[ad_1]

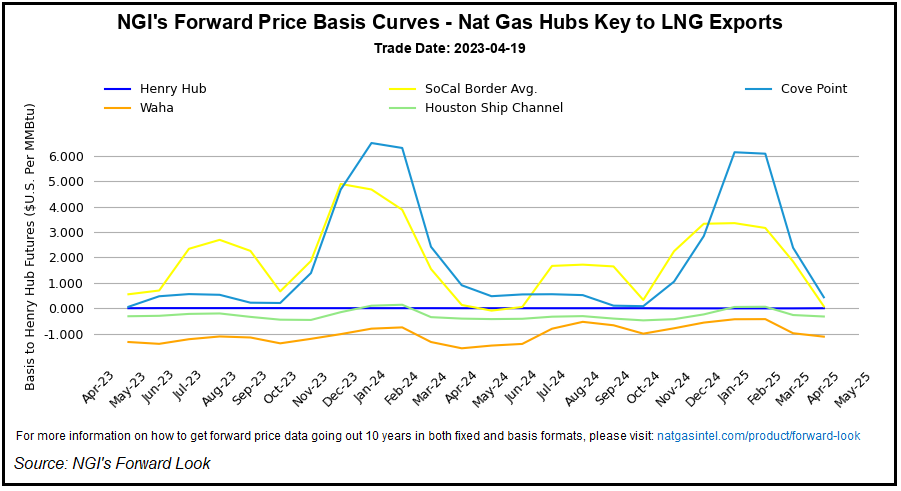

Drawing assist from spring chills and a strengthening weather-driven demand outlook, regional pure fuel forwards usually gained floor through the April 13-19 buying and selling interval, although a number of western hubs moderated sharply week/week.

Might mounted costs at Henry Hub climbed 12.9 cents to finish the interval at $2.225/MMBtu, mirroring beneficial properties in Nymex futures and setting the tempo for will increase of round a nickel to a dime at quite a few Decrease 48 hubs.

Up to date forecasts from Maxar’s Climate Desk Thursday confirmed cooler traits for the japanese Decrease 48 in each the six- to 10-day and 11- to 15-day home windows.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

The forecaster known as for beneath regular temperatures to cowl the japanese half of the nation for many of the six- to 10-day (from subsequent Tuesday via April 29) interval.

“This contains the South, the place traits are additionally wetter with rounds of unsettled situations over the course of the interval,” Maxar stated. “The forecast has Chicago with lows within the higher 30s to low 40s and highs within the 50s, and Atlanta with lows within the 50s and highs within the 60s to low 70s.

“Beneath regular temperatures are additionally within the East, established beneath excessive strain early and maintained by easterly move through the second half. Alternatively, a ridge builds into the West with regular to above regular temperatures.”

Maxar stated it anticipated cooler-than-normal temperatures to increase into the 11- to 15-day window for the japanese Decrease 48.

“Above-normal temperatures favor the Inside West, however California returns to the cooler aspect of regular late as a Pacific trough strikes overhead,” Maxar stated.

Chicago Citygate Might mounted costs gained 9.2 cents week/week to finish at $2.041, whereas Transco Zone 5 picked up 10.6 cents to succeed in $2.273.

In the meantime, with up to date climate maps promoting hotter temperatures over the western Decrease 48, a number of regional hubs accordingly noticed moderating premiums through the April 13-19 interval. Malin shed 33.9 cents for Might supply, falling to $2.742. Opal Might mounted costs dropped 25.6 cents to finish at $2.640.

SoCal Surges

SoCal Citygate was a notable outlier, with Might mounted costs surging 46.4 cents for the interval to $5.026.

Southern California Fuel (SoCal) was scheduled to carry out remediation work on its Line 5000 beginning final Monday (April 17) and increasing via April 28, Wooden Mackenzie analyst Quinn Schulz stated in a current word to shoppers.

The work was anticipated to limit capability via the EP-Ehrenberg/NBP-Blythe sub-zone by 0.63 Bcf/d, equating to a reduce of round 174 MMcf/d day/day when evaluating pre-maintenance volumes to well timed flows on the primary day of the occasion, in line with Schulz.

Nonetheless, the beginning of the upkeep coincided with a comparatively low demand interval for the area, in line with Schulz.

“Demand just lately nominated a previous 30-day minimal of two.05 Bcf on April 16,” the analyst stated.

The upper SoCal Citygate forwards additionally come as Power Info Administration (EIA) knowledge confirmed the EIA Pacific area barrelling into the summer season cooling season with a traditionally meager stock cushion.

Within the newest EIA storage report Thursday, Pacific area stockpiles rose 9 Bcf to 83 Bcf as of April 14, a 53.4% deficit to the five-year common of 178 Bcf.

Document LNG Exports

Nymex futures superior through the April 13-19 interval, together with a 16.1-cent rally on Monday. Regardless of stumbling in Wednesday’s session, the Might contract managed to complete in optimistic territory on Thursday, selecting up 2.7 cents to settle at $2.249, up round 1 / 4 versus the week-earlier interval.

The entrance month eased decrease on Friday as merchants continued to mull balances following a plump stock construct within the newest EIA pure fuel storage report. The Might contract in the end settled at $2.233, off 1.6 cents day/day.

ICAP Technical Evaluation analyst Brian LaRose highlighted “stiff resistance” related to “the convergence of the 50-day transferring averages and higher bollinger bands,” which repelled bulls through the interval.

“Now watching to see if the 22-day transferring averages can present assist,” LaRose advised shoppers Thursday. “If they will, one other run on the 50-day transferring averages could possibly be on faucet for this week. If they can’t, a drift sideways/decrease could possibly be on faucet for the Might expiry.”

When it comes to fundamentals, EBW Analytics Group attributed current futures strengthening to a mixture of restoration from a interval of “excessive spot market weak point,” record-high LNG export volumes and bullish climate traits.

The energy in liquefied pure fuel exports primarily based on current estimates may result in “bullish analyst revisions” within the weeks forward, in line with EBW analyst Eli Rubin.

Current EBW estimates put seven-day common liquefied pure fuel exports at greater than 14.5 Bcf/d, a brand new document excessive.

“Previous to March, weekly common demand had by no means surpassed 13.2 Bcf/d,” Rubin stated. “The burst larger is tied to Freeport’s long-awaited reopening and new all-time facility information. Many analyst projections for the 2023 injection season seem to stay within the 13.0-13.5 Bcf/d vary, nonetheless.

“Though seasonal upkeep work and a small danger of shut-ins later this fall could dispel current energy, a chance of bullish revisions may assist tighten seasonal storage trajectory projections within the coming weeks.”

[ad_2]

Source_link