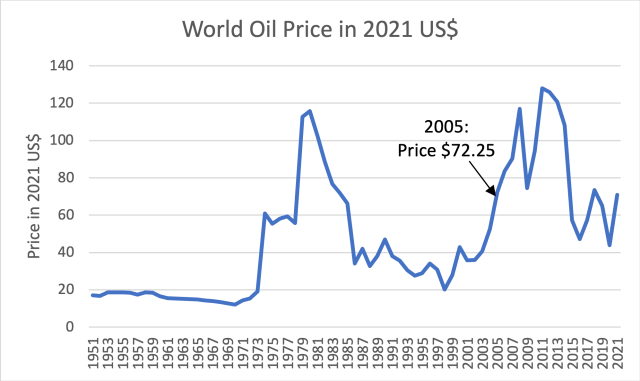

It’s best to see the impression (or lack thereof) of rising rates of interest by common month-to-month world oil costs.

Determine 2. Common month-to-month Brent spot oil costs primarily based on knowledge of the US Vitality Data Administration. Newest month proven is July 2022.

The US Federal Reserve started elevating goal rates of interest in June 2004 when the common Brent oil worth was solely $38.22 per barrel. These rates of interest stopped rising on the finish of June 2006, when oil costs averaged $68.56 per barrel. Oil costs on this foundation ultimately reached $132.72 per barrel in July 2008. (All of those quantities are in {dollars} of the day, fairly than being adjusted for inflation.) Thus, the very best worth was over thrice the value in June 2004, when the US Federal Reserve made the choice to begin elevating goal rates of interest.

Primarily based on Determine 2 (together with my notes concerning the timing of the rate of interest rise), I’d conclude that elevating rates of interest didn’t work very properly at bringing down the value of oil when it was tried within the 2004 to 2006 interval. In fact, the financial system was rising quickly, then. The speedy development of the financial system seemingly led to the very excessive oil worth proven in mid-2008.

I count on that the results of the US Federal Reserve elevating rates of interest now, in a low-growth world financial system, is perhaps fairly totally different. The world’s debt bubble may pop, resulting in a worse state of affairs than the monetary disaster of 2008. Not directly, each property costs and commodity costs, together with oil costs, would are likely to fall very low.

Analysts wanting on the state of affairs from strictly an power perspective are likely to miss the interconnected nature of the financial system. Elements which power analysts overlook (significantly debt turning into unimaginable to repay, as rates of interest rise) could result in an end result that’s just about the alternative results of the usual perception. The everyday perception of power analysts is that low oil provide will result in very excessive costs and extra oil manufacturing. Within the present state of affairs, I count on that the end result is perhaps nearer to the alternative: Oil costs will fall due to monetary issues introduced on by the upper rates of interest, and these decrease oil costs will result in even decrease oil manufacturing.

[2] The aim of the US Federal reserve elevating goal rates of interest was to flatten the expansion charge of the world financial system. Trying again at Determine 1, the expansion in power consumption per capita was a lot decrease after the Nice Recession. I doubt that now in 2022, we would like even decrease development (actually, extra shrinkage) in power consumption per capita for future years.*

Taking a look at Determine 1, development in power consumption per capita has been very sluggish because the Nice Recession. An individual wonders: What’s the level of governments and their central banks pushing the world financial system down, now in 2022, when the world financial system is already barely capable of preserve worldwide provide traces and supply sufficient diesel for all the world’s vehicles and agricultural gear?

If the world financial system is pushed downward now, what would the end result be? Would some nations discover themselves unable to afford fossil gasoline power merchandise sooner or later? This may result in issues each in rising and transporting meals, at the very least for these nations. Would the entire world undergo a significant disaster of some type, reminiscent of a monetary disaster? The world financial system is a self-organizing system. It’s troublesome to forecast exactly how the state of affairs would work out.

[3] Whereas the expansion charge in power consumption per capita was a lot decrease after 2008, the value of crude oil shortly bounced again to over $120 per barrel in inflation-adjusted costs.

Determine 3 exhibits that oil costs instantly bounced again up after the Nice Recession of 2008-2009. Quantitative Easing (QE), which the US Federal Reserve started in late 2008, helped power costs to shoot again up once more. QE helped preserve the price of borrowing by governments low, permitting governments to run bigger deficits than may in any other case have been potential with out rates of interest rising. These greater deficits added to the demand for commodities of every kind, together with oil, thus elevating costs.

Determine 3. Common annual oil costs inflation-adjusted oil costs primarily based on knowledge from BP’s 2022 Statistical Assessment of World Vitality. Quantities proven are Brent equal spot costs.

