[ad_1]

What’s going to 2021 carry after a chaotic yr during which spot LNG costs bounced from file lows to file highs, delaying billions of {dollars} in ultimate funding selections (FID)? Whereas the underlying fundamentals point out that the excess situations that characterised a lot of 2020 would definitely persist, this consequence will not be assured.

Individuals encounter difficulties in making funding and contracting selections at an insecure stage of the cycle, in addition to a higher emphasis on sustainability and capital self-discipline.

What influence will the unprecedented winter spot LNG worth spike have available on the market in 2021?

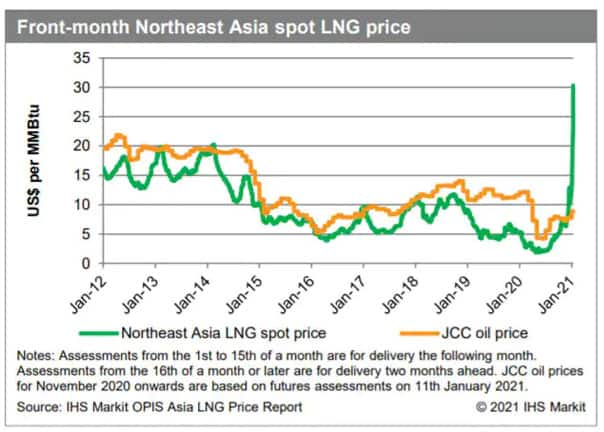

Northeast Asian spot LNG costs for February 2021 supply reached $33.65/MMBtu on January 12, 2021, a brand new day by day excessive by far. The rise was a major shock, particularly because it got here only a few months after LNG exports have been lowered to steadiness the market in mild international situations, leading to file lows of $1.90/MMBtu in June 2020.

A number of elements converged to push costs up. Owing to a number of liquefaction outages and an absence of accessible transportation, Asian LNG demand spiked because of the chilly climate whereas provide was constrained. Costs soared previous prior highs as a consequence of market illiquidity and the lack to redirect provides the place it was required on quick discover.

A key query is whether or not the present worth rise is a one-off results of an ideal storm of occasions, or if it signifies that the LNG extra that arose in summer season 2020 has already been labored off way more rapidly than deliberate. Underlying elements, which will probably be examined in additional element in later questions, proceed to point to extra circumstances and low costs resurfacing in summer season 2021, with provide capability forecast to rise sooner than demand and transport not projected to be as tight. Due to this yr’s spot worth rise, utilities are anticipated to designate extra long-term provides and lock up short-term commitments for subsequent winter, easing any squeeze on immediate costs.

Nonetheless, in a market presently characterised by restricted commerce volumes and difficulties bodily responding to fast worth alerts, there’s a risk of surges in winter 2021-2022, particularly if extreme chilly climate occasions coincide with provide interruptions as soon as extra.

Will COVID-19 proceed to dent international LNG demand development, or ought to we count on a pointy restoration?

