[ad_1]

With constrained markets alongside the West Coast the notable exception, pure fuel forwards tumbled through the Dec. 22-28 buying and selling interval as winter upside worth dangers pale on forecasts exhibiting a gentle begin to 2023.

Fastened costs for February supply at Henry Hub shed 55.3 cents to finish the interval at $4.698/MMBtu, and quite a few hubs all through the jap two-thirds of the Decrease 48 posted week/week losses of round 50 cents or extra, NGI Ahead Look knowledge present.

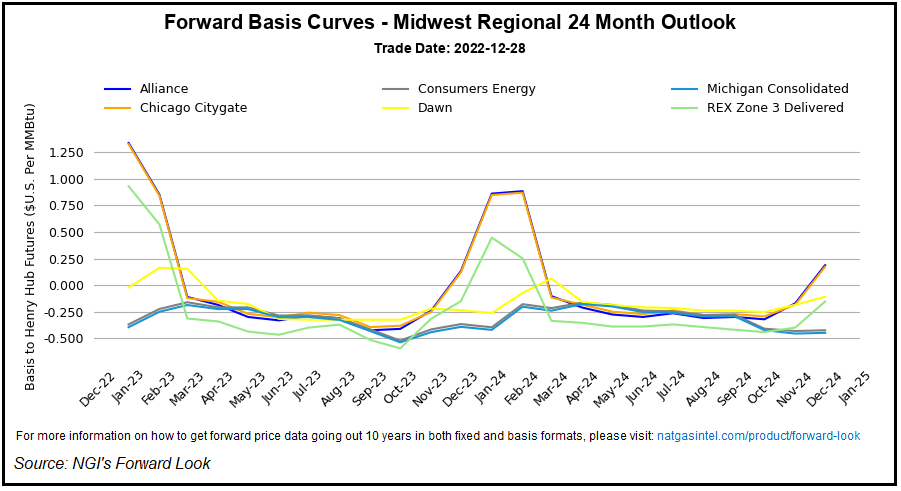

Within the Midwest, February fastened costs at Chicago Citygate gave up 73.0 cents to finish at $5.525, whereas within the Northeast, Transco Zone 6 NY fell 55.3 cents to $12.678.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

In the meantime, elevated costs have been the pervading theme for western markets this winter, and that continued through the Dec. 22-28 buying and selling interval.

February fastened costs in Southern California surged above the $20 mark, with SoCal Citygate selecting up $4.853 to finish at $21.853. PG&E Citygate jumped $2.683 to $17.678.

Demand on the SoCal and PG&E programs just lately “plummeted” versus situations noticed on Dec. 22, Wooden Mackenzie analyst Quinn Schulz mentioned in a observe to shoppers Wednesday.

Nonetheless, bodily costs remained sharply elevated “as depleted inventories start to hunt some restoration,” Schulz mentioned. “Complete stock for SoCal sank to previous five-year minimal ranges on Dec. 16, and adjusted PG&E stock reached its personal previous five-year minimal on Dec. 20.”

SoCal inventories stood at 61 Bcf as of Dec. 28, or 11 Bcf beneath the five-year common, with PG&E stockpiles at round 79 Bcf on Dec. 27, about 42 Bcf beneath the five-year, in accordance with the analyst.

Mixed Pacific area storage stood at 165 Bcf as of Dec. 23, a 35.8% deficit to the five-year common, in accordance with the Vitality Data Administration (EIA).

Winter Dangers Fading

Undercutting the bullish affect of a wave of intimidating Arctic chills that swept by way of the Decrease 48 over the Christmas vacation, a decisively bearish temperature outlook heading into early January put downward strain on Nymex futures through the Dec. 22-28 interval.

The January Nymex contract rolled off the board at $4.709 Wednesday after a 57.3 cent swoon. In its first day because the immediate month, February gave up one other 12.6 cents to settle at $4.559.

Costs continued to grind decrease on Friday as merchants shrugged off a hefty 213 Bcf withdrawal from storage within the newest EIA report. February in the end settled at $4.475, down 8.4 cents on the day.

Manufacturing freeze-offs amid December chilly will go a way towards tightening balances, however not sufficient to utterly offset oversupplied situations, in accordance with analysts at East Daley Analytics.

“The Arctic blast that ripped by way of the nation over the vacations introduced blistering chilly temperatures which have put a dent in December pure fuel provide,” the analysts mentioned. “Basin pipeline samples present whole U.S. fuel manufacturing declined by 21% on the peak of the storm” and was just lately nonetheless off by 13% “as a result of wellhead freeze-offs.”

General, the manufacturing declines would equate to a 3.7 Bcf/d discount in whole provide volumes for December, which helps “offset the oversupply” however is “not almost sufficient to rebalance” the market on an annual foundation, the agency estimated.

February Nymex costs as of Thursday have been properly shy of key resistance recognized by ICAP Technical Evaluation as needed for bulls to beat with a view to stem the tide.

“Would wish to see the bulls promptly ship pure fuel surging again above $5.031 to have any shot at avoiding additional draw back,” ICAP analyst Brian LaRose mentioned in a current observe to shoppers. “And if the bulls are unable to stage an intervention? Peg $4.342, $4.220-4.093 and $3.924-3.800-3.746 because the steps decrease from right here.”

Climate knowledge as of noon Thursday continued to promote a “a lot hotter than regular U.S. sample” by way of Jan. 9, in accordance with NatGasWeather.

“The truth is, this era is without doubt one of the warmest begins to January on report,” with heating diploma days set to drop to properly beneath regular ranges nationally, the agency mentioned. “The most recent noon knowledge once more held hotter traits for Jan. 10-13 as chilly air over Canada fails to advance as aggressively into the U.S. As such, the Jan. 10-13 interval stays to the bearish aspect as a substitute of nearer to seasonal/impartial.”

Whereas it remained a chance that the climate knowledge had “trended too heat” for the 15-day projection interval, NatGasWeather mentioned it will require “appreciable colder traits” to carry an finish to “bearish climate headwinds.”

The evaporation of worth for the January contract heading into expiration “resets the desk” for Nymex futures, and indicators level to additional declines from right here, in accordance with EBW Analytics Group analyst Eli Rubin.

“Additional out on the ahead curve, the April 2023 contract lastly slipped from backwardation into contango versus Might as winter dangers ebbed,” Rubin mentioned in a observe to shoppers Thursday. “However the precipitous declines, nonetheless, the March contract retains a 21 cent premium to April — a premium that’s more likely to slender or vanish utterly within the subsequent two months.

“With the April contract slumping to below $4.00 for the primary time since March — and continued downward strain doubtless amid an ample storage outlook and a balmy begin to January — it will not be shocking to see March fall one other 50-75 cents over the subsequent 30-45 days.”

[ad_2]

Source_link