The chart above exhibits common annual Brent oil costs by means of 2021. The above chart doesn’t present 2022 costs. The present Brent oil worth is about $91 per barrel. So, oil costs as we speak are just a little greater than they’ve been not too long ago, however they’re nowhere practically as excessive as they have been within the 2011 to 2013 interval or within the late Seventies. The acute response we’re seeing could be very unusual. The issue appears to be rather more than oil costs, by themselves.

[4] Excessive costs within the 2006 to 2013 interval allowed the rise of unconventional oil manufacturing. These excessive oil costs additionally helped preserve typical oil manufacturing from falling after 2005.

It’s troublesome to seek out element on the exact quantity of unconventional oil, however some nations are identified for his or her unconventional oil manufacturing. For instance, the US has develop into a pacesetter within the extraction of tight oil from shale formations. Canada additionally produces just a little tight oil, nevertheless it additionally produces fairly a little bit of very heavy oil from the oil sands. Venezuela produces a distinct kind of very heavy oil. Brazil produces crude oil from below the salt layer of the ocean, generally referred to as pre-salt crude oil. These unconventional kinds of extraction are usually costly.

Determine 4 exhibits world oil manufacturing for numerous combos of nations. The highest line is complete world crude oil manufacturing. The underside grey line approximates world complete typical oil manufacturing. Unconventional oil manufacturing has been rising since, say, 2010, so this approximation is best for years 2010 and subsequent years on the chart, than it’s for earlier years.

Determine 4. Crude and condensate oil manufacturing primarily based on worldwide knowledge of the US Vitality Data Administration. The decrease traces subtract the total quantity of crude and condensate manufacturing for the nations listed. These nations have substantial quantities of unconventional oil manufacturing, however they might even have some typical manufacturing.

From this chart, it seems that world typical oil manufacturing leveled off after 2005. Some individuals (sometimes called “Peak Oilers”) have been involved that typical oil manufacturing would attain a peak and start to say no, beginning shortly after 2005.

The factor that appears to have saved manufacturing from falling after 2005 is the steep rise in oil costs within the 2004 to 2008 interval. Determine 3 exhibits that oil costs have been fairly low between 1986 and 2003. As soon as oil costs started to rise in 2004 and 2005, oil corporations discovered that they’d sufficient income that they might begin adopting extra intensive (and costly) extraction methods. This allowed extra oil to be extracted from present typical oil fields. In fact, diminishing returns nonetheless set in, even with these extra intensive methods.

These diminishing returns are most likely a significant purpose that typical oil manufacturing began to fall in 2019. Not directly, diminishing returns seemingly contributed to the decline in 2020, and the failure of the oil provide to bounce again as much as its 2018 (or 2019) degree in 2021.

[5] A greater approach of world crude oil manufacturing is on per capita foundation as a result of the world’s crude oil wants depend upon world inhabitants.

Everybody on the planet wants the good thing about crude oil, since crude oil is utilized in farming and in transporting items of every kind. Thus, the necessity for crude oil rises with inhabitants development. I want analyzing crude oil manufacturing on a per capita foundation.

Determine 5. Per capita crude oil manufacturing primarily based on worldwide knowledge by nation from the US Vitality Data Administration.

Determine 5 exhibits that on a per capita foundation, typical crude oil manufacturing (grey backside line) began declining after 2005. It was solely with the addition of unconventional oil that crude oil manufacturing per capita might stay pretty degree between 2005 and 2018 or 2019.

[6] Unconventional oil, if analyzed by itself, appears to be fairly worth delicate. If politicians all over the place need to maintain oil costs down, the world can’t rely on extracting very a lot of the massive quantity of unconventional oil assets that appear to be out there.

Determine 6. Crude oil manufacturing primarily based on worldwide knowledge for the US Vitality Data Administration for every of the nations proven.

On Determine 6, crude oil manufacturing dips in 2016 and 2017 and in addition in 2020 and 2021. Each the 2016 the 2020 dips are associated to low worth. The continued low costs in 2017 and 2021 could replicate start-up issues after a low worth, or they might replicate skepticism that costs can keep excessive sufficient to make continued extraction worthwhile. Canada appears to indicate related dips in its oil manufacturing.