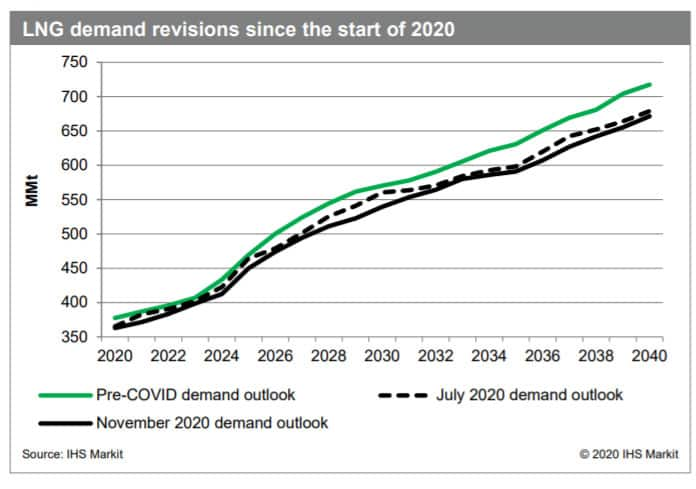

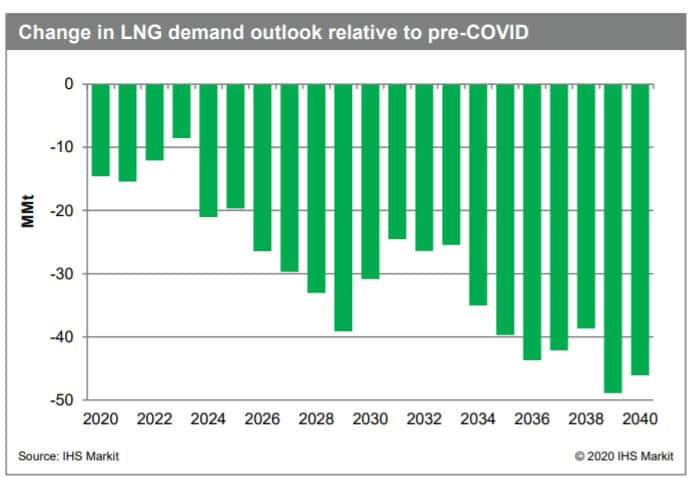

Because the influence of COVID-19 aggravated already shaky fundamentals, S&P World predicts that surplus capability accounted for six% of the LNG market in 2020. In 2021, we predict a 3% year-over-year (YOY) improve in demand (assuming regular climate situations) to be met by a 4% YOY development in accessible provide, implying a structural surplus as soon as extra.

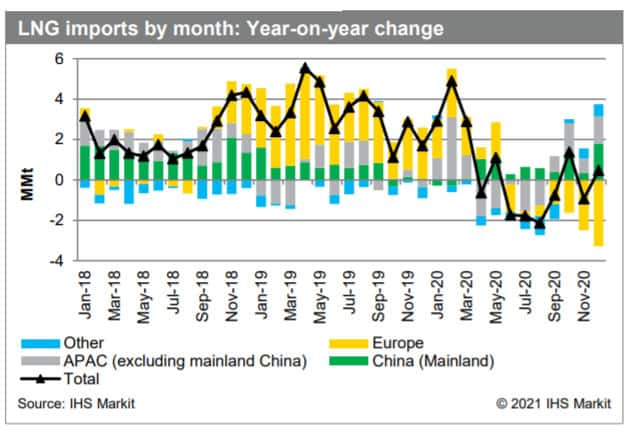

Previous to the worldwide unfold of COVID-19, S&P World anticipated LNG commerce to develop by almost 5% yr on yr (YOY) in 2020; nonetheless, precise LNG commerce development in 2020 was only one.5 p.c YOY (roughly 13 MMt under our authentic expectations), owing partially to containment measures put in place to curb the virus’s unfold and its financial ramifications. COVID-19’s continued influence on LNG demand development is without doubt one of the most essential parts in how the LNG market will steadiness in 2021.

With the distribution of vaccines persevering with to ramp up world wide, some observers are longing for a sharper demand restoration in 2021 given the resiliency some key markets confirmed final yr.

The priority is whether or not demand will rebound rapidly sufficient to compensate for the expansion misplaced in 2020 and sustain with the rise in accessible provide. The extent of the demand will increase in mainland China, which is anticipated to be the world’s best rising market in 2020, will probably be an important determinant of the worldwide steadiness. The expansion of LNG demand within the area was aided by a pricing benefit over oil-indexed pipelines, which is much less prone to be repeated in 2021. New pipeline rampups, for instance, are prone to forestall any LNG demand rebound in Mexico, which noticed the best YOY LNG demand discount in 2020.

Will provide cutbacks be wanted once more, or will the market stay tighter than anticipated?

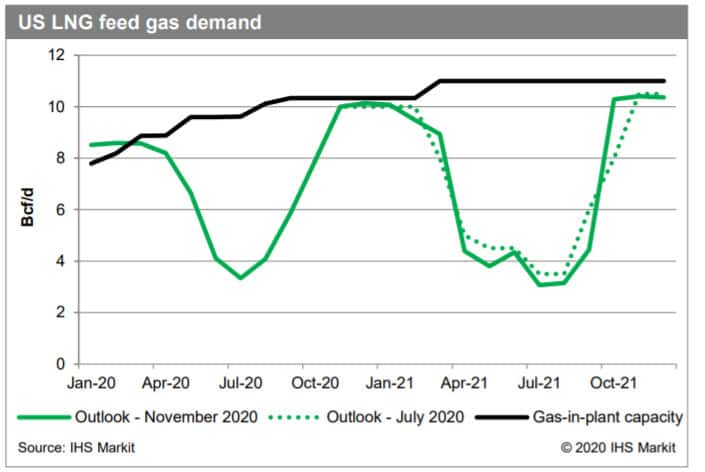

To steadiness the market in 2020, the excess situations resulted in common international liquefaction utilisation plunging to historic lows all through the summer season months as demand did not sustain with accessible provide. Versatile producers in two nations, the US and Egypt, have been chargeable for many of the provide decreases.

From June to August, common utilisation throughout the six current vegetation in the US fell to only 40%, whereas Egypt solely exported one cargo from March to September. Attributable to a seasonal spike in worldwide LNG demand and a powerful soar in costs, each nations’ export charges rebounded to almost full capability by the top of the yr.

Nonetheless, a major variety of provide outages occurred concurrently in This autumn 2020, which took an estimated 6–8% of obtainable export capability offline directly in some durations—an unusually giant quantity.

An enormous query for the LNG market is: Are these short-lived outages or will they proceed to have an effect on international provide via the yr?

Due to continued feedstock drops (e.g., Equatorial Guinea LNG, Atlantic LNG, and Bontang LNG) and prolonged outages (e.g., Hammerfest LNG and Gorgon LNG), some utilisation decreases are already recognized to stretch into 2021, however the length and scale of many of those decreases are unknown.

Moreover, among the lowered liquefaction utilisation is probably going attributable to acute constraints within the transport market (e.g., Angola LNG and quite a few cancelled cargoes within the US), which ought to ease as further newbuild vessels enter the market and the winter demand peak eases.

In keeping with our present demand forecasts for 2021, a major quantity of provide capability would must be unavailable all through the summer season to keep away from market-related provide cuts in the US and Egypt. The continuation of present outages—or the incidence of future ones—would possibly enable for increased utilisation charges than in 2020, however they’re unlikely to remove the requirement for for some cutbacks. On an annualized common foundation, roughly 27 MMtpa of capability would want to stay offline to steadiness present expectations of normal-weather demand.

How would possibly capital constraints reshape LNG enterprise fashions?

Following the 2020 demand and worth shocks, IOGCs—which, as LNG aggregators, utilised their monetary sheets and worldwide portfolios to propel lots of the latest liquefaction investments—are beneath strain to minimise capital publicity, generate superior returns, and return money to shareholders. The LNG trade will face a problem in 2021 and past because of this circumstance.

The problem is how LNG enterprise fashions would possibly evolve to draw completely different sources of lower-cost financing and their diversified threat tolerance in a world of low rates of interest and authorities fiscal stimulus. Extra builders might carve out or spin off segments of the LNG worth chain sooner or later.

Future LNG investments will probably be beneath strain and uncovered to many litmus assessments, even with a decrease price of capital. Is the venture in a position to ship a market-competitive price of provide whereas nonetheless assuring an inexpensive risk-adjusted return for the sponsors? Is it higher to return funds to shareholders and, if essential, buy further LNG from different events? Does the venture’s environmental footprint match with the sponsors’ and clients’ sustainability methods and their views on when LNG demand might peak?

Be taught extra concerning the LNG market from our webinar, COVID-19 and low oil worth: What’s forward for the worldwide LNG market?

[ad_2]

Source_link