Venezuela exhibits a reasonably totally different sample. Data from the US Vitality Data Administration mentions that the nation began having main issues as soon as the world oil worth began falling in 2014. I’m conscious that the US has had sanctions towards Venezuela in recent times, nevertheless it appears to me that these sanctions are carefully associated to Venezuela’s oil worth issues. If Venezuela’s very heavy oil might actually be extracted profitably, and the producers of this oil may very well be taxed to supply providers for the individuals of Venezuela, the nation wouldn’t have the various issues that it has as we speak. The nation seemingly wants a worth between $200 and $300 per barrel to permit enough funds for extraction plus ample tax income.

Brazil’s oil manufacturing appears to be comparatively extra secure, however its development has been sluggish. It has taken a few years to get its manufacturing as much as 2.9 million barrels per day. There’s additionally some pre-salt oil manufacturing simply now getting began in Angola and different nations of West Africa. Any such oil requires a excessive degree of technical experience and imported assets from world wide. If world commerce falters, this kind of oil manufacturing is more likely to falter, as properly.

A big share of the world’s oil reserves are unconventional oil reserves, of 1 kind or one other. The truth that rising oil costs are an actual downside for residents signifies that these unconventional reserves are unlikely to be tapped. As an alternative, we could also be coping with critically quick provides of merchandise we want for working our financial system, together with diesel oil and jet gasoline.

[7] Determine 1 at first of this publish indicated falling major power consumption per capita. This downside extends to greater than oil. On a per capita foundation, each coal and nuclear power consumption are falling.

Virtually nobody pays any consideration to coal consumption, however that is the gasoline that allowed the Industrial Revolution to begin. It’s affordable to count on that because the world financial system began utilizing coal first, it is perhaps the primary to deplete. Determine 7 exhibits that world coal consumption per capita hit a peak in 2011 and has declined since then.

Determine 7. World coal consumption per capita, primarily based on knowledge from BP’s 2022 Statistical Assessment of World Vitality.

Many people have heard about Aesop’s Fable, The Fox and the Grapes. In accordance with Wikipedia, “The story issues a fox that tries to eat grapes from a vine however can’t attain them. Quite than admit defeat, he states they’re undesirable. The expression ‘bitter grapes’ originated from this fable.”

Within the case of coal, we’re informed that coal is undesirable as a result of it is extremely polluting and raises CO2 ranges. Whereas this stuff are true, coal has traditionally been very cheap, and that is vital for individuals shopping for coal. Coal can also be simple to move. It may very well be used for gasoline as an alternative of reducing down timber, thus serving to native ecosystems. The unfavourable issues that we’re being informed about coal are true, however it’s arduous to seek out an ample cheap substitute.

Determine 8 exhibits that world nuclear power per capita can also be falling. To some extent, its fall has stabilized since 2012 as a result of China and some different “creating nations” have been including nuclear capability, whereas developed nations in Europe have tended to take away their present nuclear energy vegetation.

Determine 8. World nuclear electrical energy consumption per capita, primarily based on knowledge from BP’s 2022 Statistical Assessment of World Vitality. Quantities are primarily based on the quantity of fossil fuels that this electrical energy would theoretically exchange.

Nuclear power is complicated as a result of specialists appear to disagree on how harmful nuclear energy vegetation are, over the long run. One concern pertains to correct disposal of spent gasoline after its use.

[8] The world appears to be at a troublesome time now as a result of we don’t have any good choices for fixing our falling power consumption per capita downside, with out drastically lowering world inhabitants. The 2 selections that appear to be out there each appear to be far higher-priced than is possible.

There are two selections that appear to be out there:

[A] Encourage giant quantities of fossil gasoline manufacturing by encouraging very excessive fossil gasoline costs. With such excessive costs, say $300 per barrel for oil, unconventional crude oil in lots of components of the world can be out there. Unconventional coal, reminiscent of that below the North Sea, would even be out there. With sufficiently excessive costs, pure fuel manufacturing may very well be raised. This pure fuel may very well be shipped as liquefied pure fuel (LNG) world wide at nice price. Moreover, many processing vegetation may very well be constructed, each for supercooling the pure fuel to permit it to be shipped world wide and for re-gasification, when it arrives at its vacation spot.

With this strategy, meals prices can be very excessive. A lot of the world’s inhabitants would wish to work within the meals business and in fossil gasoline manufacturing and transport. With these priorities, residents wouldn’t have time or cash for many issues we purchase as we speak. They seemingly couldn’t afford a car or a pleasant residence. Governments would wish to shrivel in measurement, with the standard end result being authorities by an area dictator. Governments wouldn’t have enough funds for roads or colleges. CO2 emissions can be very excessive, however this seemingly wouldn’t be our greatest downside.

[B] Attempt to electrify every thing, together with agriculture. Tremendously ramp up wind and photo voltaic. Wind and photo voltaic are very intermittent, and their intermittency doesn’t match up properly with human wants. Particularly, the world’s massive want is for warmth in winter, whereas photo voltaic power is available in summer season. It can’t be saved till winter with as we speak’s know-how. Spend monumental quantities and assets on electrical energy transmission traces and batteries to attempt to considerably work round these issues. Attempt to discover substitutes for the various issues that fossil fuels present as we speak, together with paved roads and chemical substances utilized in agriculture and in drugs.

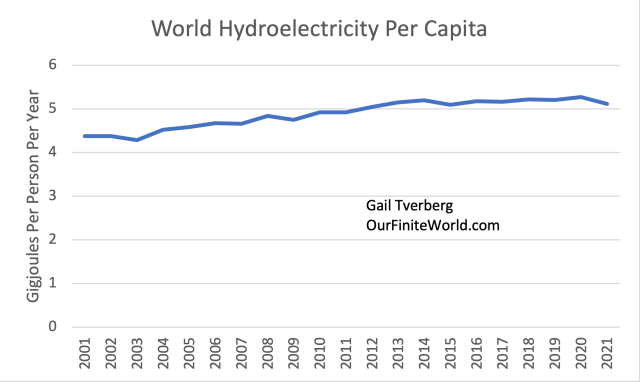

Hydroelectricity can also be a renewable type of electrical energy technology. It can’t be anticipated to ramp up a lot as a result of it has largely been constructed out already.

Determine 9. World consumption of hydroelectricity per capita, primarily based on knowledge from BP’s 2022 Statistical Assessment of World Vitality.

Even when drastically ramped up, wind and photo voltaic electrical energy manufacturing would seemingly be grossly insufficient by themselves to attempt to function any type of financial system. At a minimal, pure fuel, at very excessive price, shipped as LNG world wide, would seemingly be wanted as well as. An enormous amount of batteries can be wanted, resulting in a brief provide of supplies. Large portions of metal can be wanted to make new electrical machines to attempt to exchange present oil-power machines. A minimal 50-year transition would seemingly be wanted.

I’m uncertain that this second strategy can be possible in any affordable timeframe.

[9] Conclusion. Determine 1 appears to indicate that the world financial system is headed for a troubled instances forward.

The world financial system is a self-organizing system, so we can’t know exactly what kind adjustments within the subsequent few years will take. The financial system may be anticipated to shrink again in an uneven sample, with some components of the world and a few courses of residents, reminiscent of staff versus the aged, doing higher than others.

Leaders won’t ever inform us that the world has an power scarcity. As an alternative, leaders will inform us how terrible fossil fuels are, so that we are going to be glad that the financial system is shedding their utilization. They may by no means inform us how nugatory intermittent wind and photo voltaic are for fixing as we speak’s power issues. As an alternative, they may lead us to imagine {that a} transition to autos powered by electrical energy and batteries is simply across the nook. They may inform us that the world’s worst downside is local weather change, and that by working collectively, we are able to transfer away from fossil fuels.

The entire state of affairs jogs my memory of Aesop’s Fables. The system places a “good spin” on no matter scary adjustments are occurring. This fashion, leaders can persuade their residents that every thing is ok when, in reality, it’s not.

NOTE

*If the US Federal Reserve raises its goal rate of interest, central banks of different nations world wide are pressured to take the same motion in the event that they don’t need their currencies to fall relative to the US greenback. Nations that don’t increase their goal rates of interest are usually penalized by the market: With a falling foreign money, the native costs of oil and different commodities are likely to rise as a result of commodities are priced in US {dollars}. In consequence, residents of those nations are likely to face a worse inflation downside than they’d in any other case face.

The nation with the best enhance in its goal rate of interest can, in principle, win, in what is kind of a contest to maneuver inflation elsewhere. This competitors can’t go on indefinitely, nonetheless, as a result of each nation relies upon, to some extent, on imports from different nations. If nations with the weaker economies (i. e. those who can’t afford to boost rates of interest) cease producing important items for world commerce, it should are likely to convey the world financial system down.

Elevating rates of interest additionally raises the probability of debt defaults, and these debt defaults could be a large downside, particularly for banks and different monetary establishments. With greater rates of interest, pension funding turns into much less ample. Companies of every kind discover new funding dearer. Many companies are more likely to shrink or fail fully. These oblique impacts are yet one more approach for the world financial system to fail.

By Gail Tverberg

Extra High Reads From Oilprice.com:

Learn this text on OilPrice.com

[ad_2]

Source_link